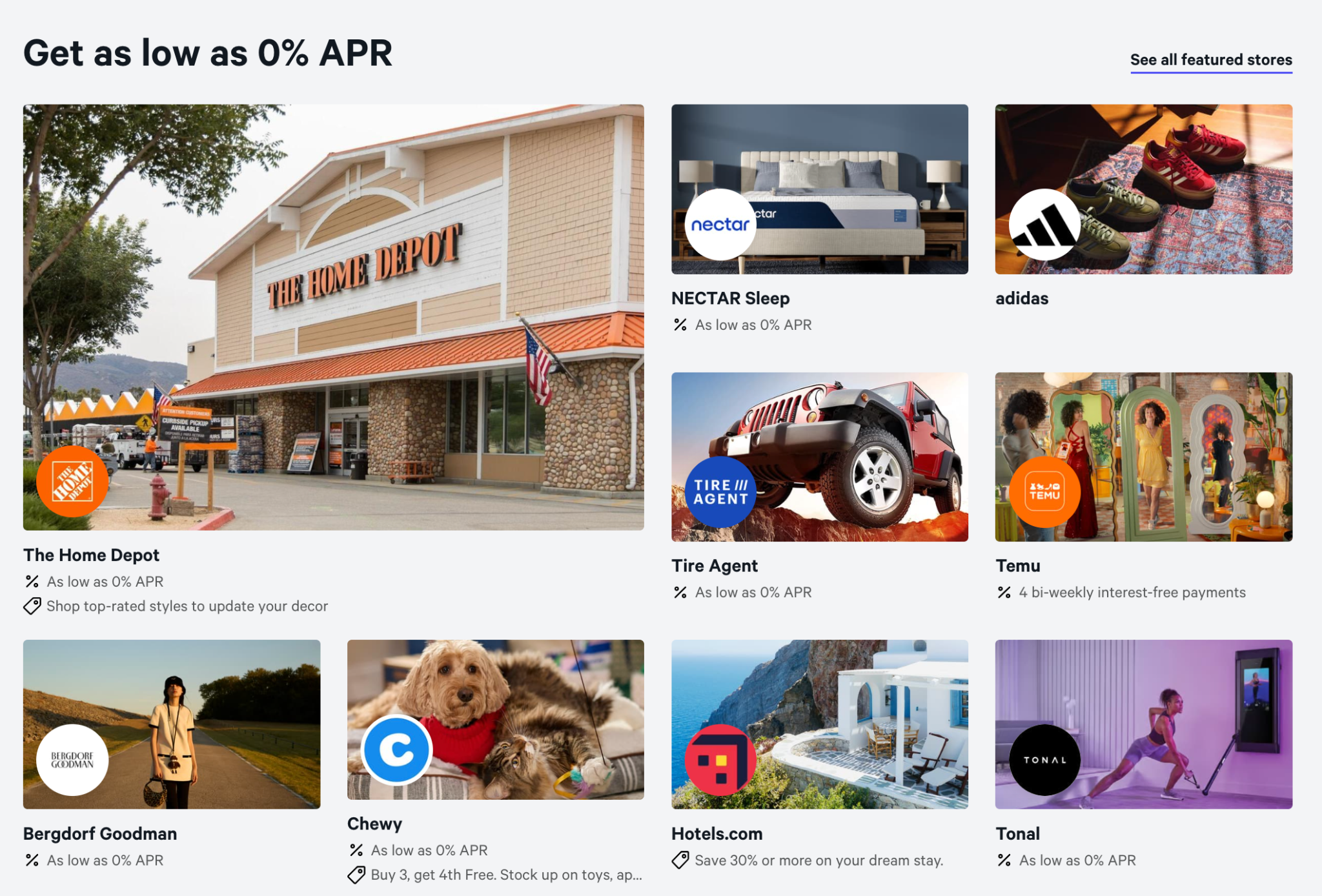

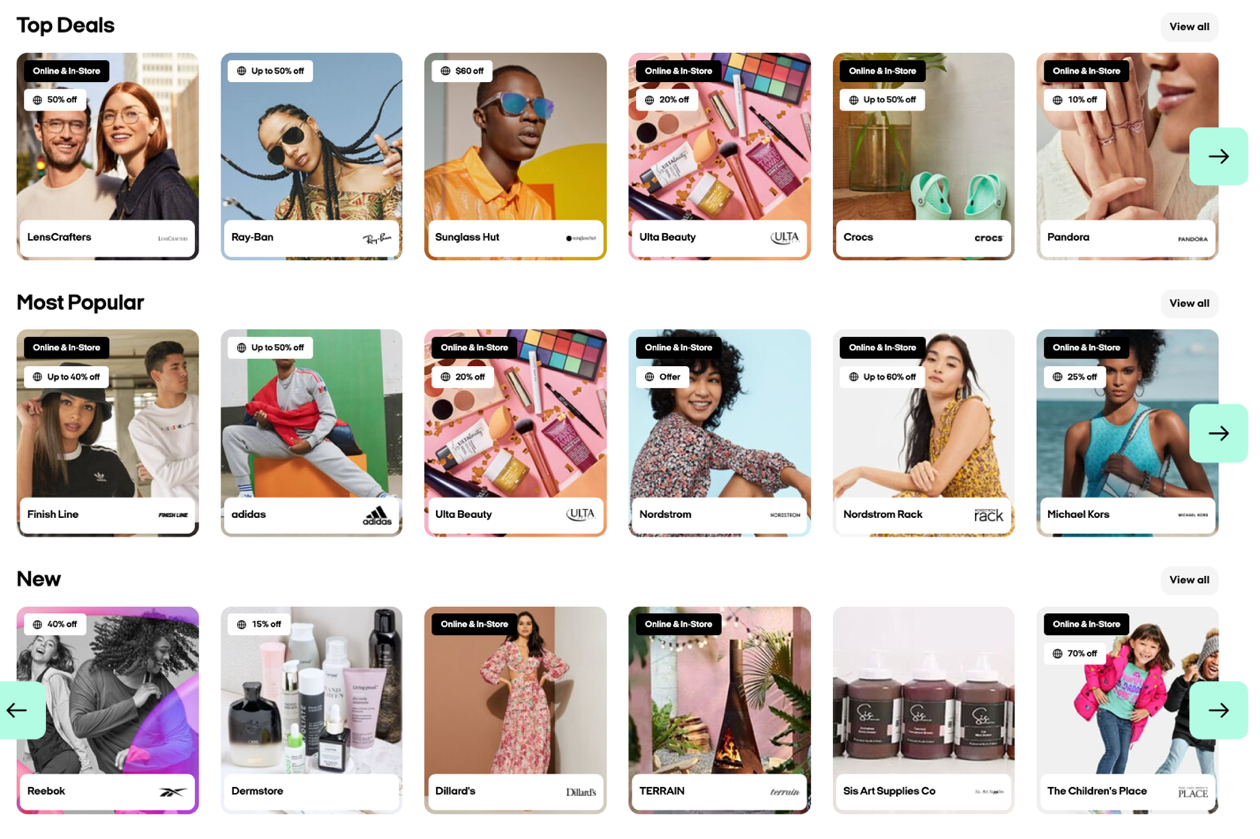

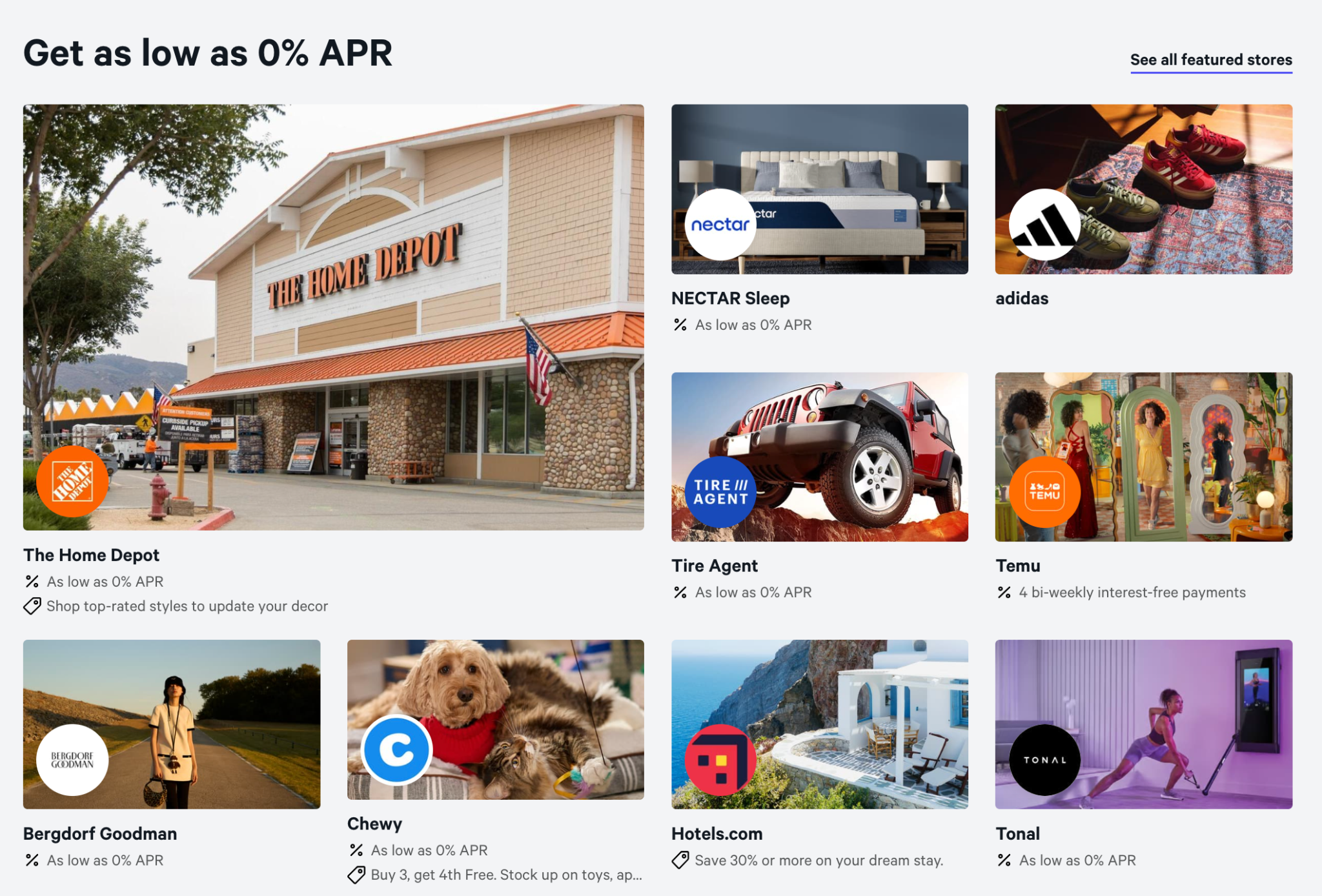

This study assessed how consumers perceived financial risks when using two popular buy-now, pay-later services, Affirm and Afterpay, that are offered at the point of sale by online vendors. Above, a few of Affirm’s merchant partners at the time of the study in 2022.

- This study investigates consumer understanding of financial risks associated with BNPL services, focusing on Affirm and Afterpay in 2022.

- BNPL services disproportionately target financially vulnerable consumers, potentially exacerbating debt cycles.

- In an experiment, most users struggled to comprehend key loan terms, such as payment frequency, number of installments, and the potential impact on credit scores.

- Authors recommend further research to assess the impact of the May 2024 expansion of Truth in Lending regulations on consumer financial outcomes.

Abstract

In December 2021, when the project plan for this experiment was written, the buy-now, pay-later (BNPL) industry was experiencing a renaissance amid a pandemic-fueled boom in e-commerce [1]. In response to a survey of Americans that year, 55.8% said they had used a BNPL service [2]. The industry processed over $120 billion in transactions the same year [3]. This surge of activity drew public attention to these services’ financial risks and regulatory ambiguity. Some BNPL companies report late payments to credit agencies, damaging customers’ credit scores [4], and impose interest and fees that customers may not expect [5]. Moreover, BNPL companies market their products to consumers already in financial distress [6], exacerbating the debt cycle that haunts many Americans today [5].

This study tested consumers’ comprehension of the financial risks they may be exposed to when using a BNPL service. Survey respondents completed an interactive web-based prototype simulating the real purchasing flow of two popular BNPL companies in 2022, Affirm [7] and Afterpay [8], and answered questions on what information they could recall. Each question in the survey corresponds to a piece ofinformation that is required to be disclosed by industries regulated under the Truth in Lending Act and Credit Card Accountability,Responsibility, and Disclosure (CARD) Act, which did not cover buy-now, pay-later companies when this study was conducted. The experiment tests the null hypothesis that consumers fully understand the loan terms they agree to when using BNPL. The results of this study are intended to inform the Consumer Financial Protection Bureau’s work to establish regulatory frameworks that protect the financial well being of U.S.consumers.

Results summary:

Our study found that the majority of participants were unable to understand some or all of the terms of the loans issued by the simulated BNPL flows. Thus, we reject the null hypothesis and assert that BNPL companies did not effectively communicate the risks associated with their service to users in 2022. We also observed differences in participant comprehension between the two simulated BNPL flows, suggesting that the lack of regulation in this industry can lead to varying financial outcomes for consumers targeted by specific BNPL companies.

Introduction

Buy-now, pay-later (BNPL) is a relatively new way to pay for an item online (and more recently, in stores) that has revolutionized the financial technology (fintech) industry [9]. BNPL companies combine the services of microloan providers and e-commerce platforms to enable consumers to pay for purchased goods in installments over a period of time. At many online checkouts, consumers will see an option to “Pay in Four” or split payments into installments rather than paying for the products in full at the point of sale (see Background for in-depth information on how BNPL and POS loans work) [8]. For many consumers, BNPL is an empowering tool that lets them purchase necessary items they cannot access if they are ineligible for traditional loans or credit cards [5]. When used responsibly, multiple BNPL services allow consumers to take out a zero-interest loan when purchasing an everyday item, without requiring a credit check, and pay it back in installments with no negative consequences. Supporters describe BNPL as a feat of financial innovation.

Figure 1.Positive user reviews for a buy-now, pay-later company, Afterpay [8].

However, BNPL’s convenience may belie financial risks for consumers who do not adequately understand how the services operate, and some of BNPL’s biggest consumers might be those who are most financially vulnerable. Studies have found that people who are experiencing financial difficulty are more likely to utilize BNPL services than those who consider their financial health to be “managing” or “thriving” [6].In addition, some BNPL services entice people to spend more than they would spend when purchasing through traditional means [4][10]. These findings, coupled with BNPL marketing tactics that target youth and minorities [11] and the American financial industry’s long history of disproportionately harming Black and Latinx communities [12], suggest the existence of a latent and poorly understood financial risk that could have a disproportionate impact on vulnerable communities.

Due to the relative youth of the industry and the lack of publicly available data, few studies exist investigating the personal financial consequences of using BNPL services. BNPL companies are not required to report many of the loans they issue to nationwide consumer reporting agencies, resulting in an insufficient volume of credit records for statistical analysis by academics [13]. Each of the handful of studies our research team uncovered, analyzing an array of datasets including credit card, bank account, and survey data, found negative personal financial outcomes associated with BNPL usage. These preliminary findings indicate troubling trends in the financial behaviors of BNPL users that could compound over time if not properly addressed.

One significant area of concern is the financial penalties incurred by BNPL users. Di Maggio et al.'s review of transaction data for over 10 million U.S. consumers found that BNPL users experience higher rates of overdraft charges, credit card interest, and late fees than non-users [14]. A study by deHaan et al. similarly found that BNPL users incur, on average, 4.0% more overdraft charges, 1.1% higher credit card interest, and 2.3% more credit card late fee charges within the year following BNPL adoption [15]. These financial penalties, when quantified in dollar amounts, can amount to an additional $68 per year in banking costs.While $68 may initially seem insignificant, the penalty becomes more severe in the context of the baseline financial fees most Americans are subject to each year. In 2023, 23 million American households charged overdraft fees paid an average of $391 [16]. On top of this, the Consumer Financial Protection Bureau (CFPB) estimated that, between 2018 and 2020, American households spent an average of $1,000 annually in credit card interest & fees [17]. The combination of compounded costs and increasing loan frequency highlights a troubling trend that could undermine the long-term financial stability of BNPL users.

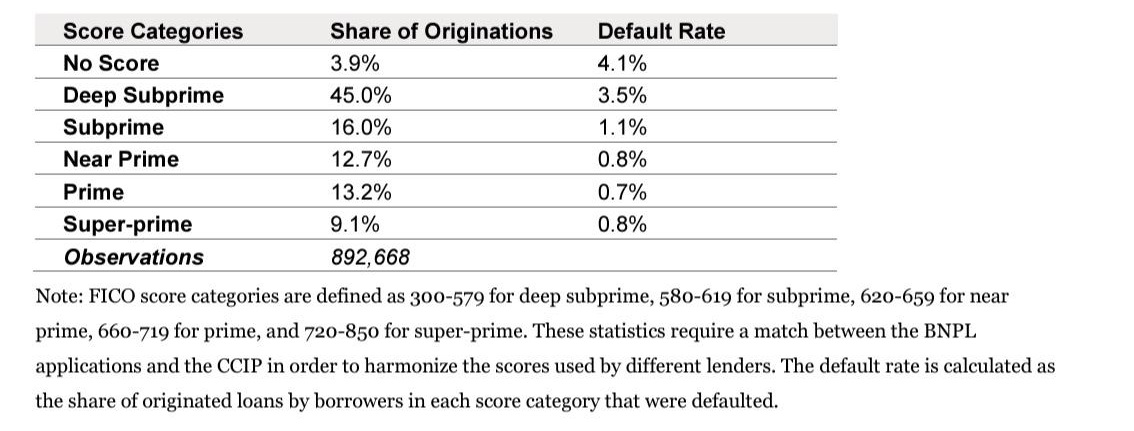

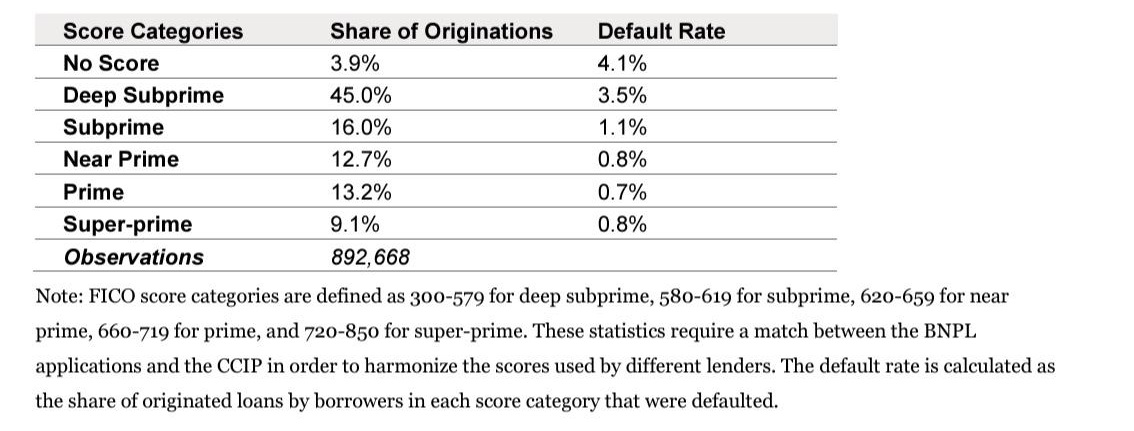

Another concerning trend is the exacerbation of debt cycles among BNPL users. While BNPL is often perceived as a payment option for large, irregular purchases, research indicates this type of usage is not the norm. Sixty-three percent of BNPL users in 2022 originated multiple simultaneous loans at some point during the year, and 33% did so across two or more firms [13]. The average number of BNPL loans issued per consumer annually rose to 9.5 that year from 8.5 in 2021. Recent data by CFPB indicates that approximately 20% of BNPL users are characterized as "heavy users," consistently originating multiple loans per month. Making matters worse, a significant percentage of "heavy users" are from subprime or deep subprime credit backgrounds, suggesting that BNPL services may disproportionately target individuals with less access to traditional forms of credit (see Figure 2). These findings indicate that BNPL, while offering convenience and accessibility, may inadvertently contribute to financial strain for many consumers. With many users engaging in frequent borrowing, often with limited understanding of the risks involved, BNPL services may perpetuate cycles of debt that are difficult to escape, particularly for vulnerable populations.

Figure 2. BNPL loan originations and defaults by credit score category 2021-2022. Over 60% of all originated BNPL loans were for consumers with deep subprime and subprime FICO scores. Data from CFPB [13].

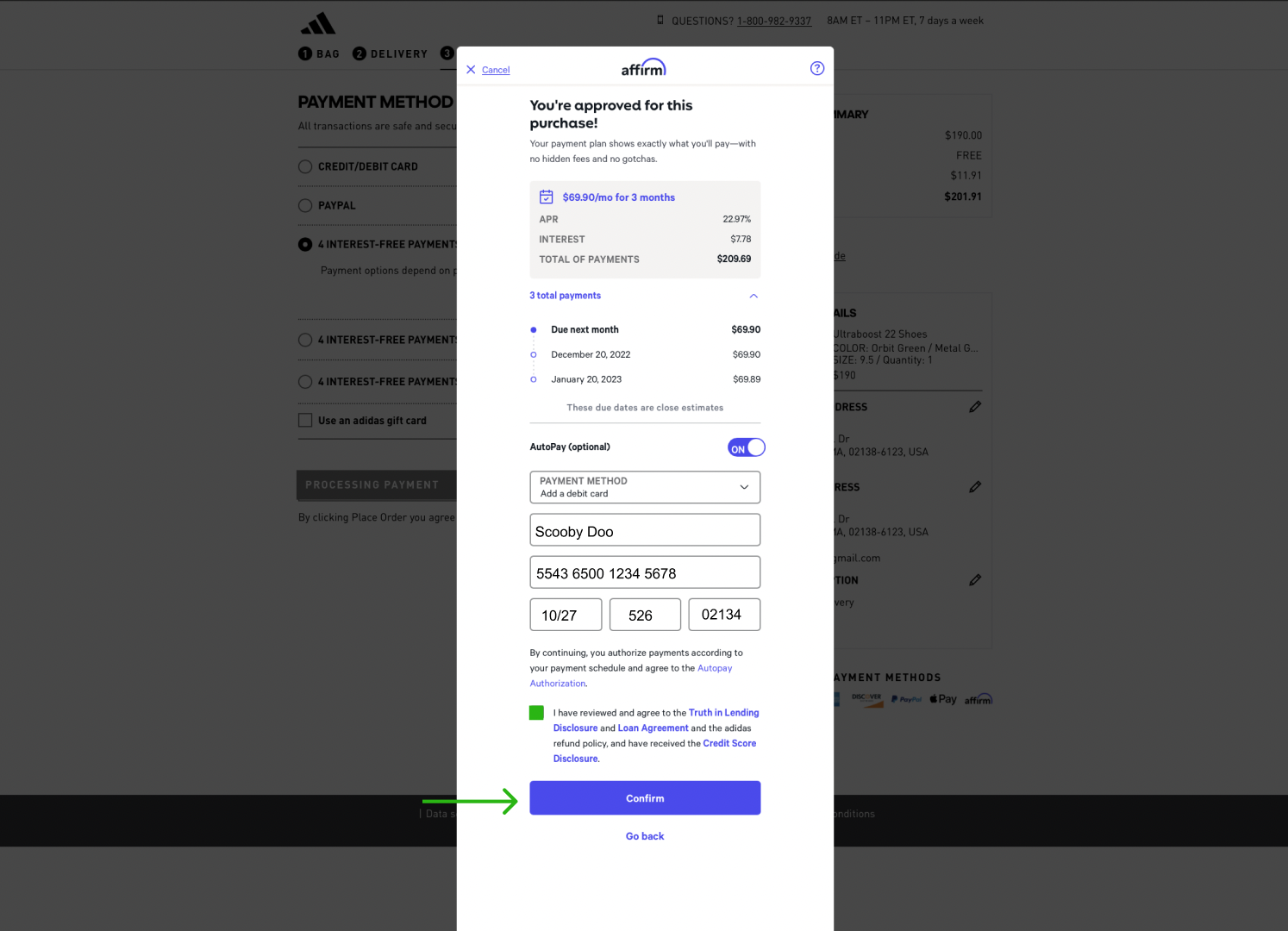

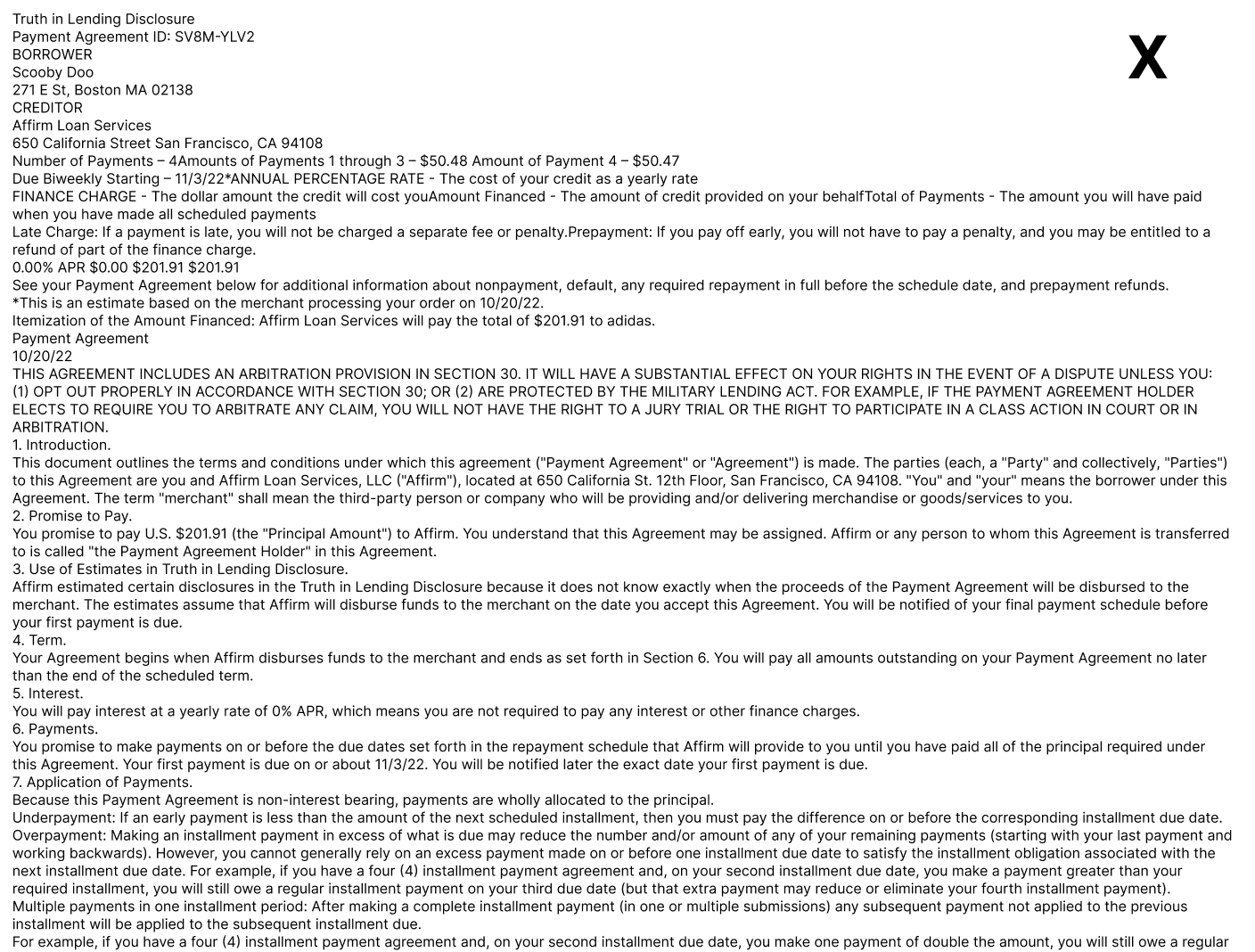

Despite these risks, when the experiment for this paper was conducted in 2022, BNPL companies operated in the US without specific regulatory oversight. This meant that companies like Affirm and Afterpay could offer loans to US consumers without disclosing interest rates, potential credit score impacts, or even that BNPL was a type of loan (see Appendix A & B for example BNPL flows in 2022). The survey questions in this experiment were specifically designed to follow disclosures required by the Truth in Lending Act, with the hopes of encouraging BNPL’s adoption under Regulation Z.

Since May 2024, BNPL services have been regulated under Regulation Z of the Truth in Lending Act (TILA) [18]. This ensures that BNPL lenders provide consumers with the same legal protections as traditional credit cards, such as the ability to dispute charges and request refunds.Regulation Z also requires certain disclosures for credit products, including annual percentage rates (APR), finance charges, and the total loan cost. These disclosures are designed to ensure consumers are fully informed about the financial products they engage with, helping them make more responsible and informed decisions. As a result of these regulatory changes, the following study might serve as an artifact against which future researchers can compare consumers’ perception of financial risks associated with BNPL post-May 2024.

Background

What is buy-now, pay-later?

Buy-now, pay-later is a term used to describe point-of-sale financing services [9]. Point of sale (POS) refers to the location in a consumer’s purchase journey where they are being presented with the opportunity to finance. The POS is where a consumer pays for a purchase—whether this is an in-person terminal or an online “checkout.” This study focused on BNPL companies that provide POS financing on e-commerce platforms.

In most cases, BNPL companies allow consumers to split the cost of an item into several installments over a predetermined period [10].Interest rates on the loan can vary depending on the size of the purchase, BNPL platform used, and the consumer’s credit history. It is not uncommon for these platforms to offer a 0% annual percentage rate (APR) at the time of purchase.

For example, if a consumer were to purchase a $100 bike, they could do so by paying $25 at the time of purchase and agreeing to 3 more $25 payments spaced out over three months.

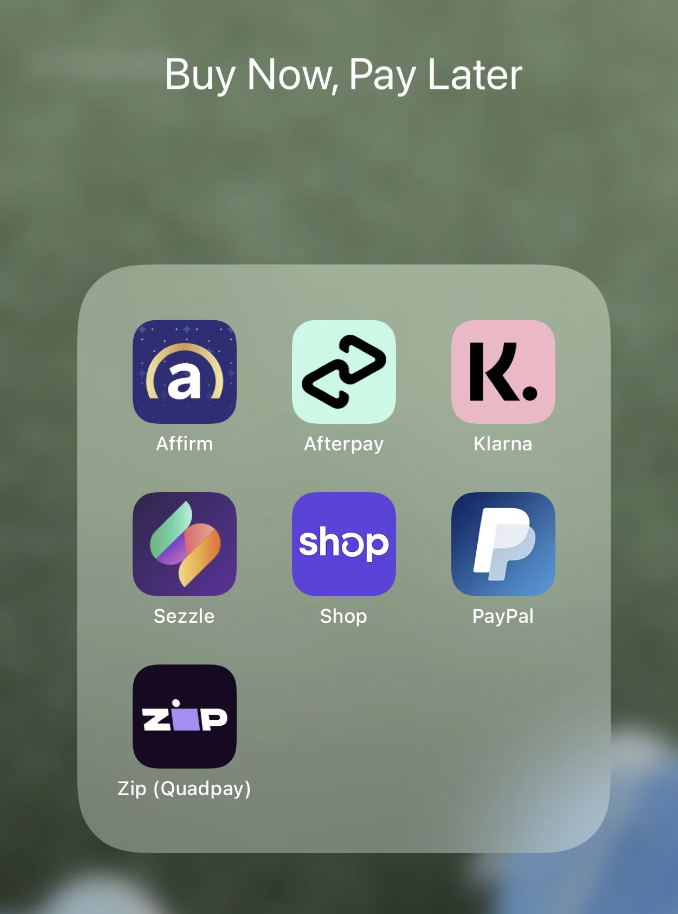

Figure 3 - The most popular BNPL companies in the United States in 2022 [19]

How do BNPL companies make money?

BNPL companies have two major sources of revenue: merchant fees and interest or late payments [20]. Every time a consumer purchases a product, the e-commerce platform pays the BNPL provider a “merchant fee.” BNPL companies claim to significantly boost online conversion rates—the likelihood that a website visitor will make a purchase—and thus can charge merchants set fees or a percentage of each transaction [21]. BNPL companies can also receive interest on the loans they offer.Depending on the service, users may pay fees for missing a payment, interest as part of the loan agreement, or additional interest on an unpaid balance when payments are missed [20].

How do BNPL companies determine the interest rate a person will pay?

Some of the concerns with BNPL services relate to their loan underwriting process. Underwriting refers to how a financing provider determines how risky it is to give a certain person a loan and what interest rate they will subsequently offer to that individual. For some providers, such as Afterpay, no interest rates are tacked onto the loans, only potential late fees [22]. However, the general trend in the BNPL industry, as in other fintech sectors, is toward setting interest rates using proprietary algorithms that assess risk in non-traditional ways [23]. Instead of relying on a credit score to determine creditworthiness, BNPL companies will sometimes assess “more than one billion data points” to determine how likely a person is to pay back their loan—including, but not limited to, the rate of payback on the specific item they are purchasing, a LinkedIn profile indicating the kinds of jobs the consumer has worked, average incomes for the zip code that the item is being shipped to [21], as well as other vague indicators. The opacity of the algorithms used has made it difficult for technologists to scrutinize BNPL providers and discern what sort of rate discrimination exists.

Where is BNPL offered?

BNPL is practically a ubiquitous service in the United States. Affirm offers financing across the price spectrum, from general merchants like Target and Walmart to luxury brands such as Oscar de la Renta and Peloton [7]. Afterpay primarily covers clothing, home, and beauty products and offers financing for hundreds of merchants [8]. Some BNPL services, including Klarna, are merchant-neutral, their digital apps enabling consumers to “pay in four,” breaking up their purchases into multiple installments, at any store [24].

What are the BNPL companies tested in this study?

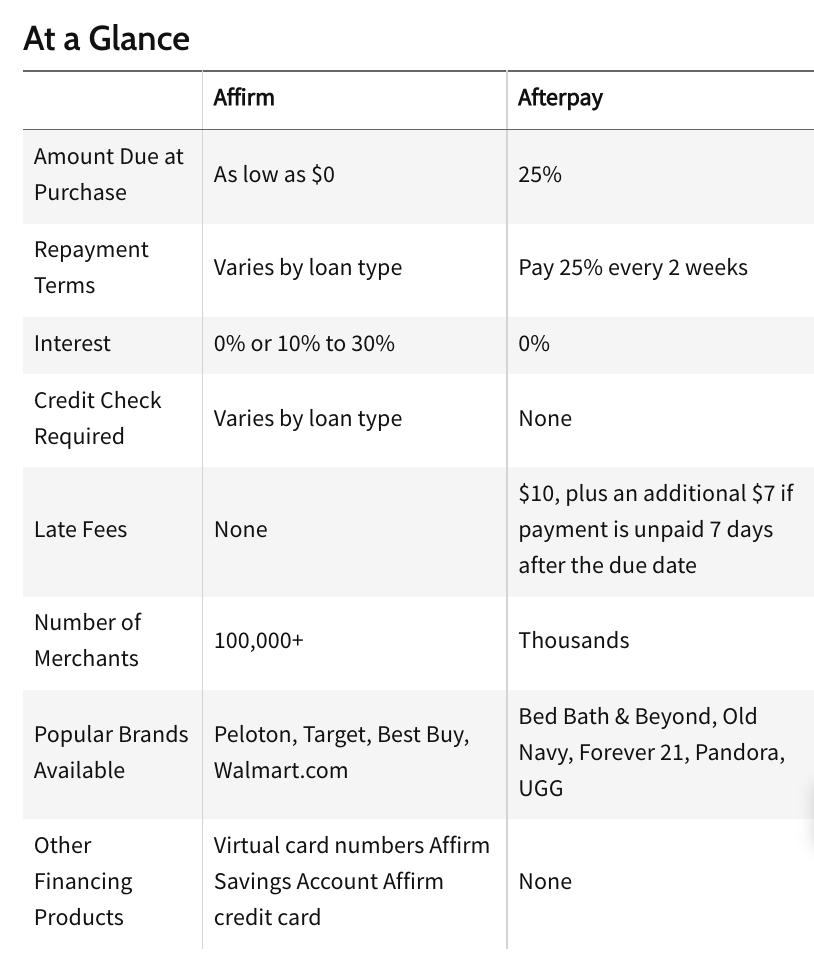

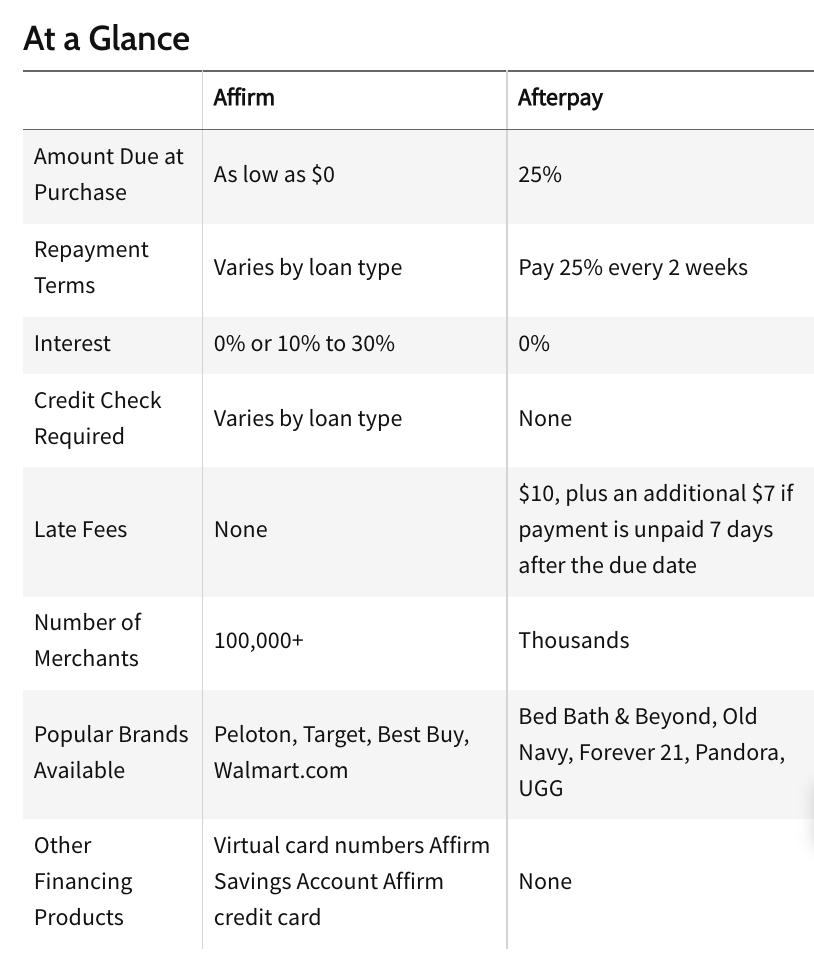

In this study, we tested two popular BNPL companies, Affirm and Afterpay. Afterpay was founded in 2014 and was formerly listed on the Australian Securities Exchange [25]. Although Afterpay was launched in Australia, its U.S. business has since outpaced its Australian customer base, and in late 2021, Square acquired Afterpay for $39 billion. Affirm was founded in San Francisco in 2012 by a co-founder of PayPal [26]. The company debuted on the NASDAQ exchange in early 2021.

Figure 4 - A comparison of lending terms offered by Afterpay and Affirm [27]

How are lending products currently regulated in the United States?

Lending is regulated in the United States through a patchwork of laws, executive orders, and court rulings. The Equal Credit Opportunity Act prohibits discrimination in any aspect of a credit transaction, including discrimination by race, religion, sex, and age [28]. The Credit Card Accountability, Responsibility, and Disclosure (CARD) Act extends the Truth in Lending Act and requires credit card issuers to uphold standards of transparency, including requirements on which disclosures must be visible and how these disclosures are presented to the consumer [29]. The Dodd-Frank Wall Street Reform and Consumer Protection Act created the Consumer Financial Protection Bureau, the leading authority in all lending products, including mortgages, credit cards, and debit cards [30].

How has BNPL regulation changed?

At the time this study was conducted, the Truth in Lending Act and CARD regulations did not apply to BNPL services because BNPL payment plans typically fall below the five-installment threshold for regulation [31]. Since May 2024, BNPL services are subject to Regulation Z of the Truth in Lending Act [18].

Methods

This study tested the 2022 purchasing flows of two BNPL companies to assess whether they effectively communicate the financial risk associated with BNPL. We chose to test two BNPL companies to avoid generalizing the results of one study to an entire industry, investigate whether certain methods of presenting information on consumer risk perform better than others, and produce concrete suggestions for purchasing flow reform.

We chose Affirm [7] and Afterpay [8] because in 2022 (when the study was conducted):

They were two of the largest BNPL platforms in the United States, with a total of over 112,000 merchants in their networks [32];

They offer different consumer experiences in their purchasing flows when displaying information on when payments are due and what may be a consequence of late payments; and

Their user bases targeted different customers. Affirm was partnered with higher-end merchants and luxury brands, [7] whereas Afterpay featured a portfolio of traditional clothing and makeup retailers [8].

By late 2024, Afterpay was working with over 348,000 global merchants [33], and Affirm closely followed with a portfolio of 320,000 [34].Their consumer checkout experiences continue to differ from one another, and both merchant networks have expanded to include both higher-end and consumer retail brands [7, 8].

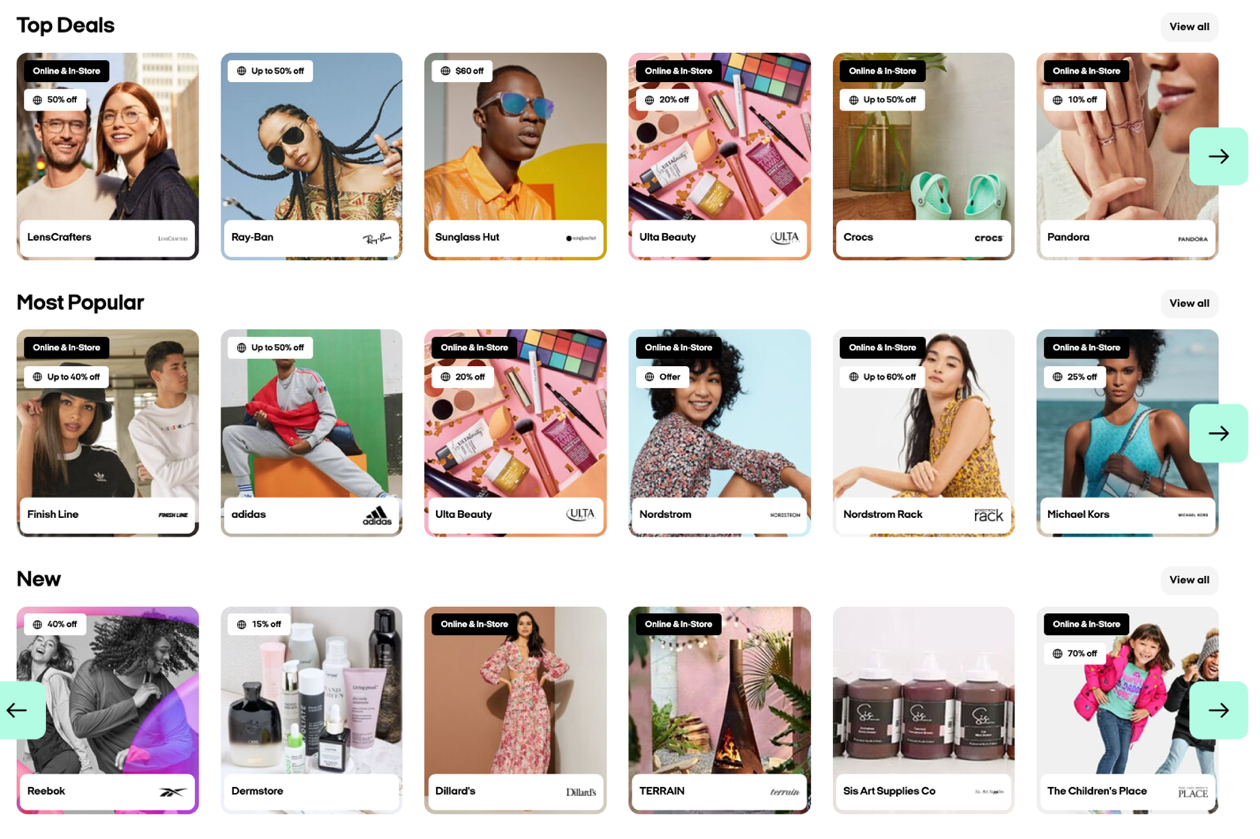

Figure 5. Merchants partnered with Affirm [7].

Figure 6. Merchants partnered with Afterpay [8].

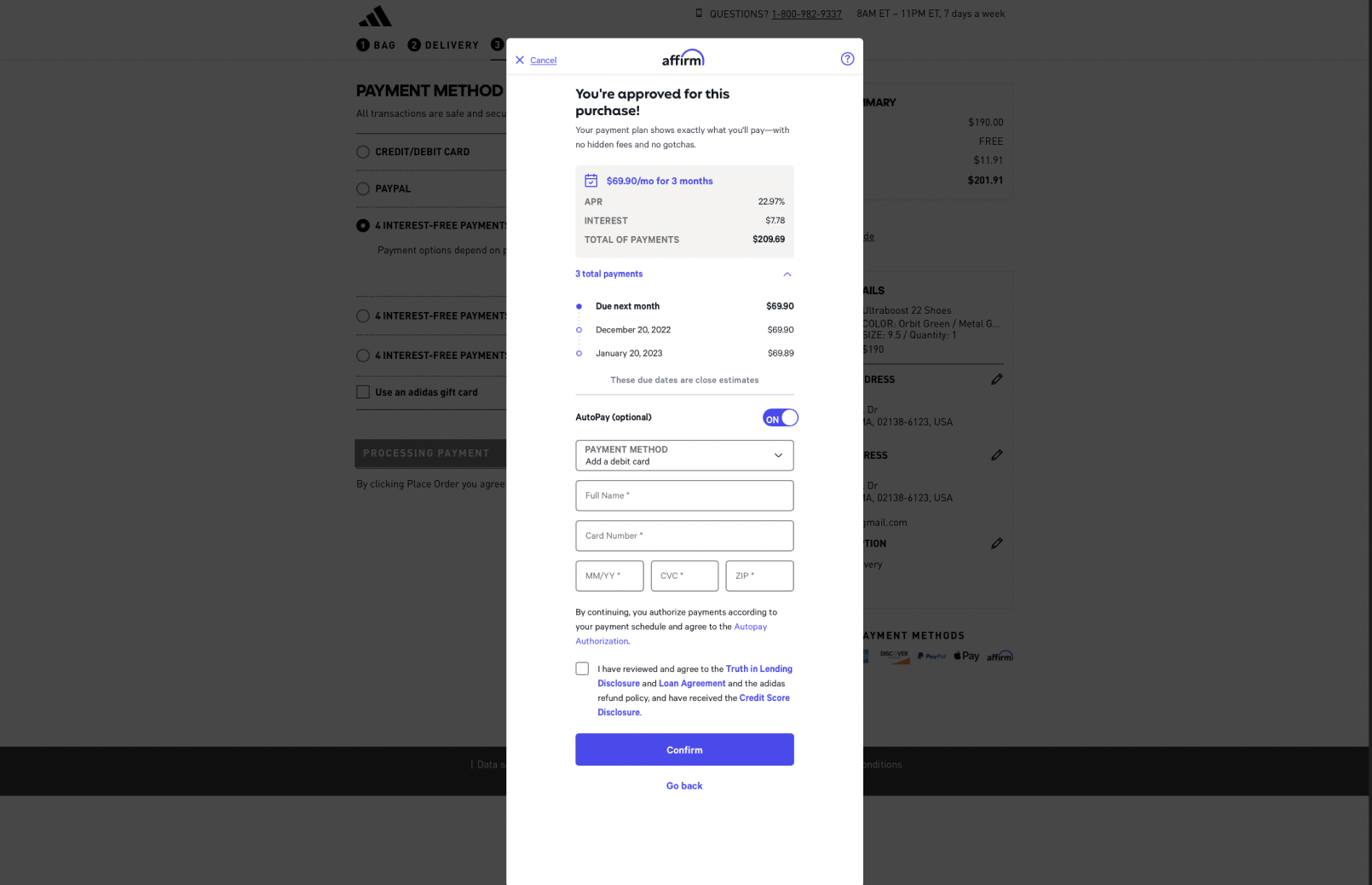

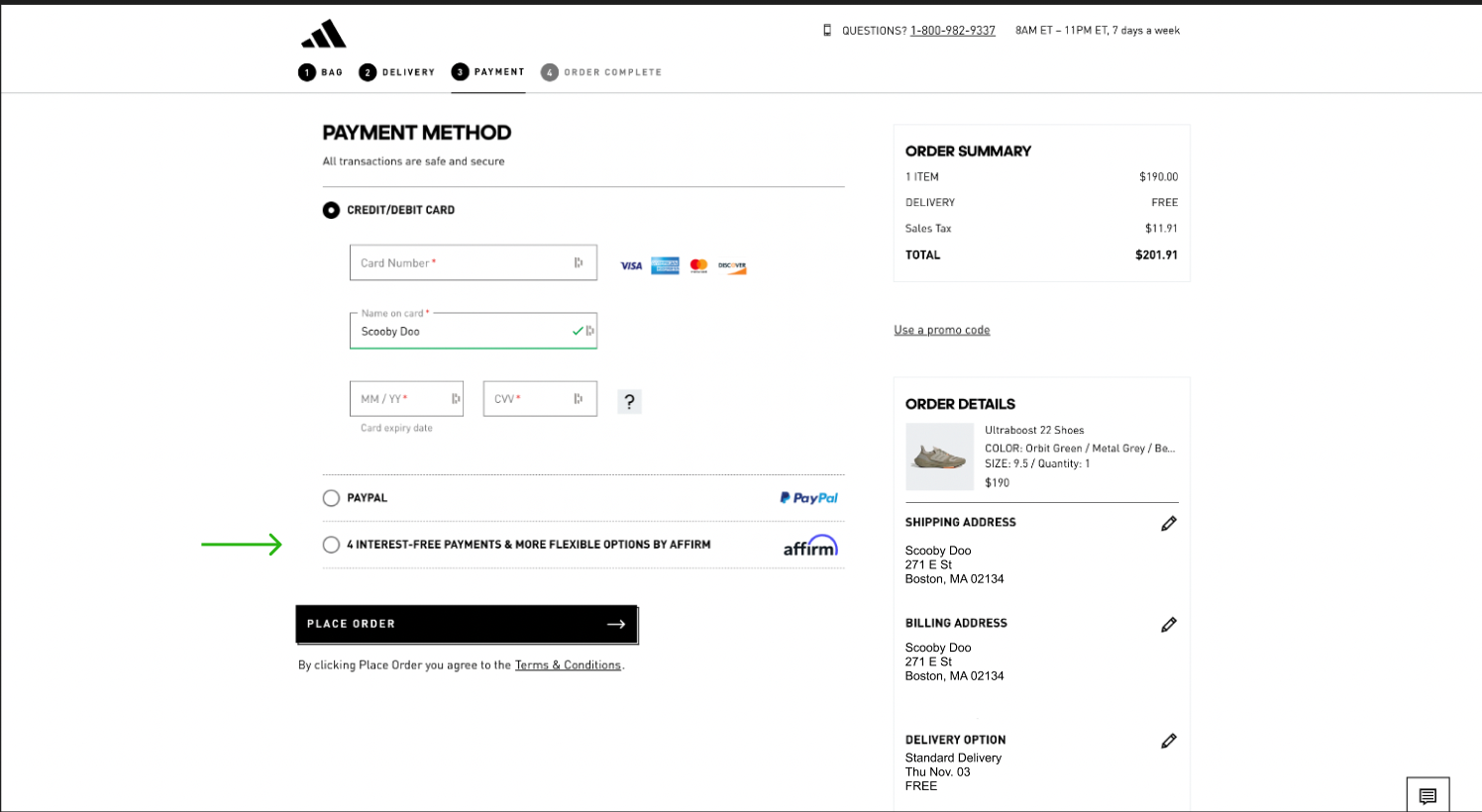

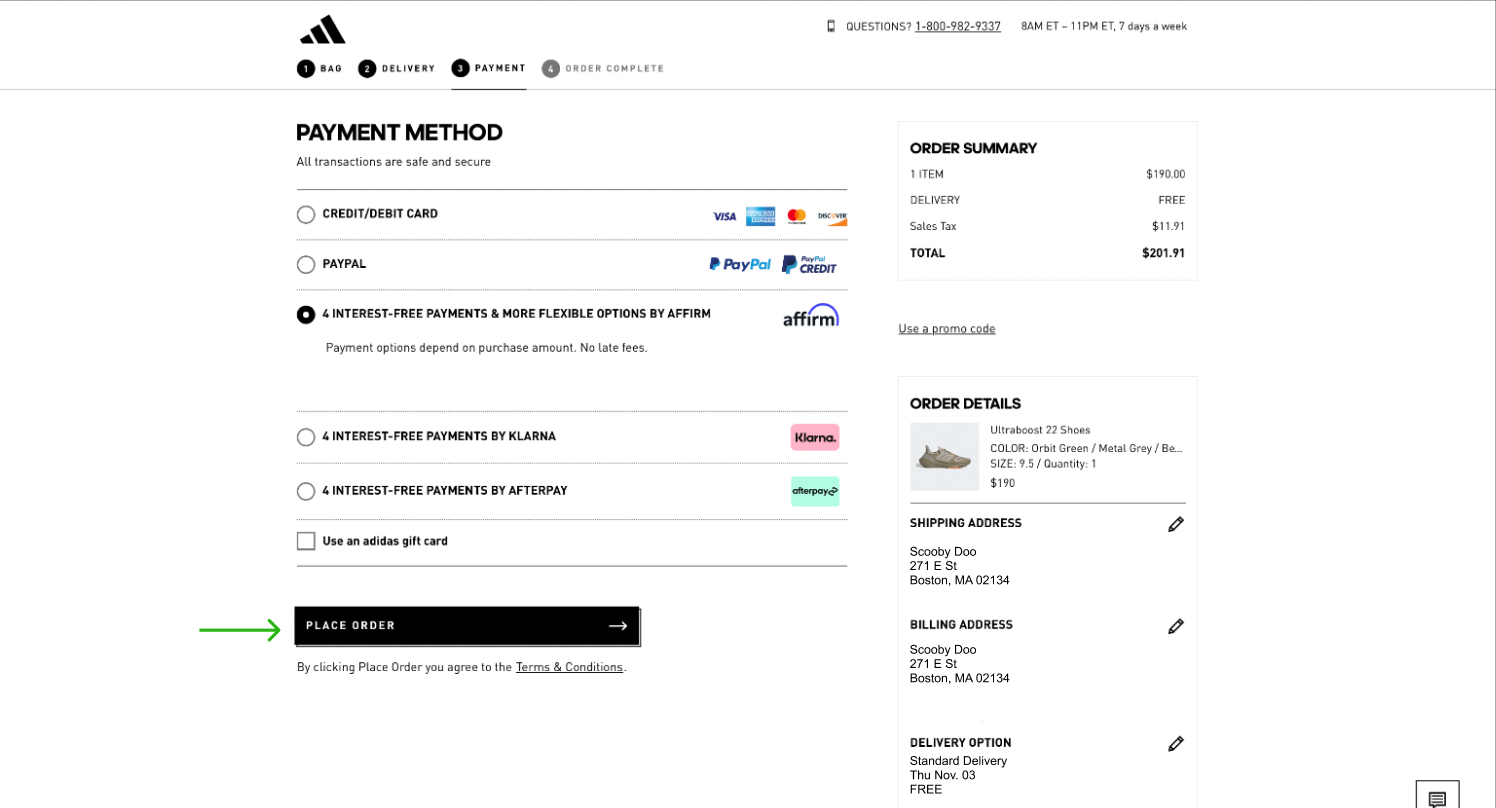

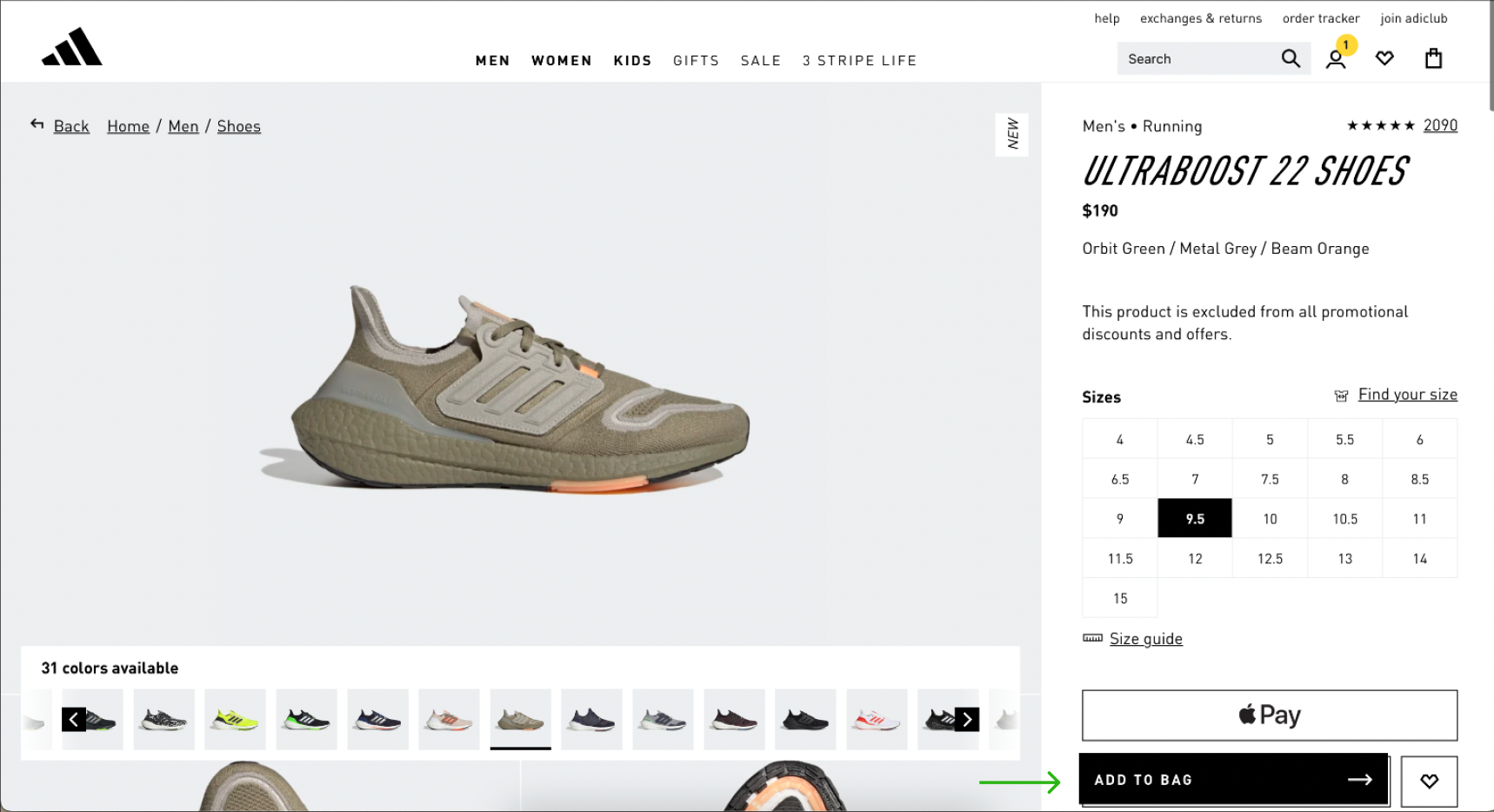

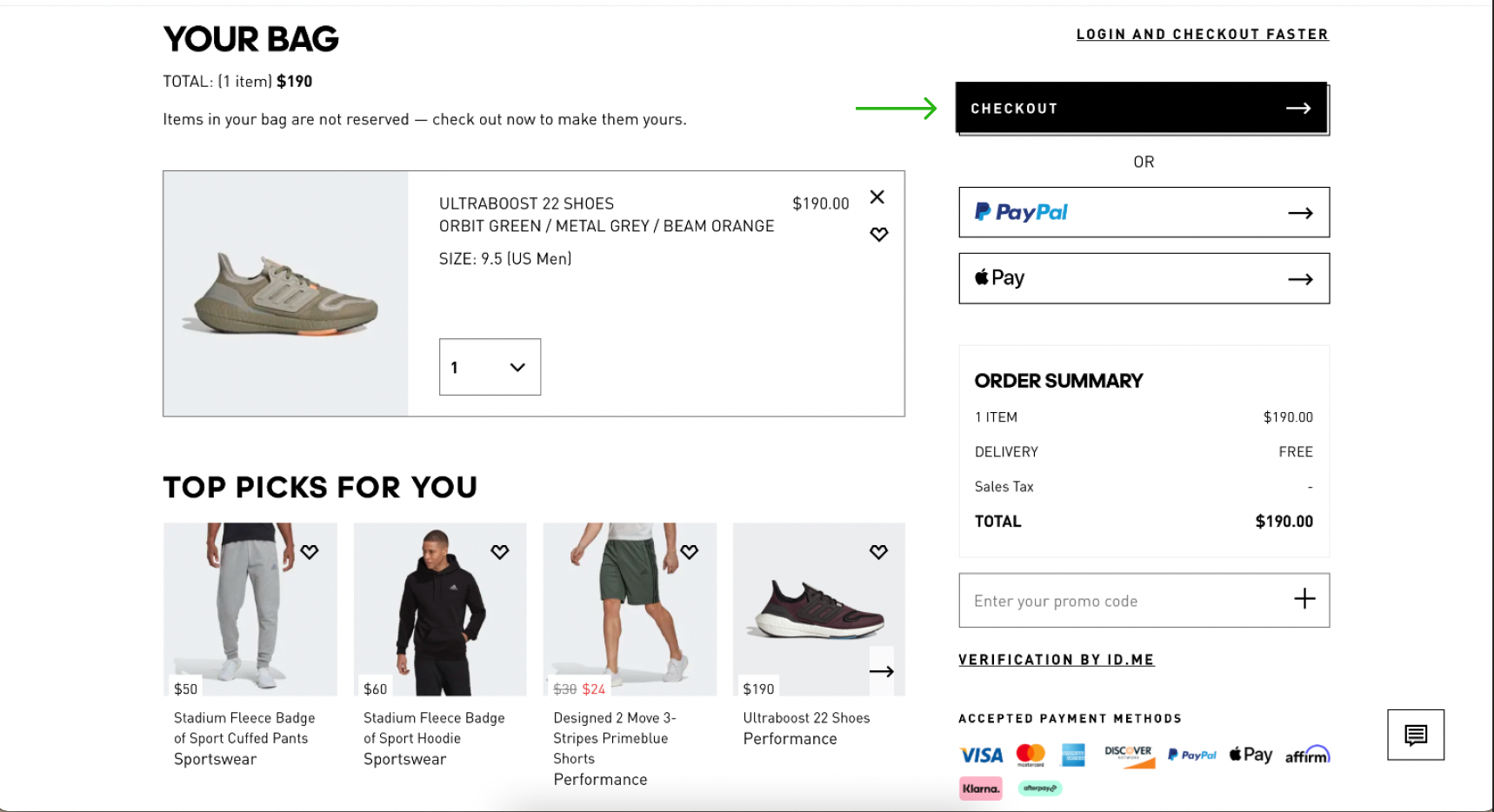

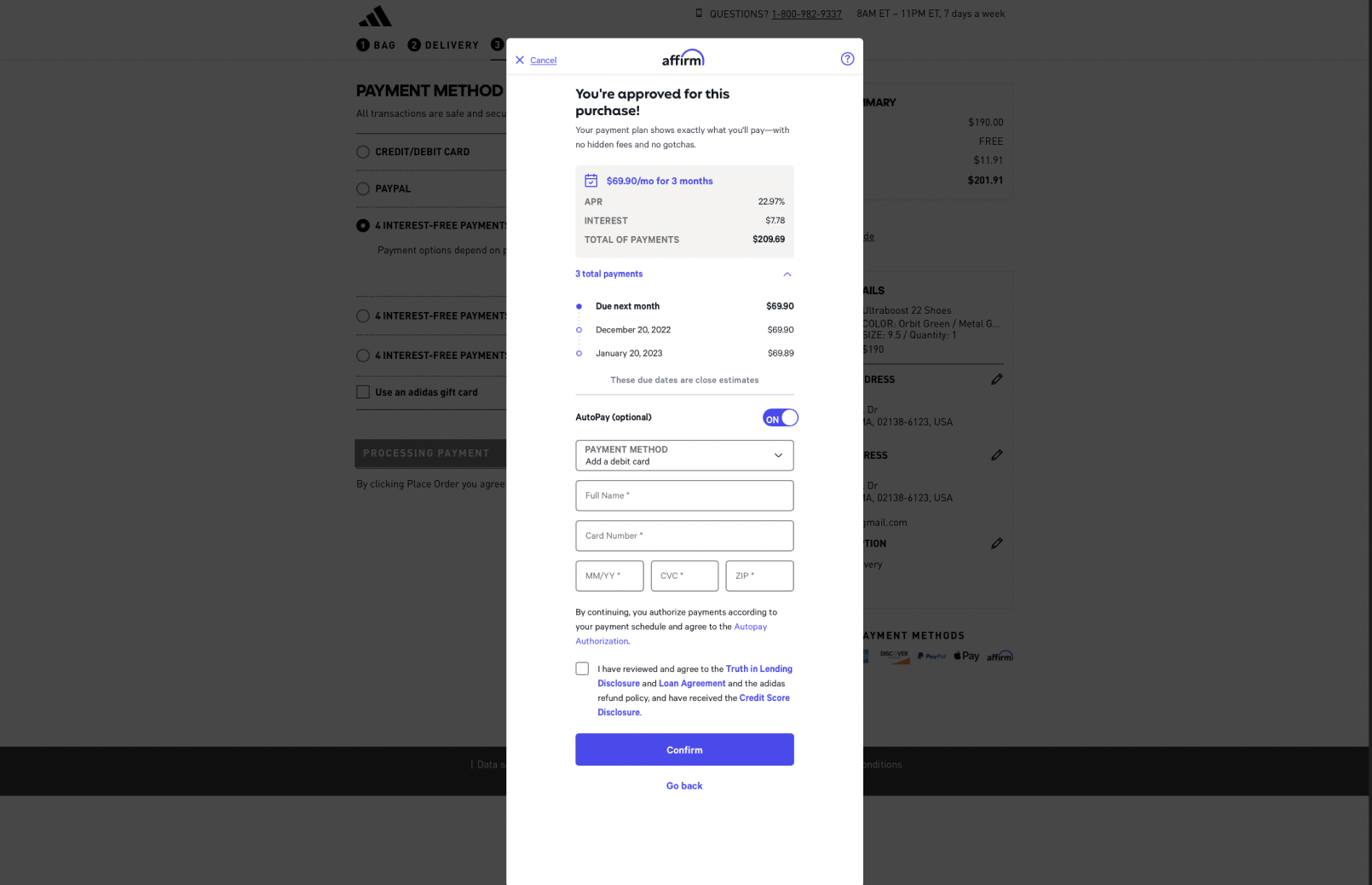

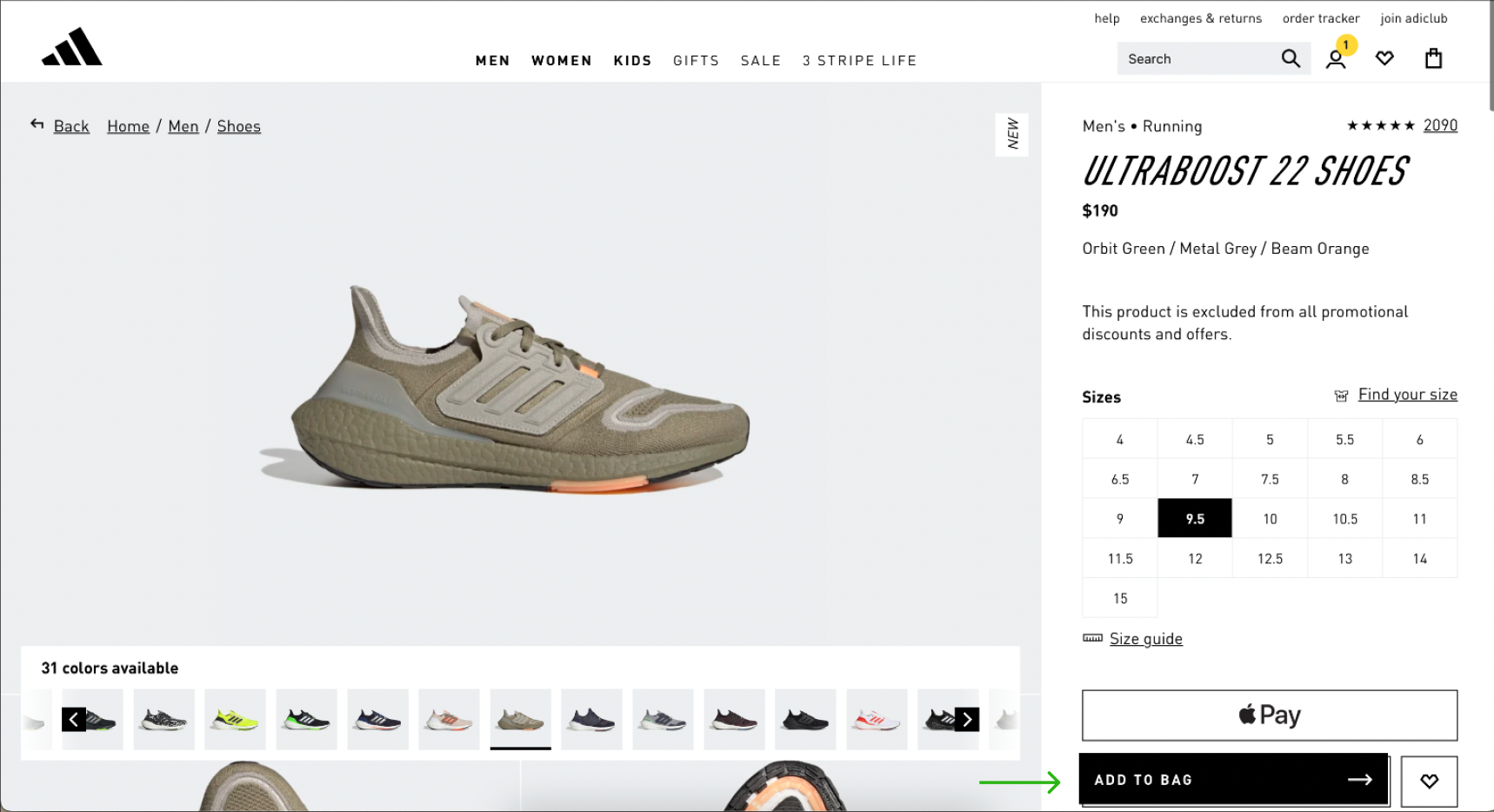

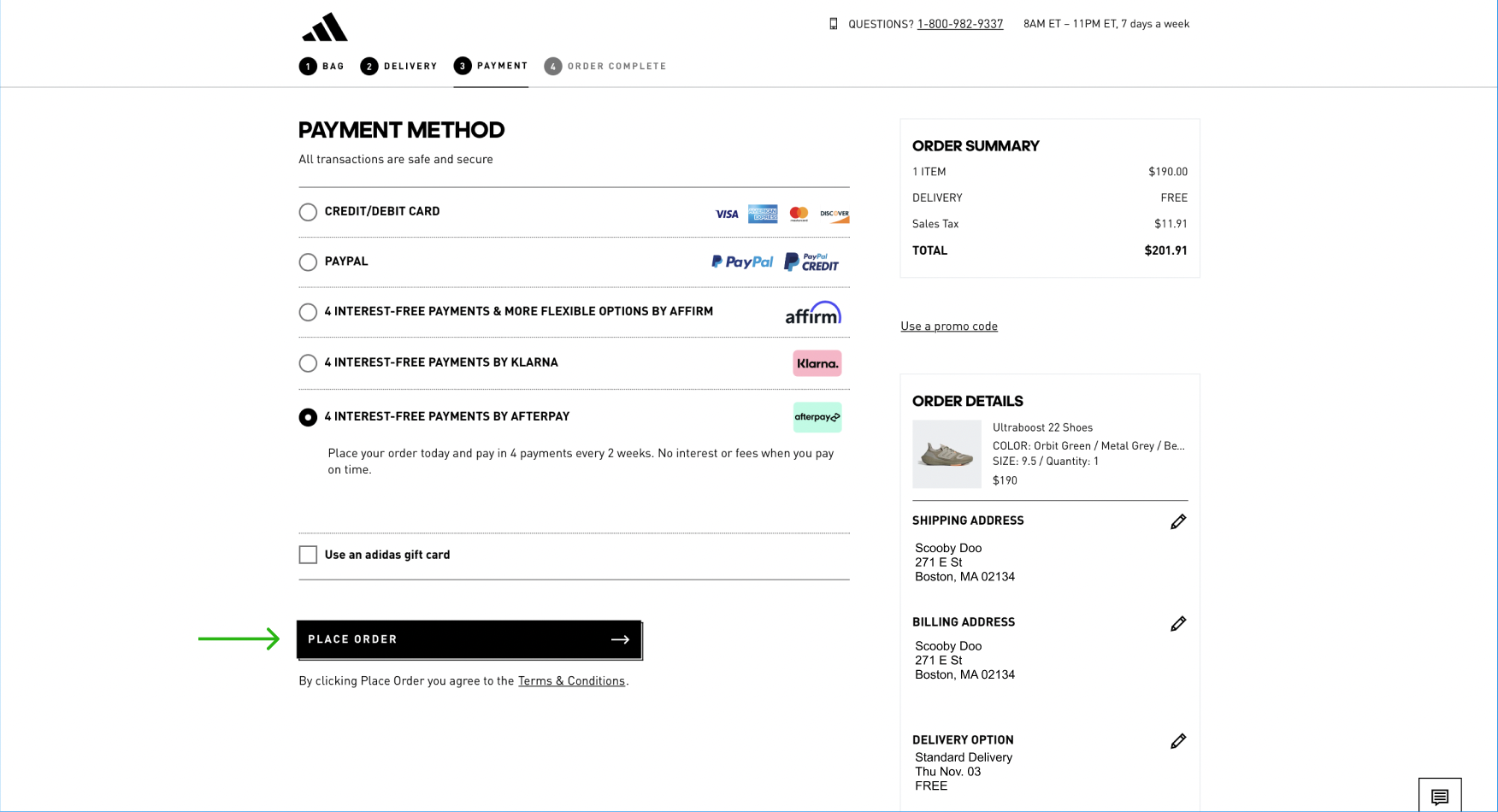

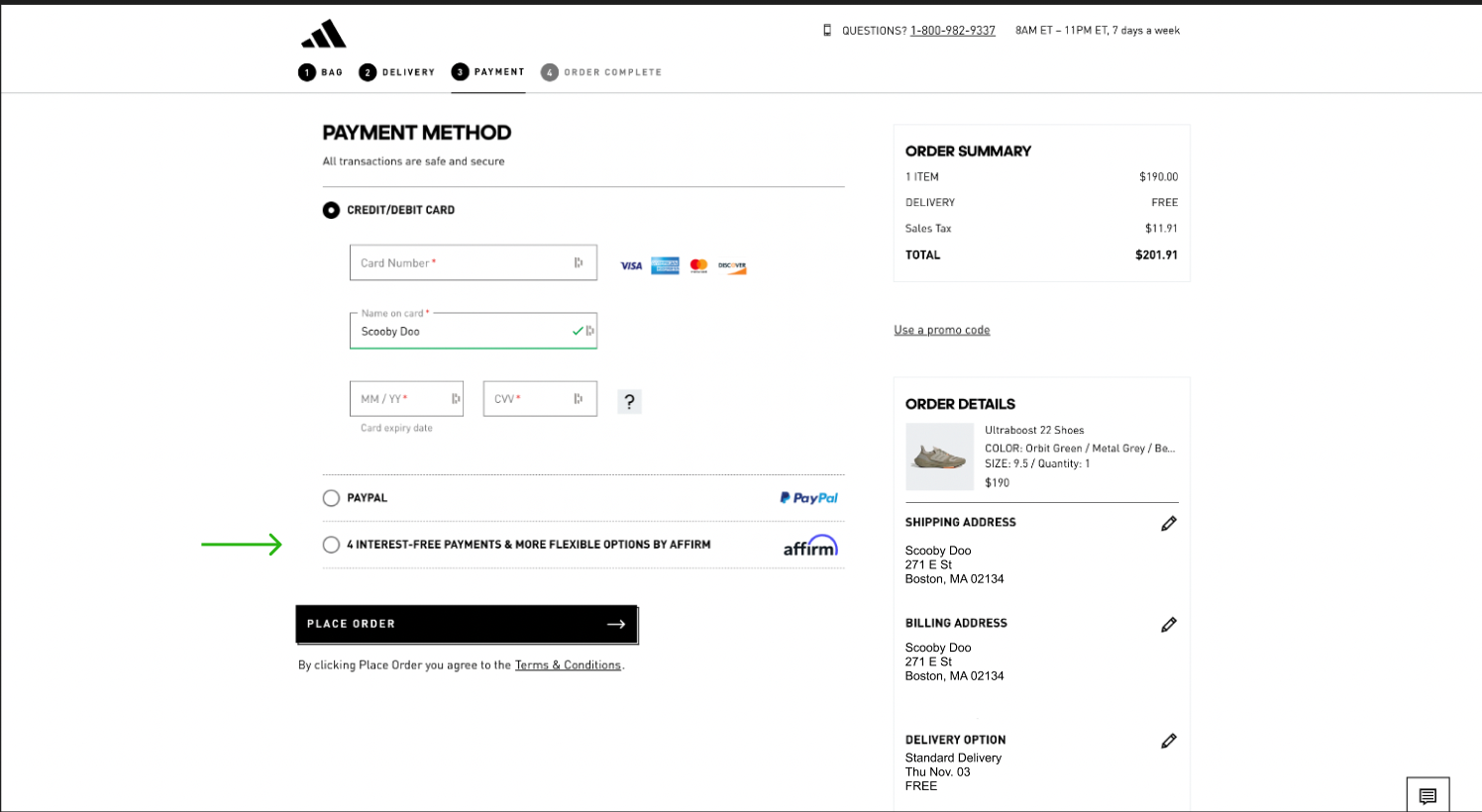

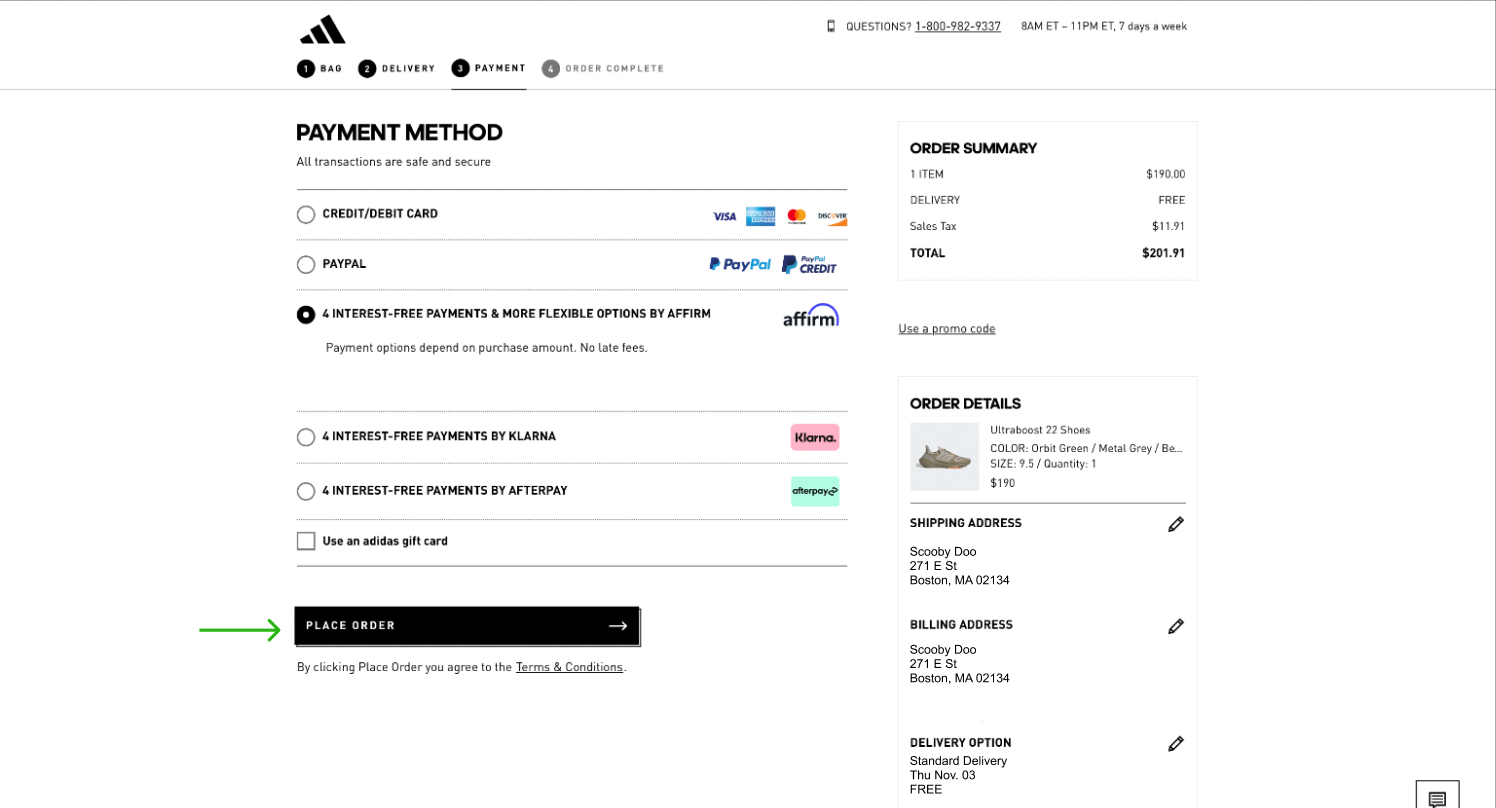

After identifying our companies of focus, we documented their BNPL purchasing flows. In this study, a “BNPL purchasing flow” is defined as the full sequence of events that take place from when a consumer has added a product to their online “shopping cart” on a retailer’s website to when they have successfully purchased the item with the help of a BNPL service. We chose to record the purchasing flows for Affirm and Afterpay on Adidas’ website because the vendor partners with both companies, minimizing differences between the two experiments.

Affirm and Afterpay offer direct API integrations to their partner companies, meaning that retailers are able to embed the BNPL company’s account creation and financing journey into their own online checkout user flows [35] [36]. However, as with most API integrations, retailers can choose how embedded the BNPL offering is in their online checkouts.Consumers using different websites may experience different presentations of BNPL signup and purchasing flows, ranging from a pop-up on a website to a link to an external website in a separate browser tab, to a complete integration, where a user can purchase and finance the item with BNPL without ever leaving the original merchant’s website. At the time the study was conducted, we found that Adidas’ website supported robust integrations with both Affirm and Afterpay. Although Affirm’s integration was more impressive from a technical standpoint, showing the Affirm purchasing flow overlaid on the Adidas website rather than opening a web view, both purchasing flows were free of bugs and navigational complexity. Choosing a well-maintained website like Adidas’ allowed for our results to demonstrate how different user interfaces can impact risk comprehension rather than highlighting issues with the implementation itself.

Usability Testing

In this study, we performed a usability test using interactive prototypes to monitor how much information is absorbed by users when purchasing goods with a BNPL platform. Usability testing is designed to show how real users will interact with a website, app, or product.

Many major tech companies perform usability testing to assess potential confusion in a

design and discover opportunities to improve the product [37]. A prototype is an interactive tool that product designers use to mimic how a website, app, or product will function. Prototypes are often used in the testing stages to account for any missed design elements or errors consumers may face before the final product is produced. In a prototype environment, users can click on images of web pages or apps as if they were within the page or app itself. The prototype will react exactly as the creator instructs it to. For example, a prototype that tests an e-commerce experience would typically take a user to an online checkout after they select “View my Shopping Cart.”

Creating Prototypes

Our study design utilized the usability testing platform Maze to measure what financial information a respondent can recall after navigating through a simulated purchasing BNPL flow [38]. We chose Maze because our discovery revealed that it is one of the only online usability testing platforms that fulfills the following criteria:

Requires respondents to complete the entire prototype before answering survey questions, reducing the risk of low-quality responses;

Measures the amount of time that respondents spend in the prototype, allowing us to invalidate the answers of respondents who spend an insufficient amount of time (< 30 seconds) in the prototype to meaningfully reflect on the experience;

Blocks respondents from returning to view the prototype while answering survey questions, simulating a true BNPL experience;

Features a database of 20k+ survey respondents who can be sorted by age, geographical location, and English proficiency and are trained on taking Maze surveys, reducing the risk of technical difficulty altering our results and allowing us to target Americans of a certain age who are proficient in English; and

Returns results from over 100 respondents in under 6 hours.

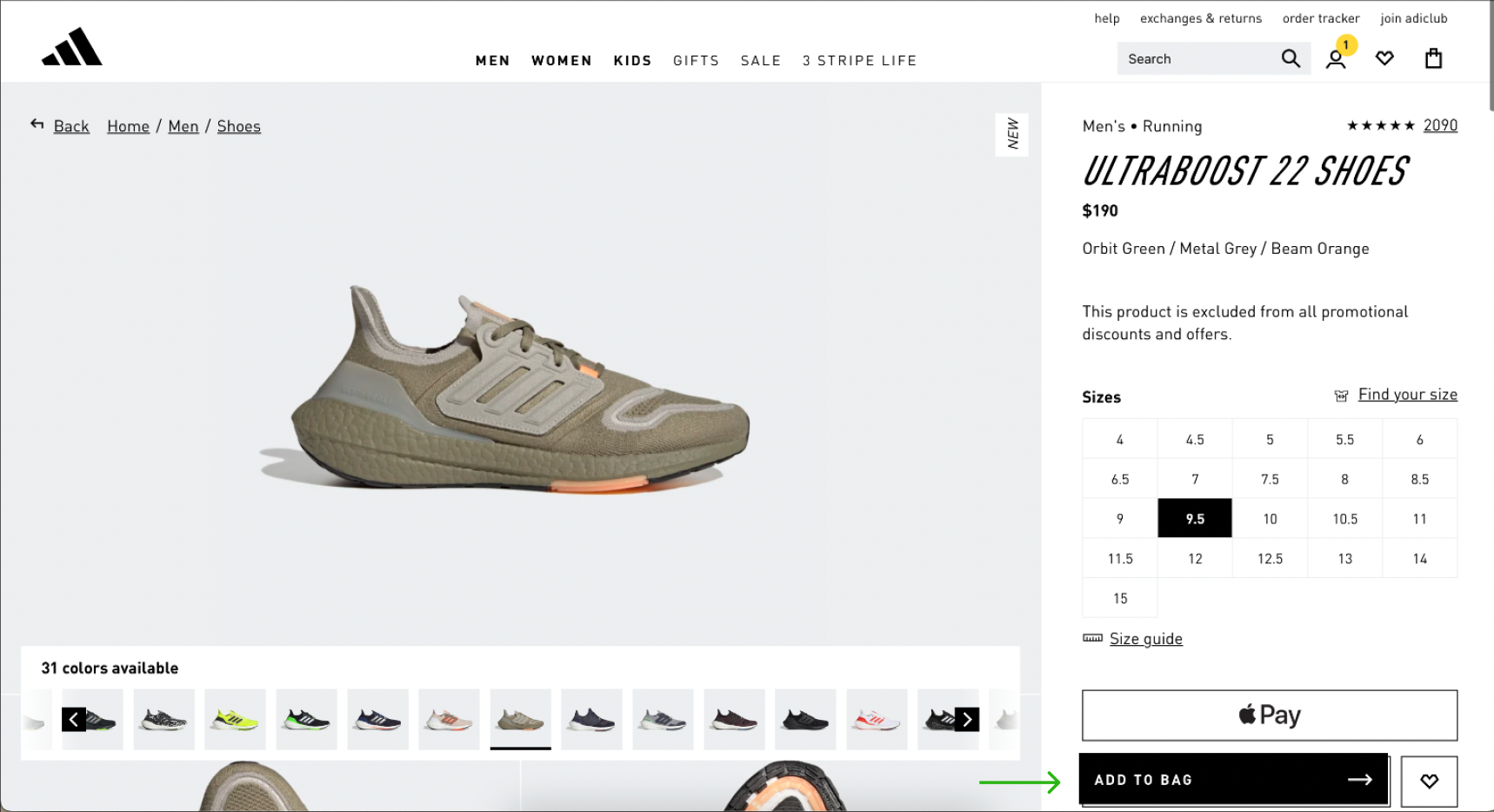

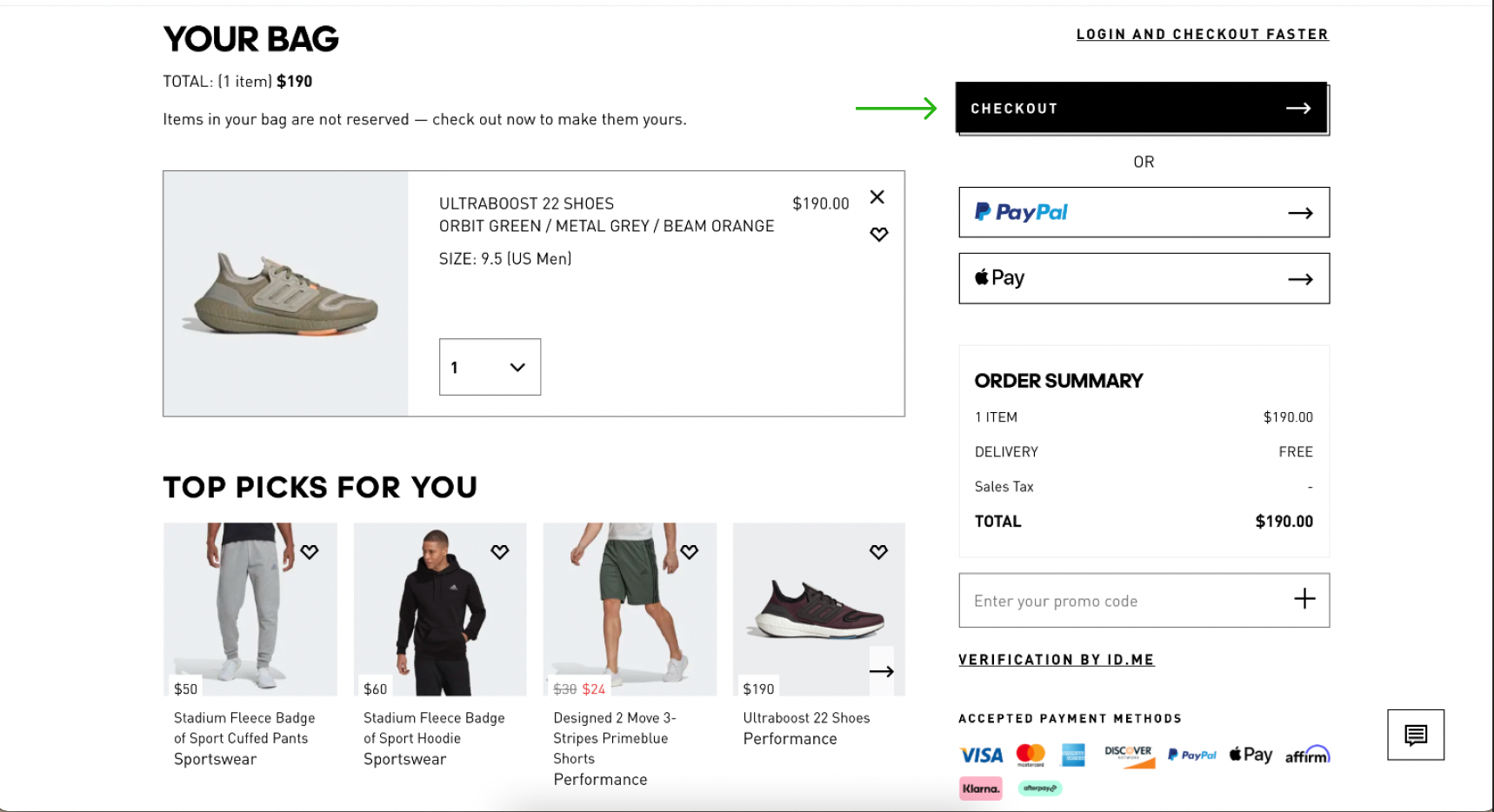

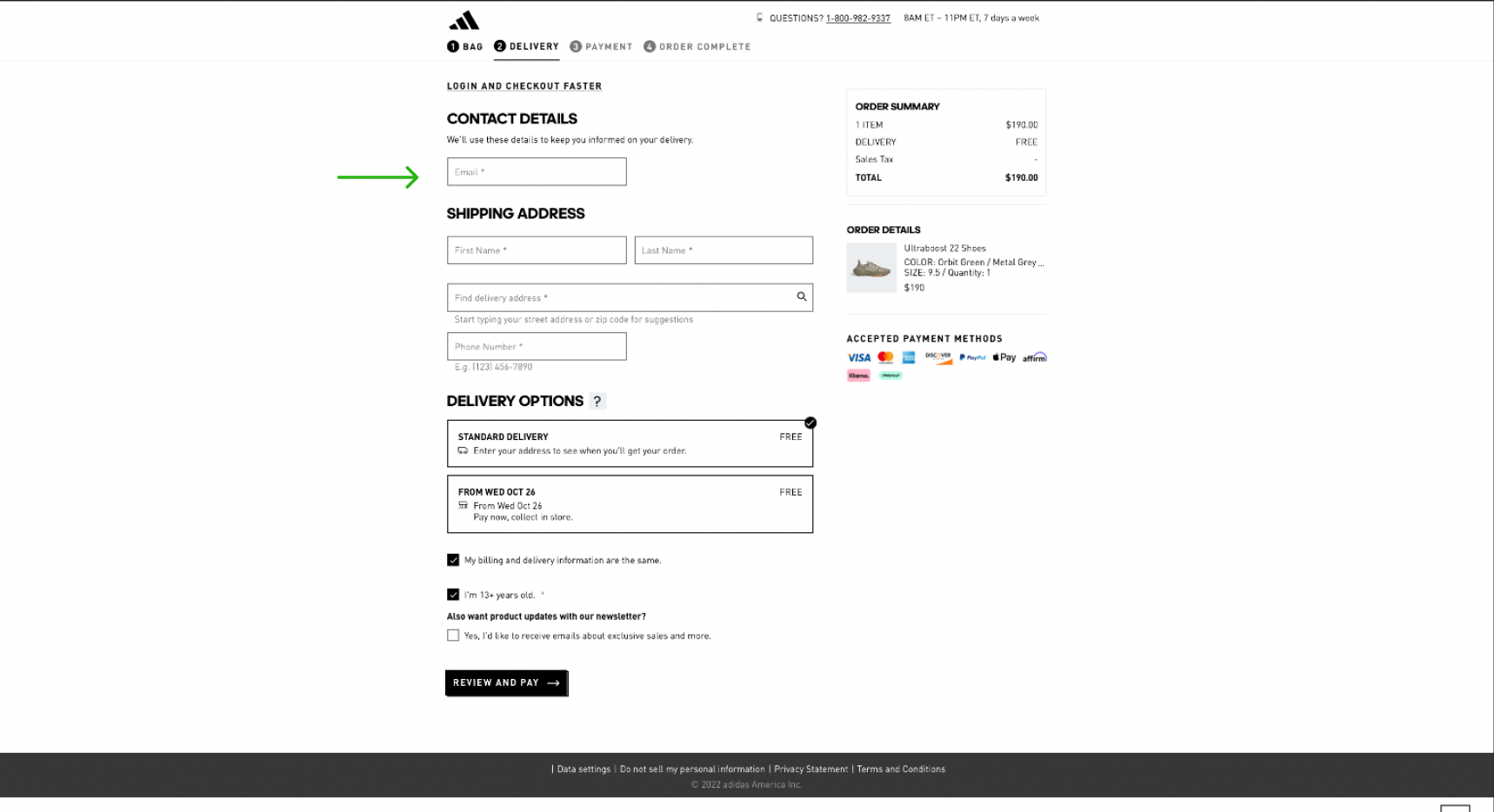

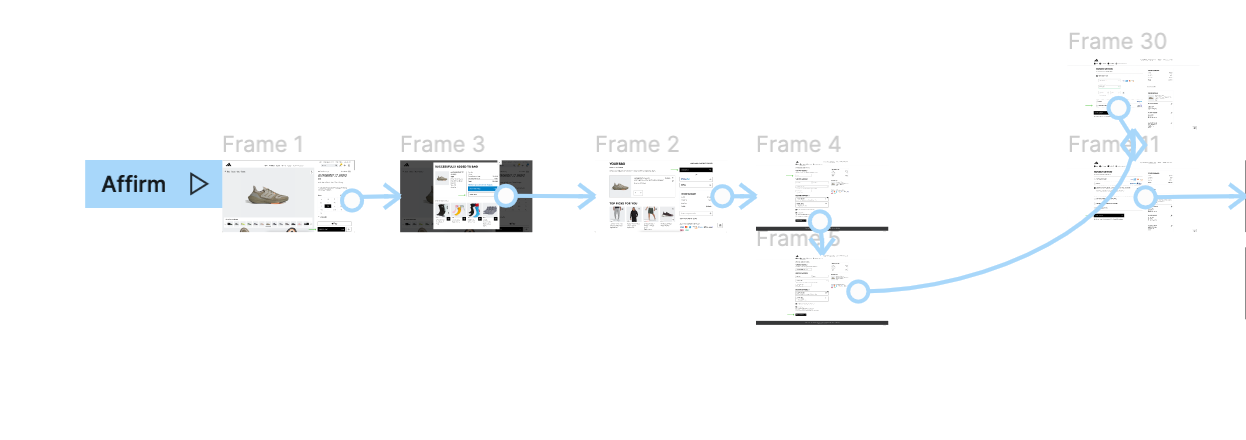

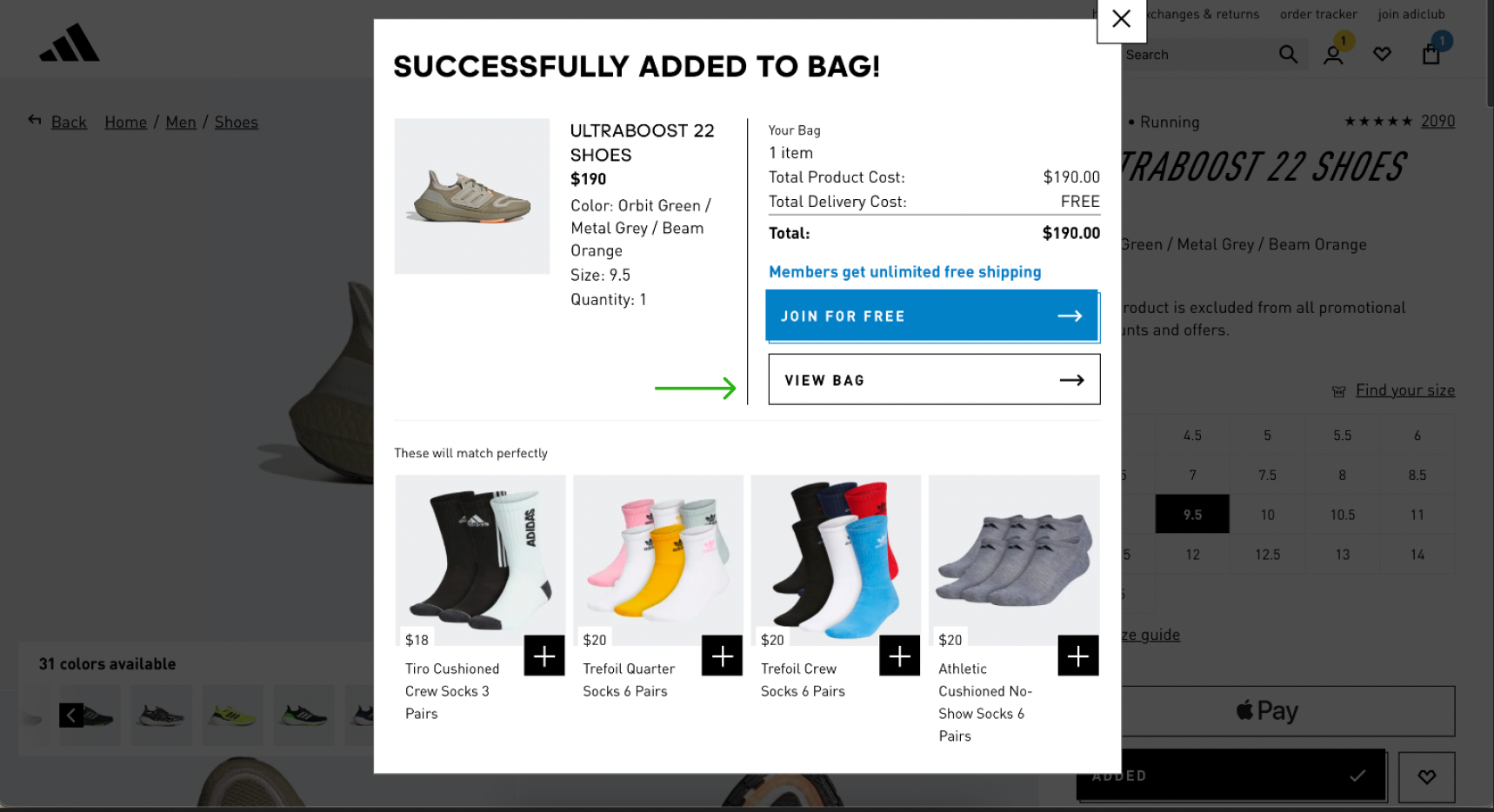

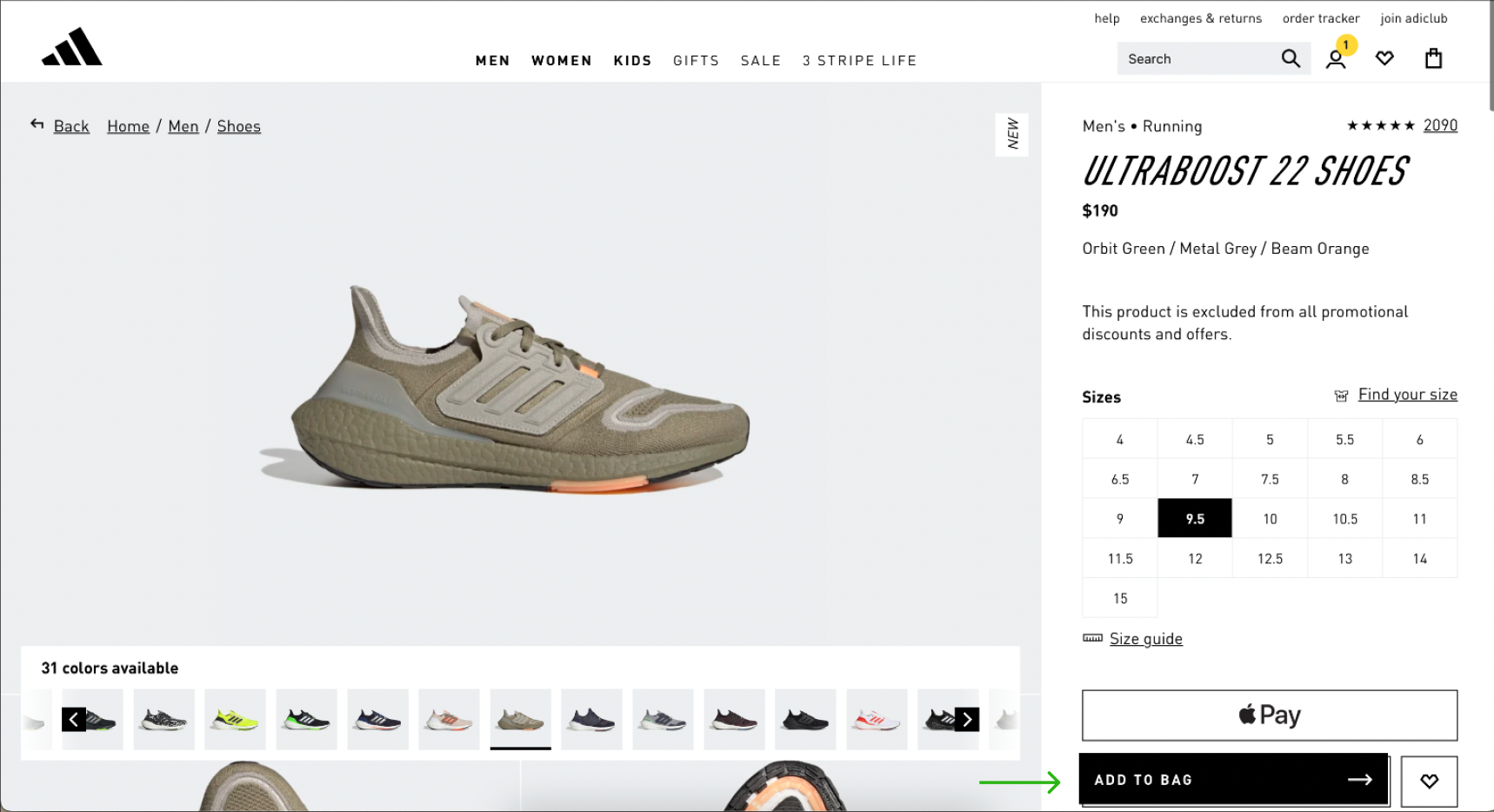

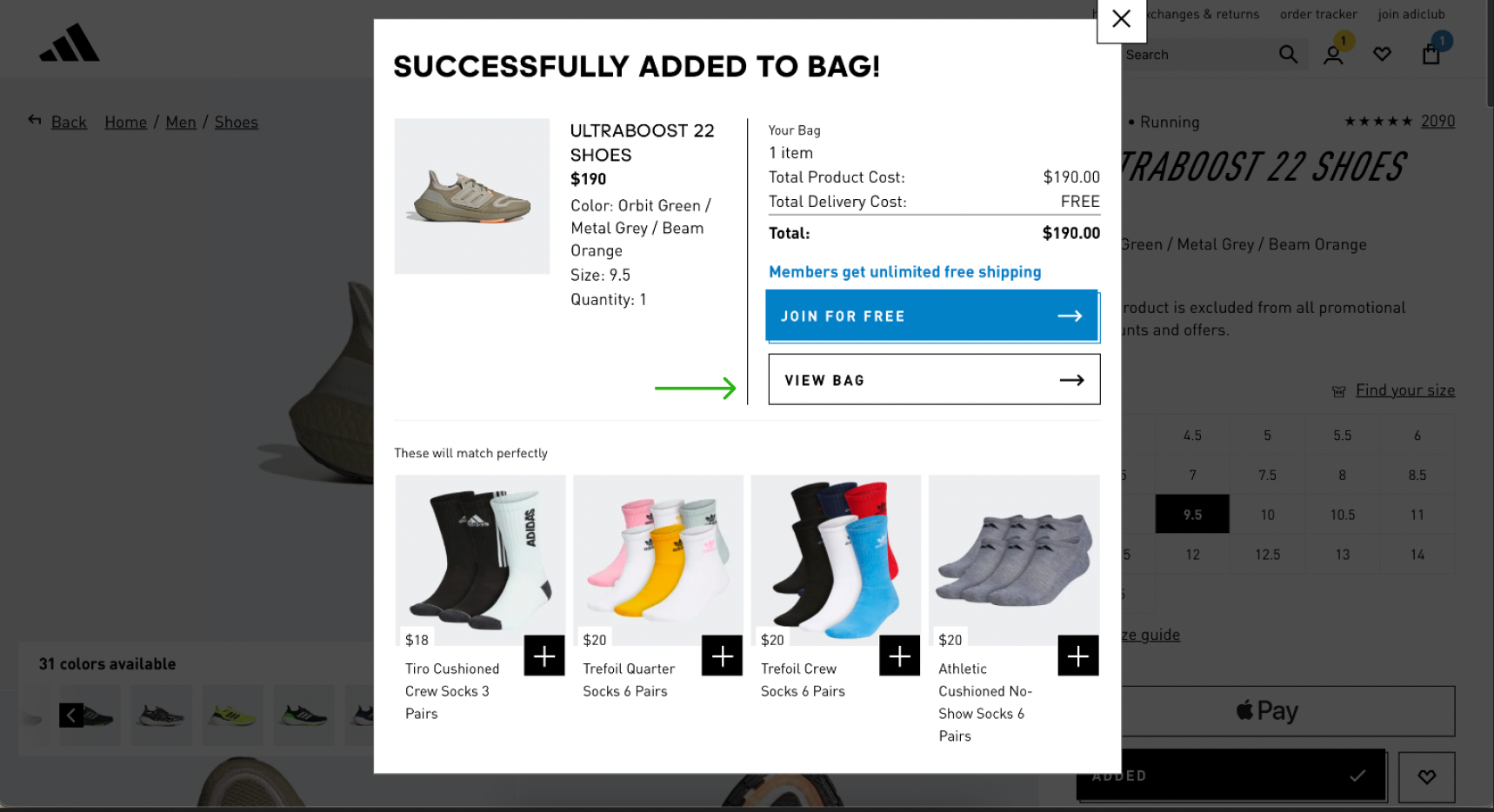

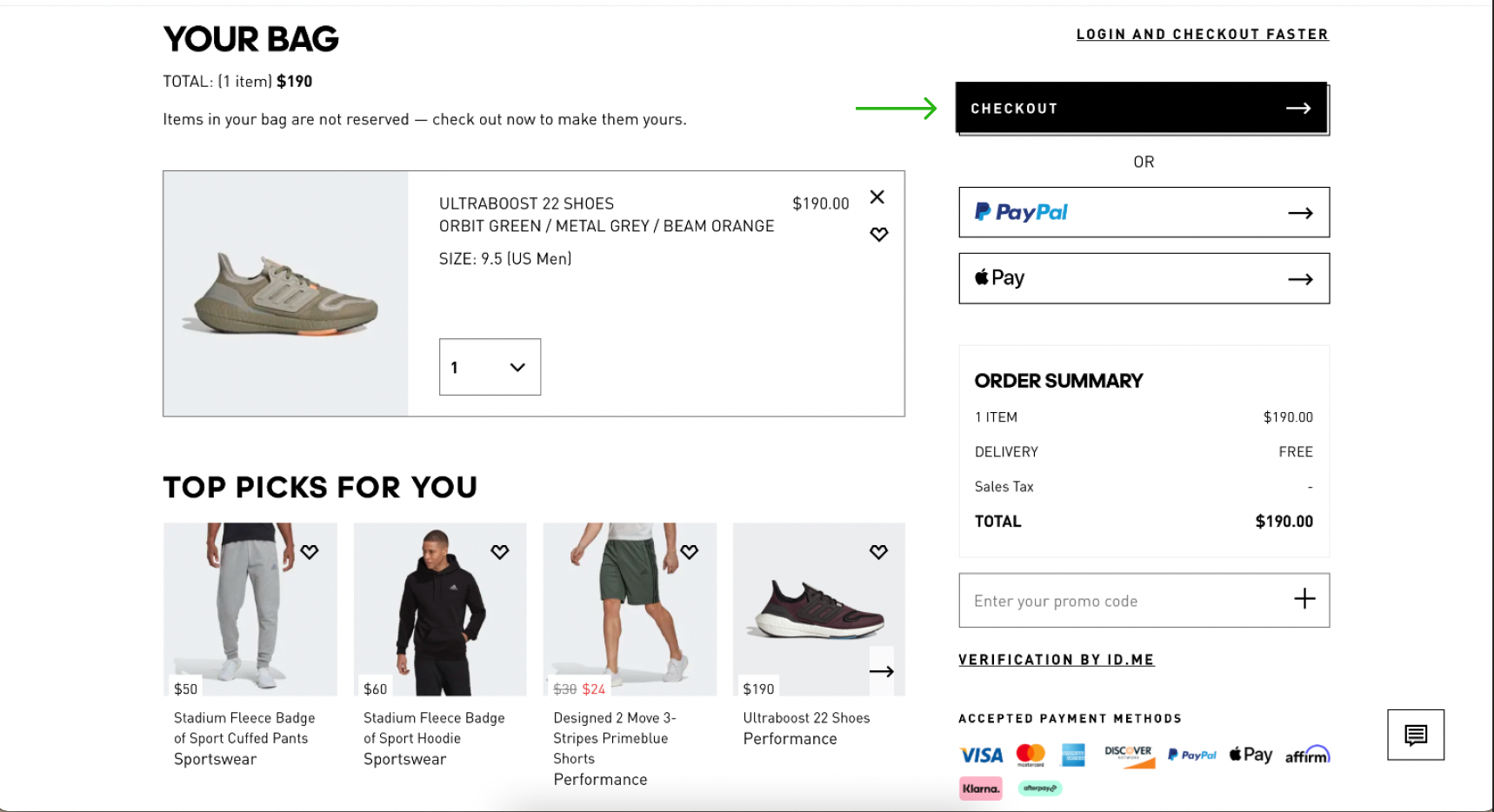

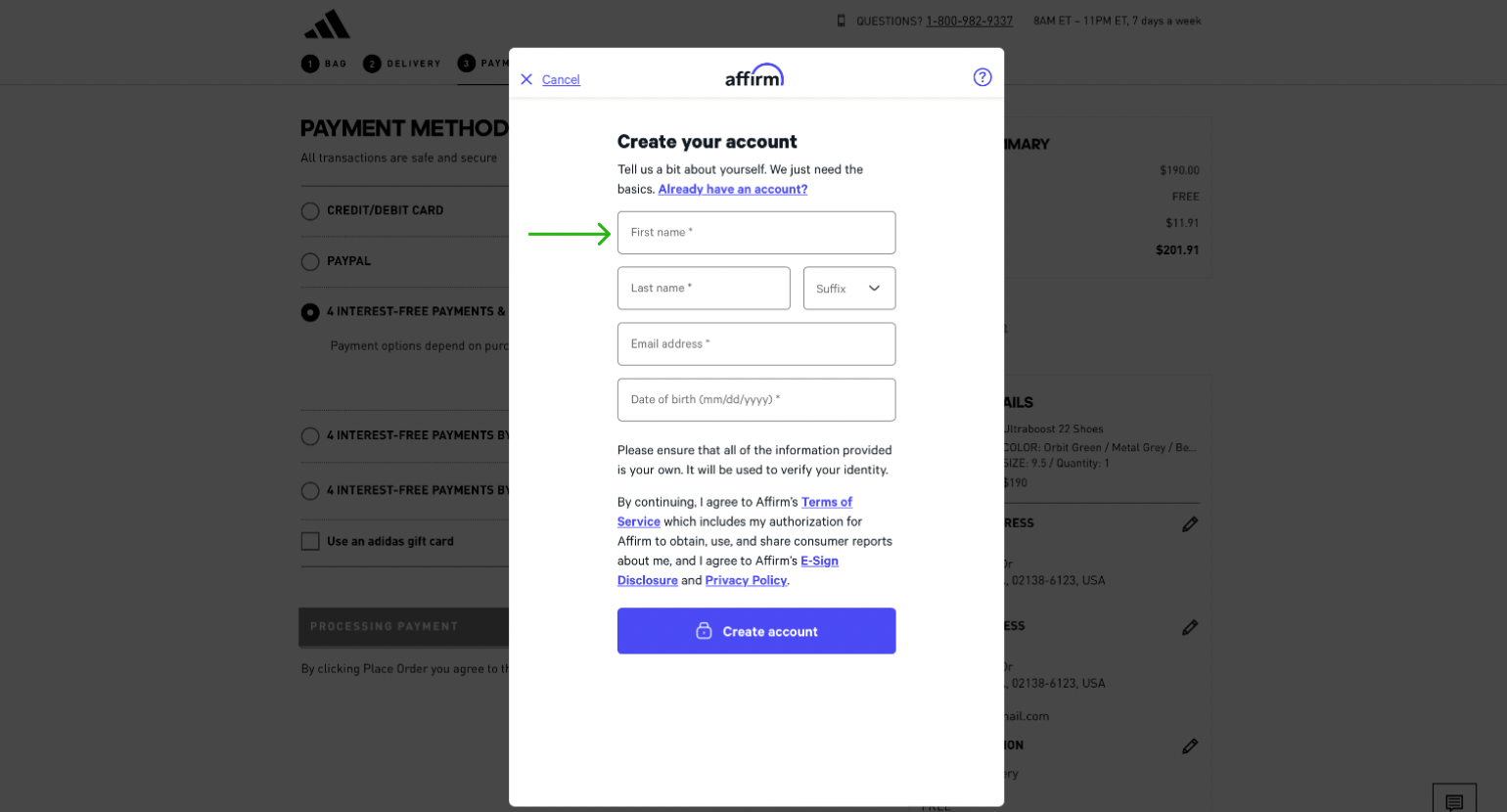

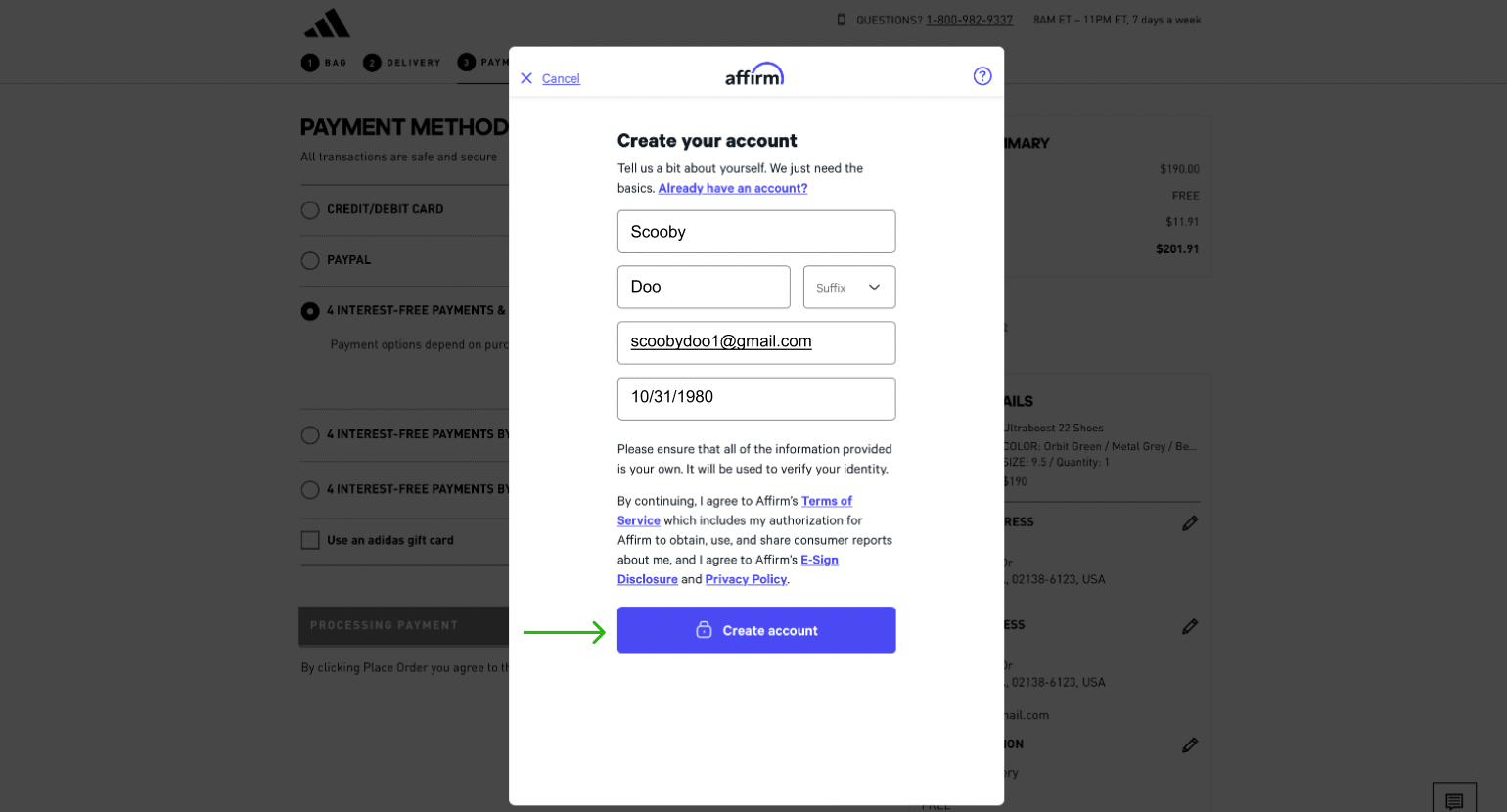

To create the prototypes for Afterpay and Affirm’s BNPL purchasing flows, we first navigated to the Adidas e-commerce website. We selected an item that would be familiar to our survey respondents, screenshotted our selection, and added it to our shopping cart. Next we navigated to our “shopping cart” or checkout page to see the item we selected to purchase. Then we began documenting our purchasing flow at the “shopping cart” or checkout page, where we took screenshots of each subsequent screen presented to us while purchasing the item using the two BNPL services.

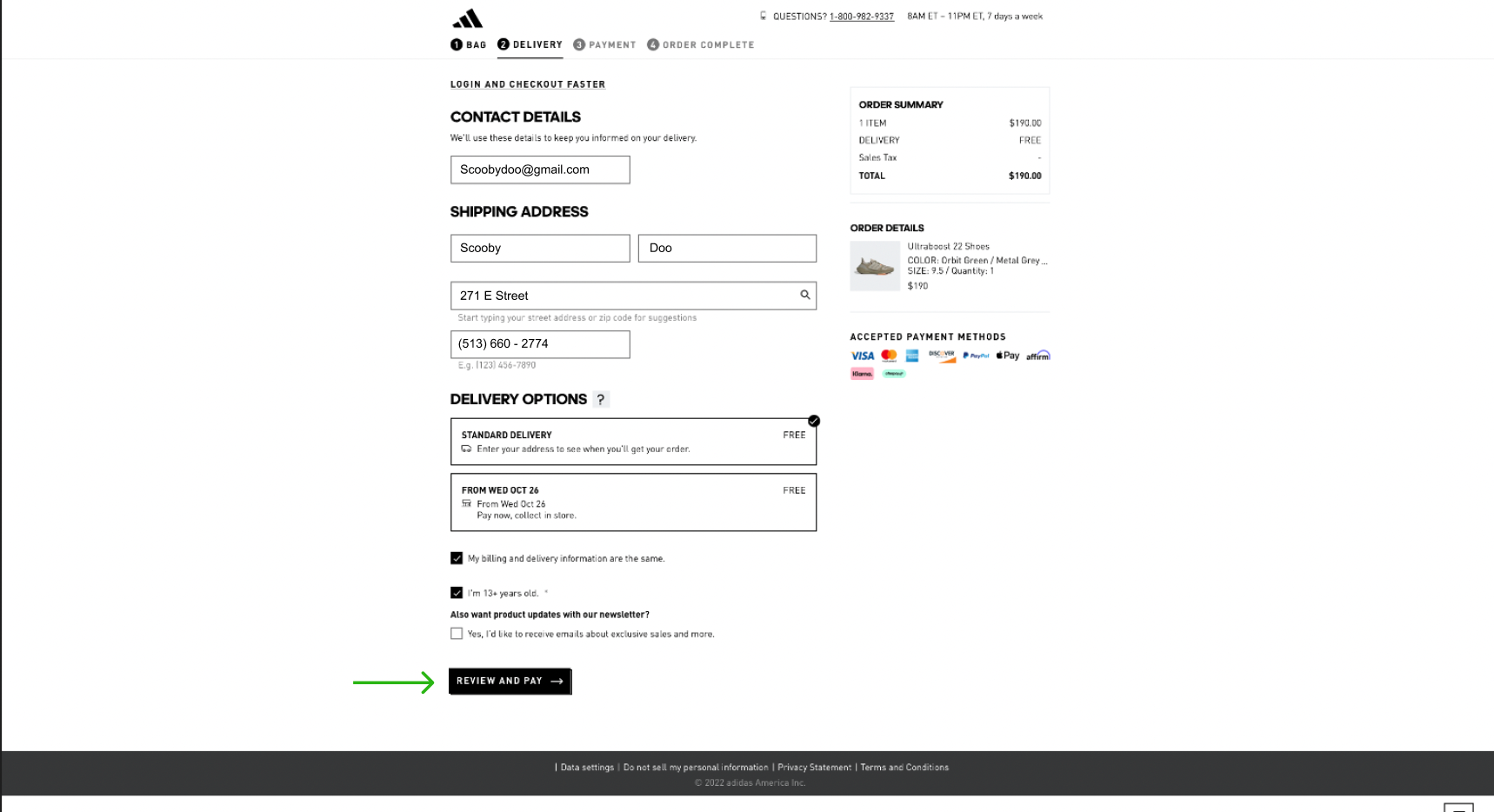

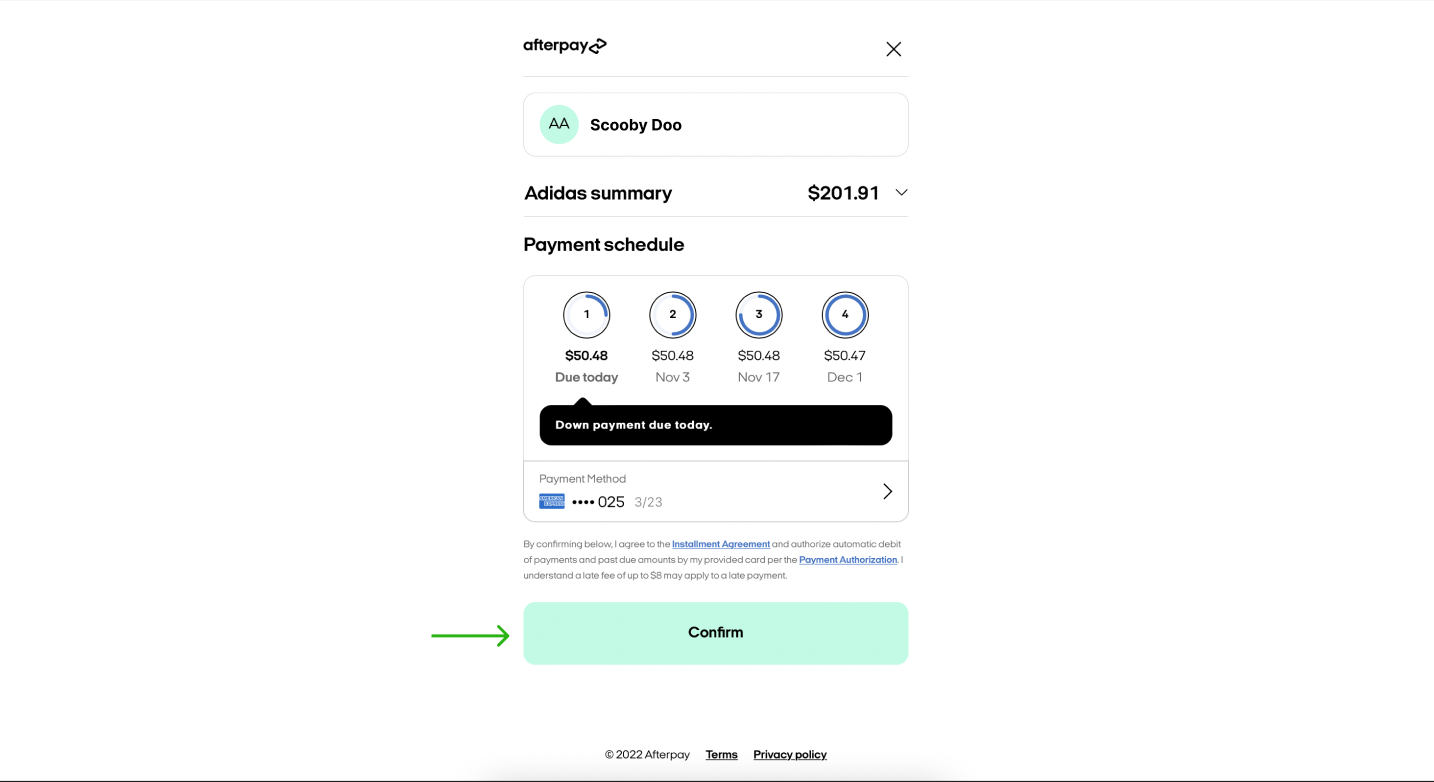

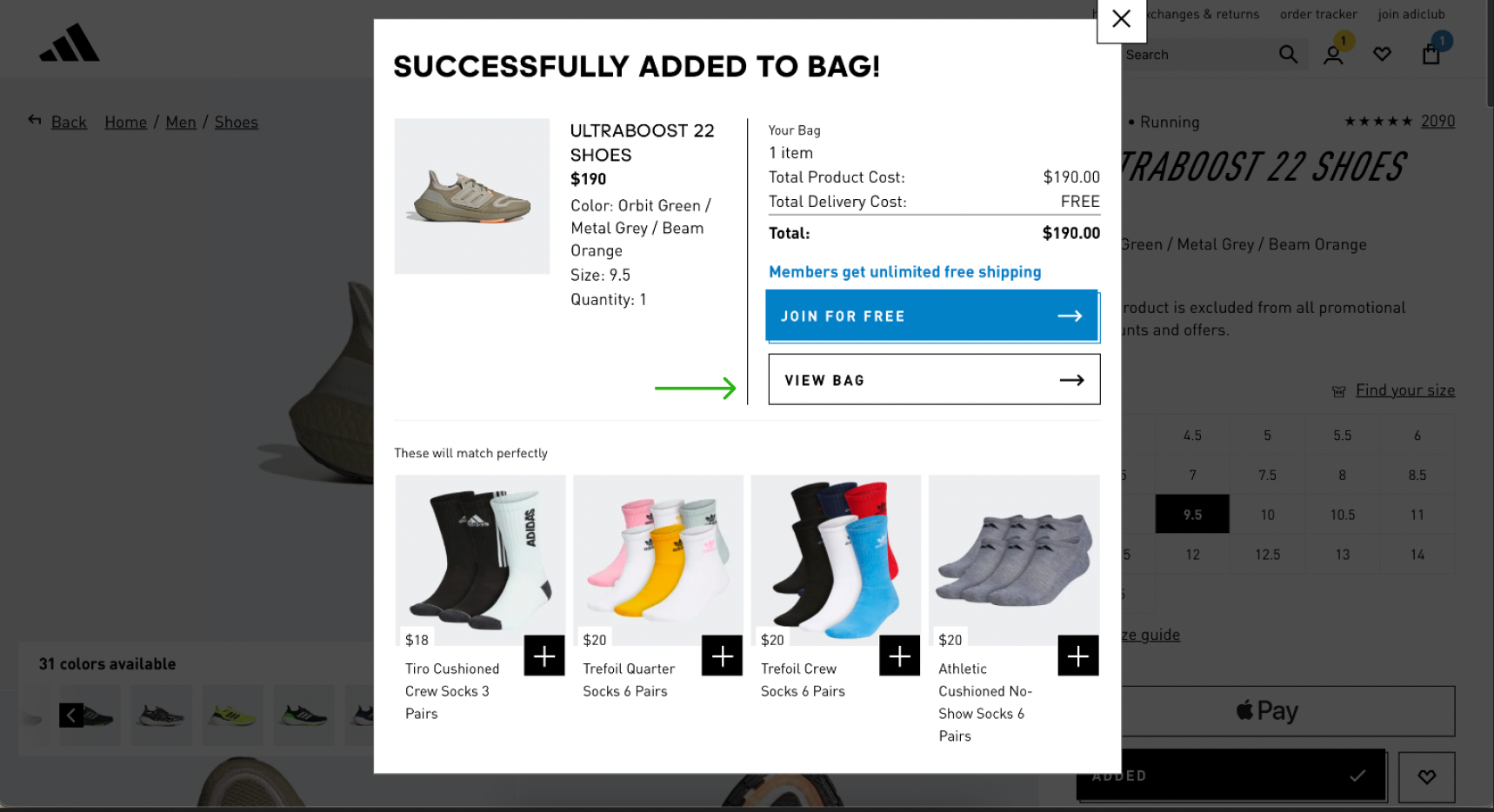

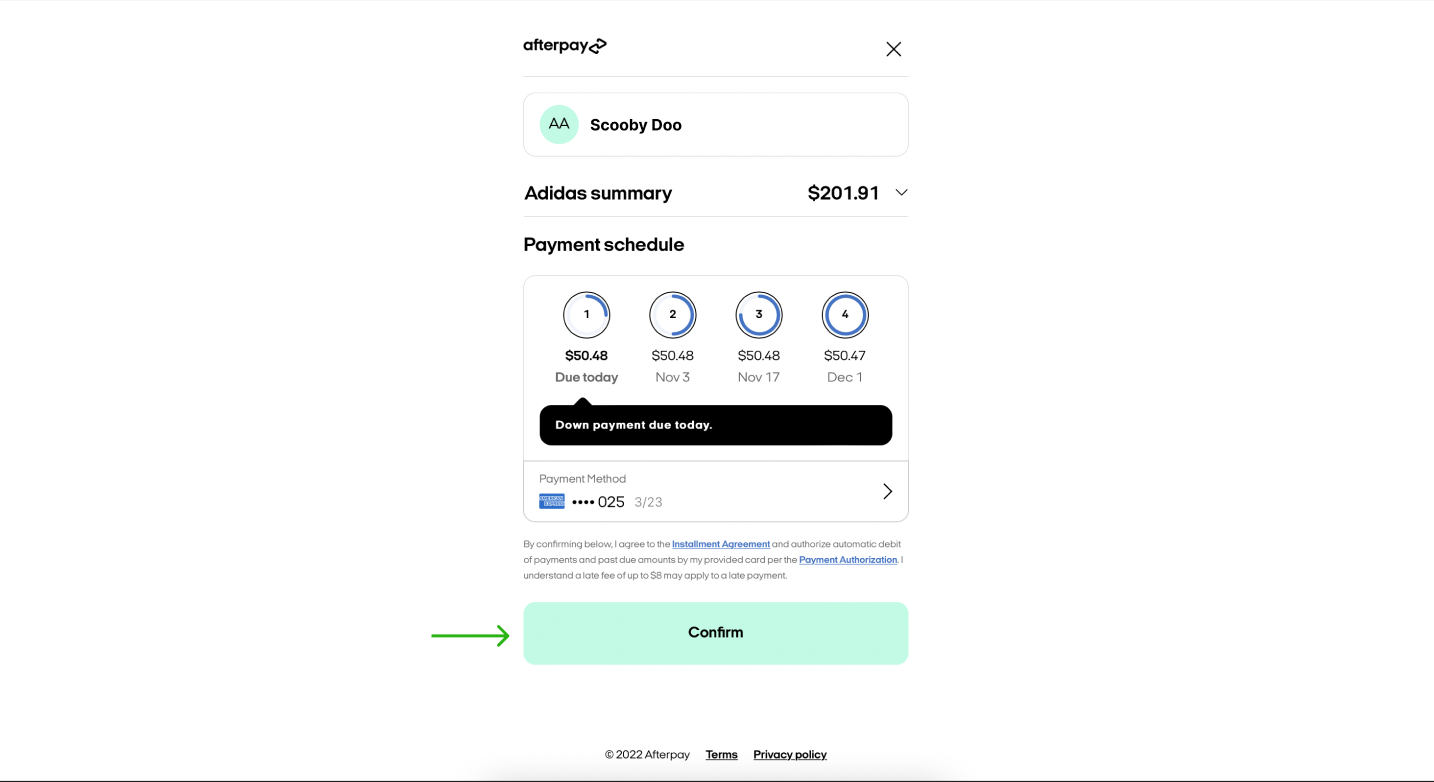

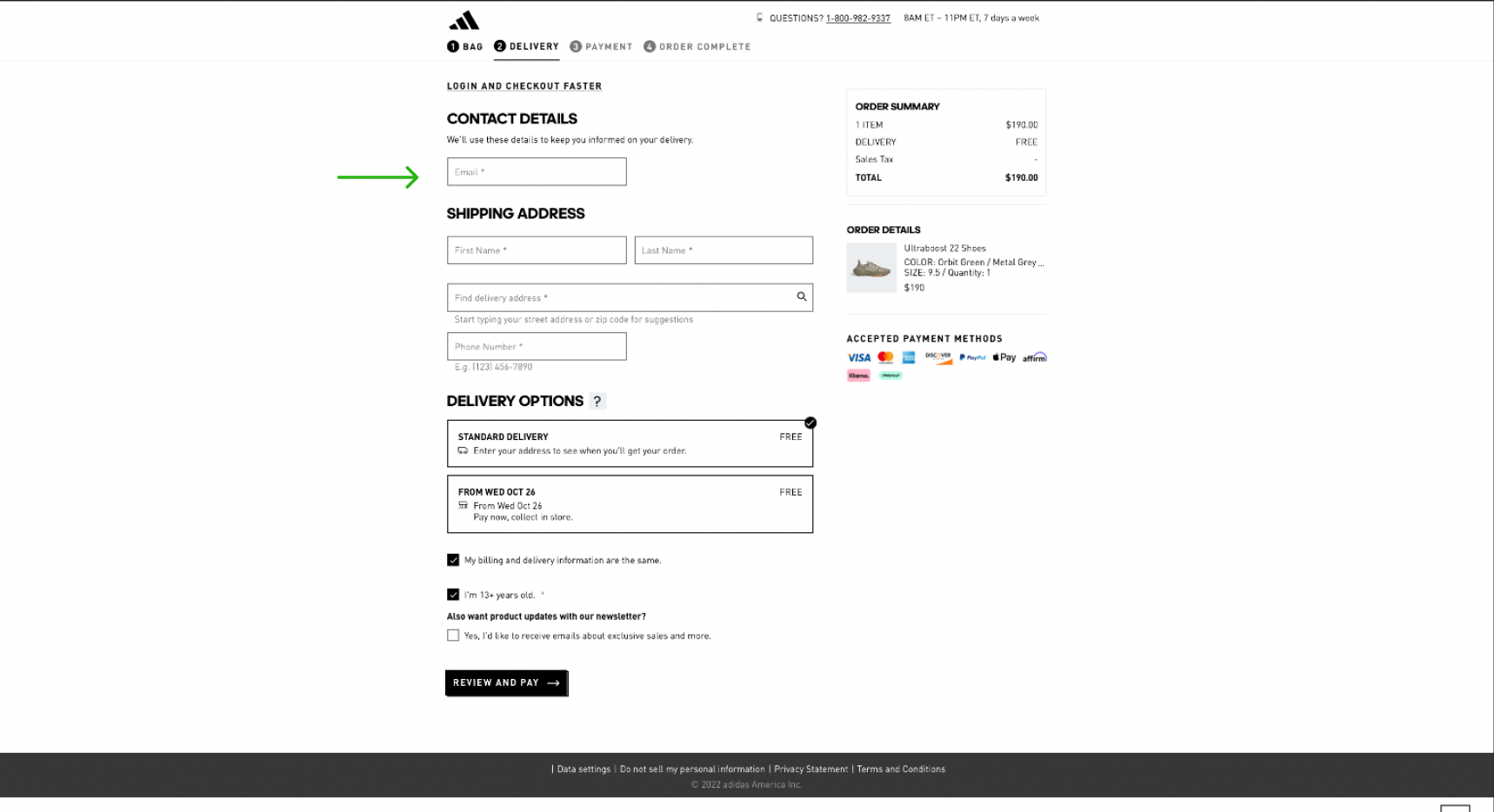

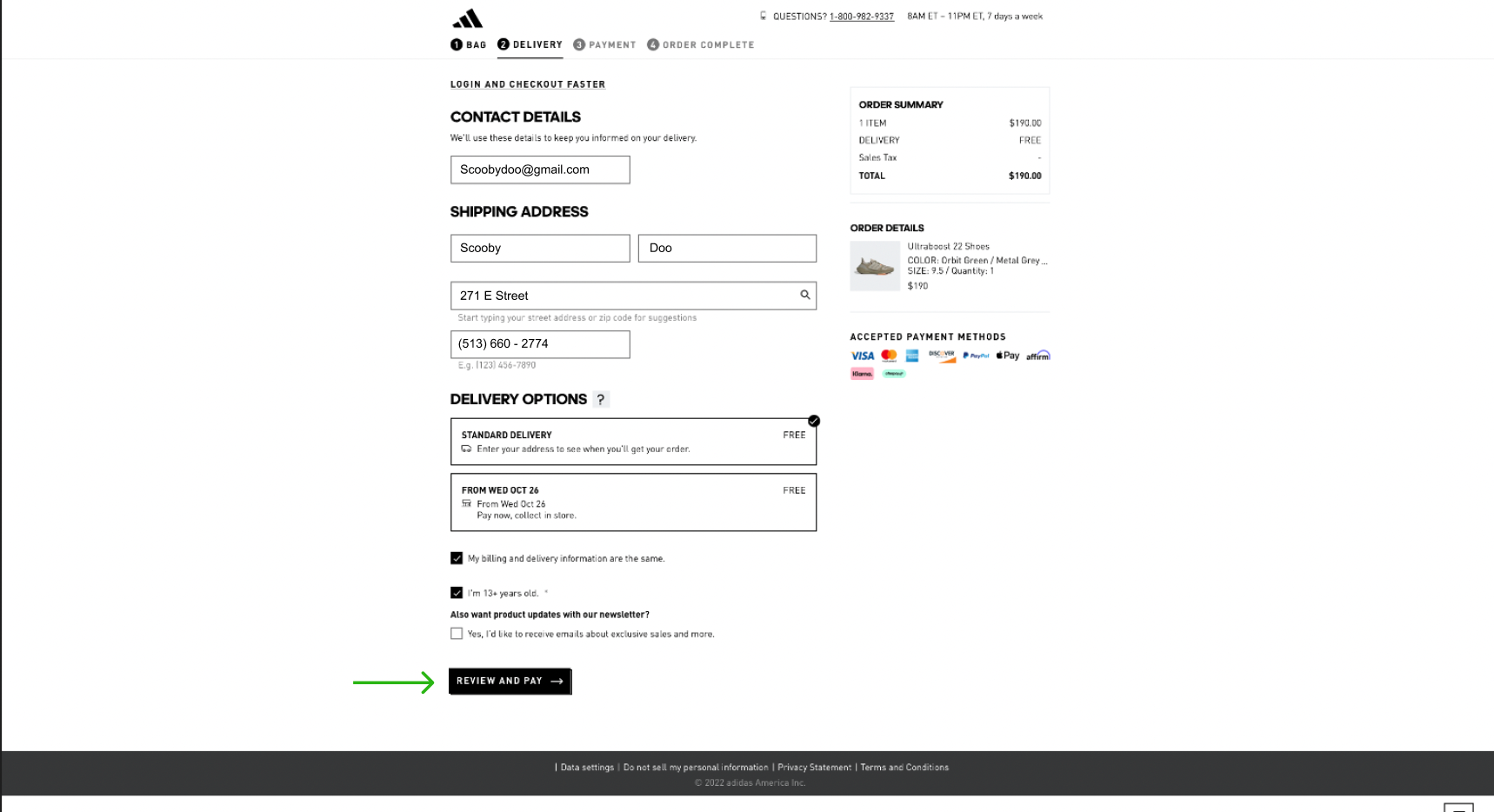

Figure 7. The first page in both the Affirm and Afterpay prototypes. Respondents simulated purchasing a pair of shoes from Adidas using two BNPL services.

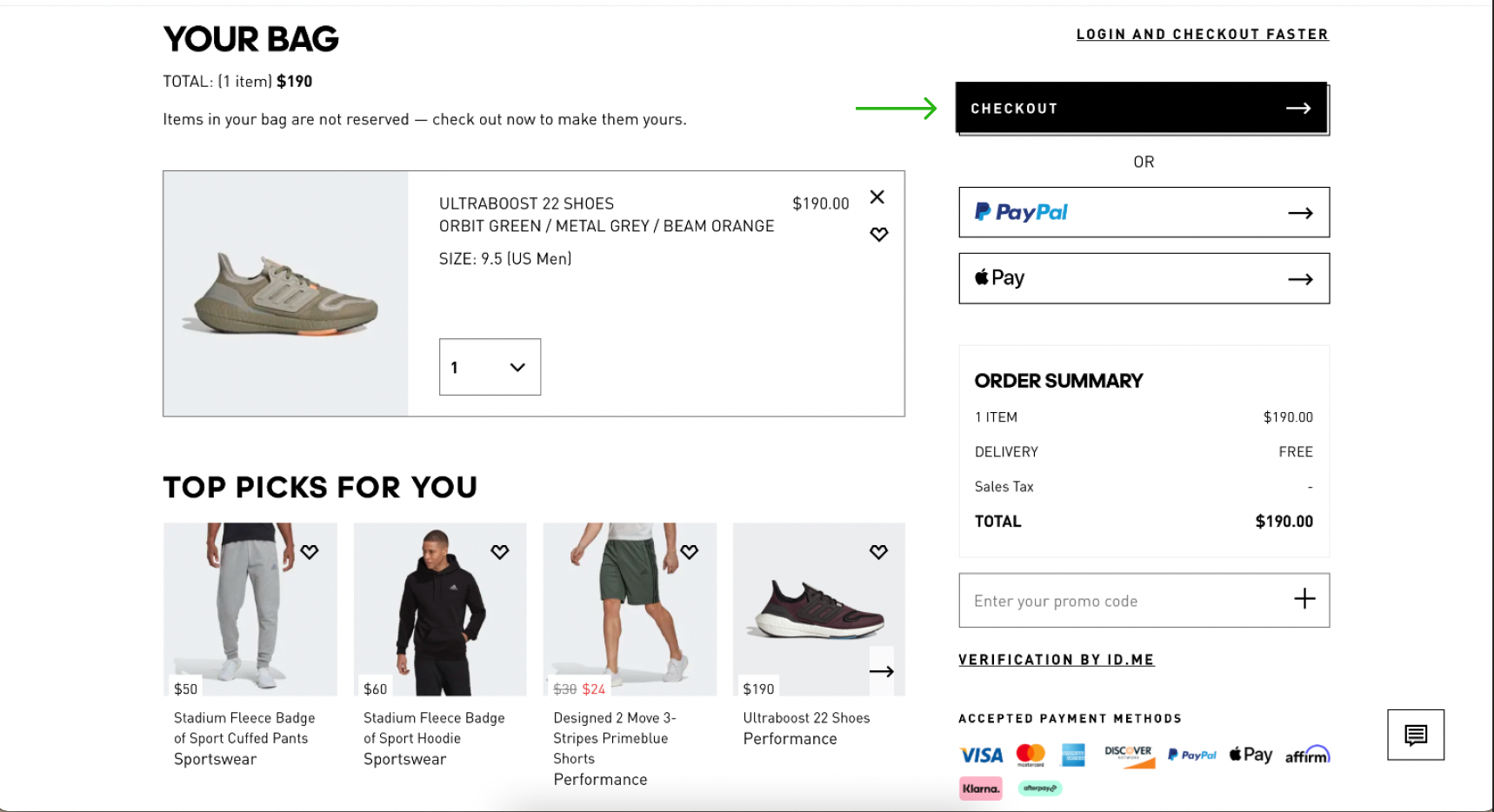

Figure 8. The shopping cart page in both the Affirm and Afterpay prototypes.

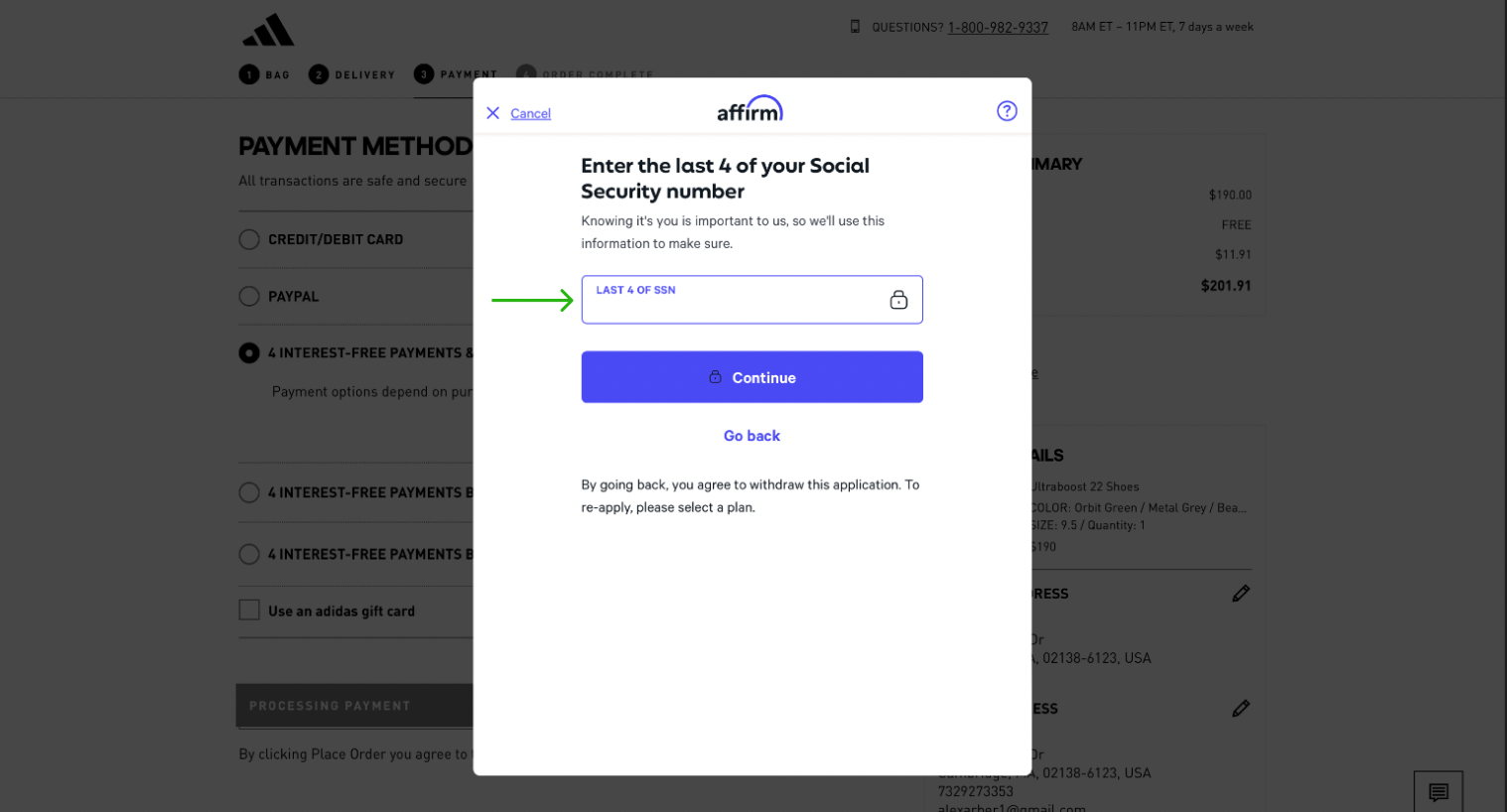

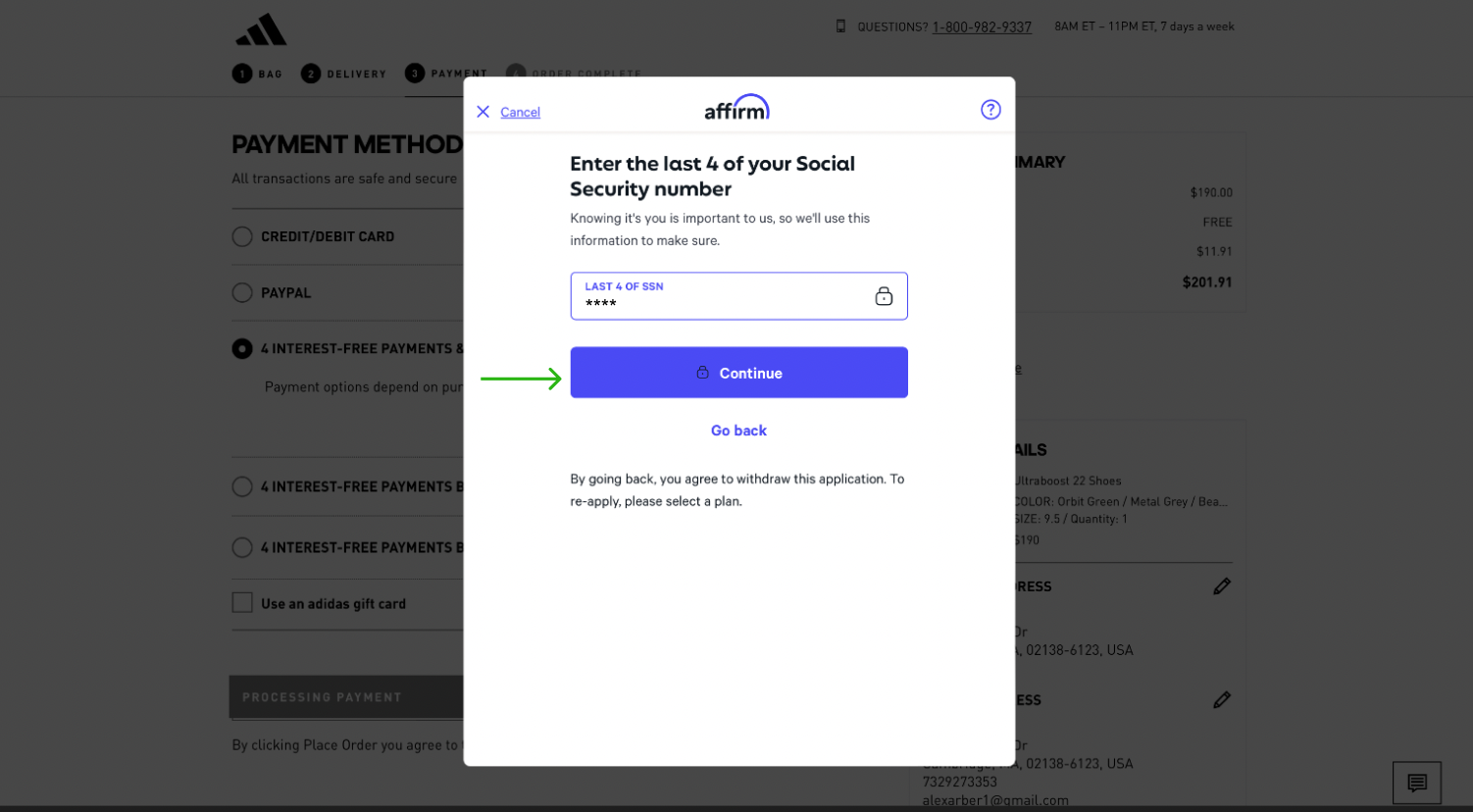

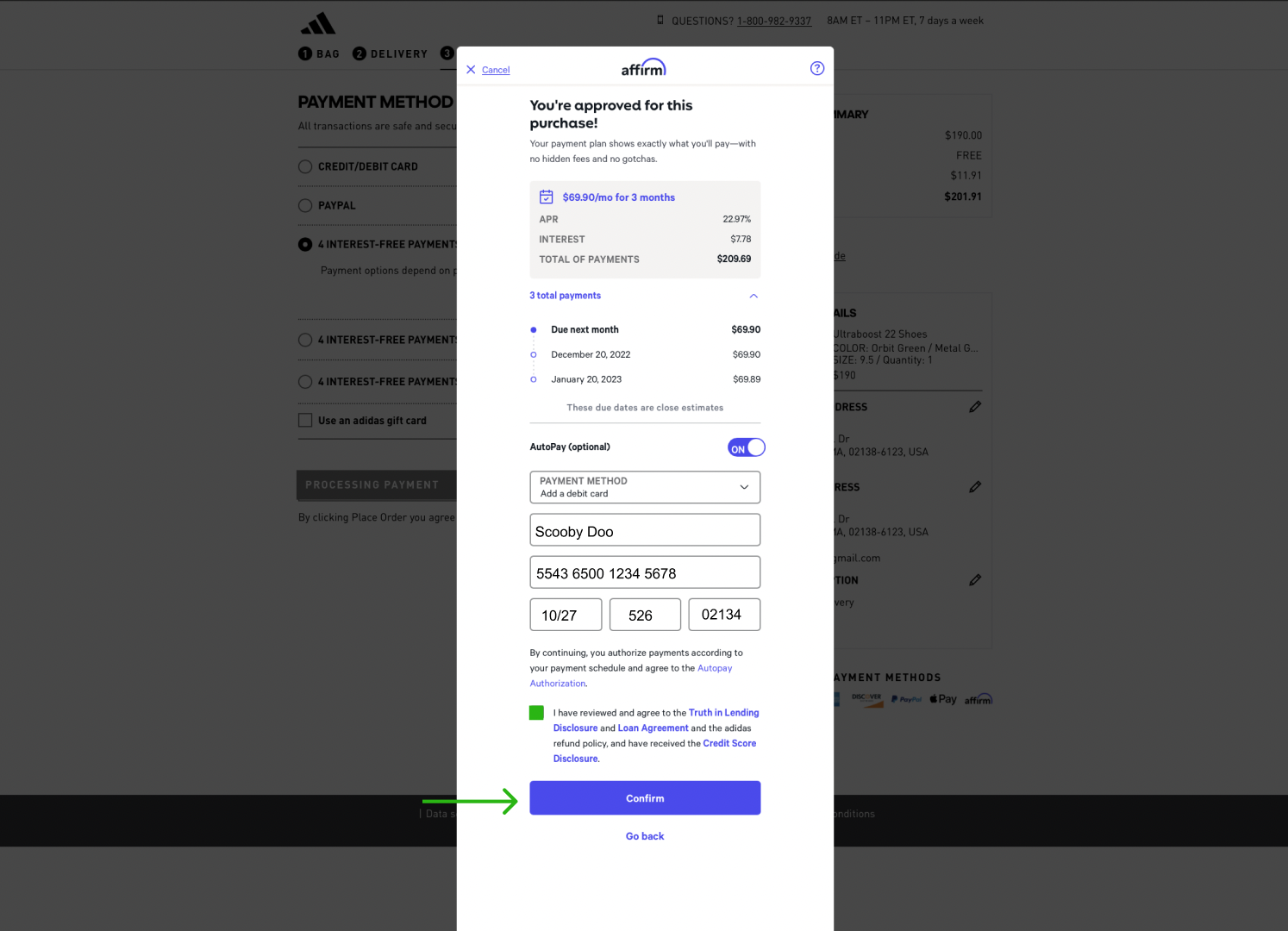

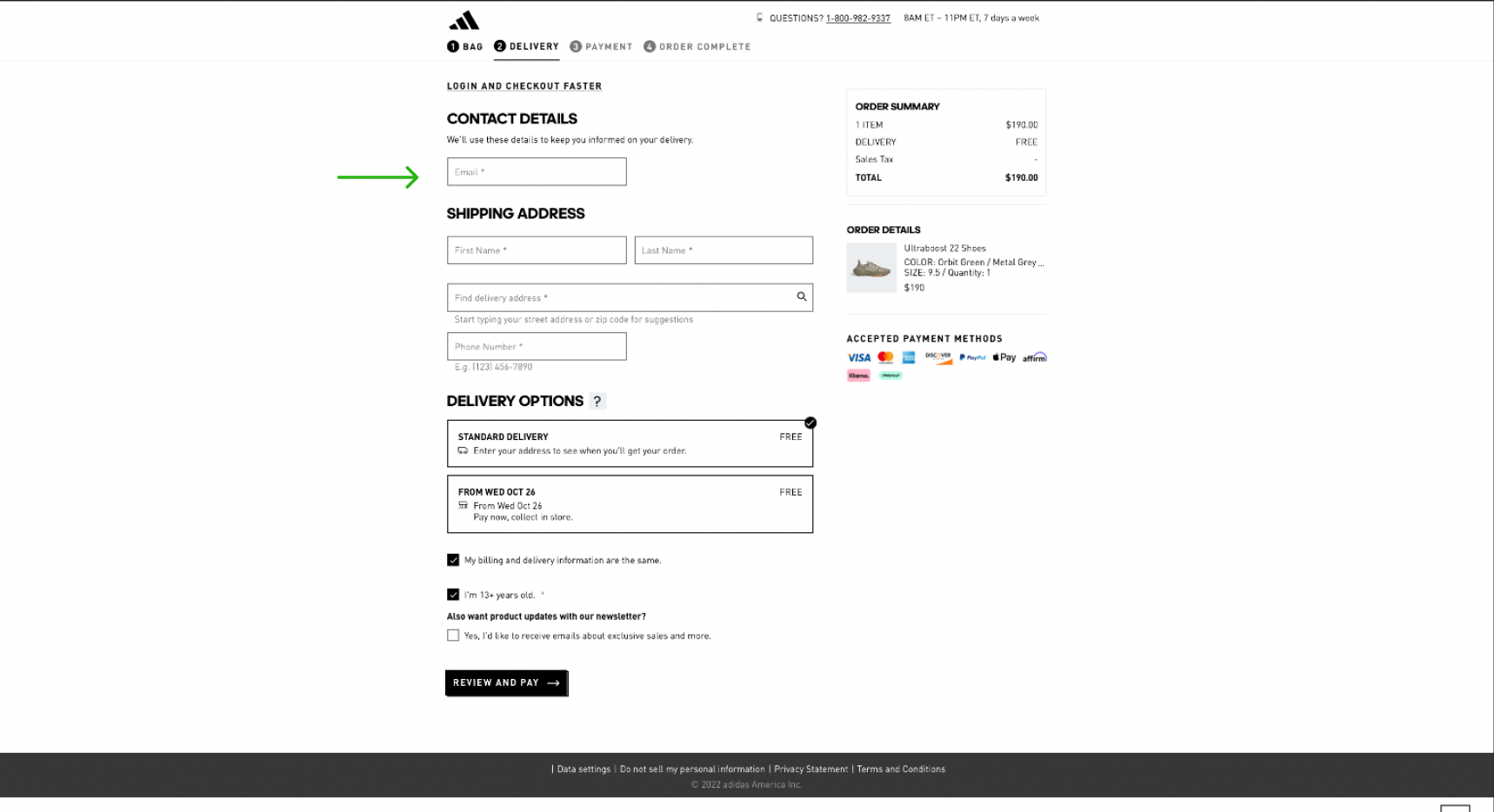

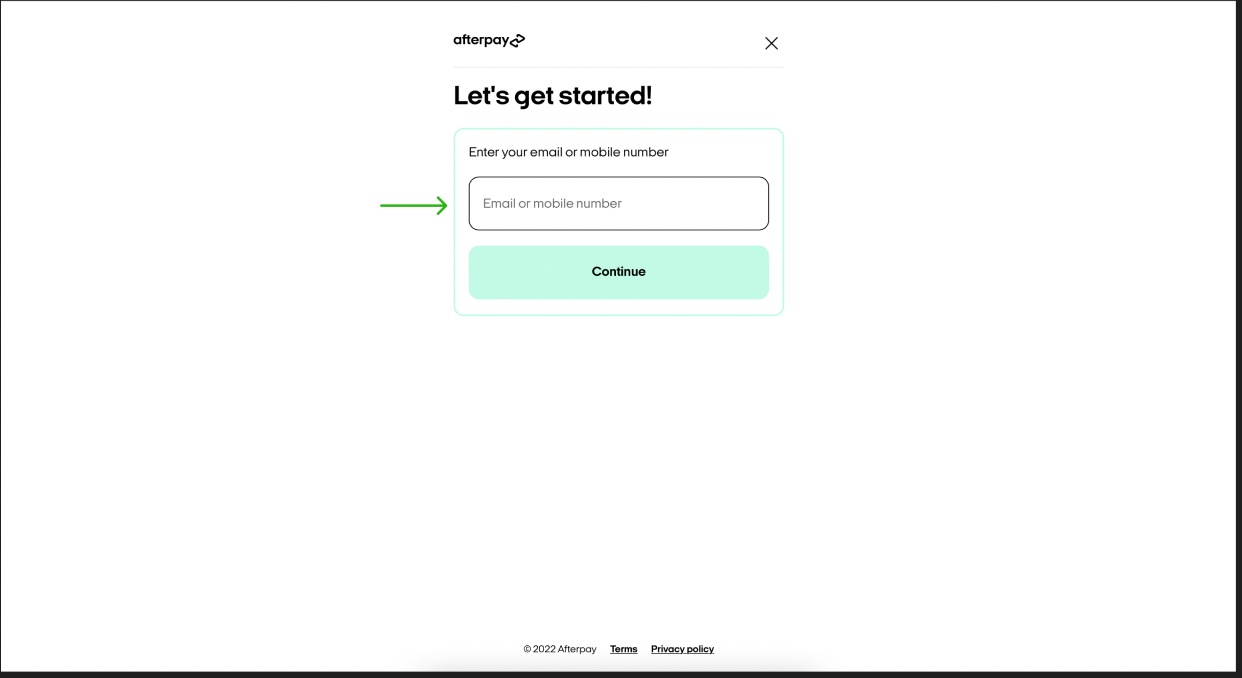

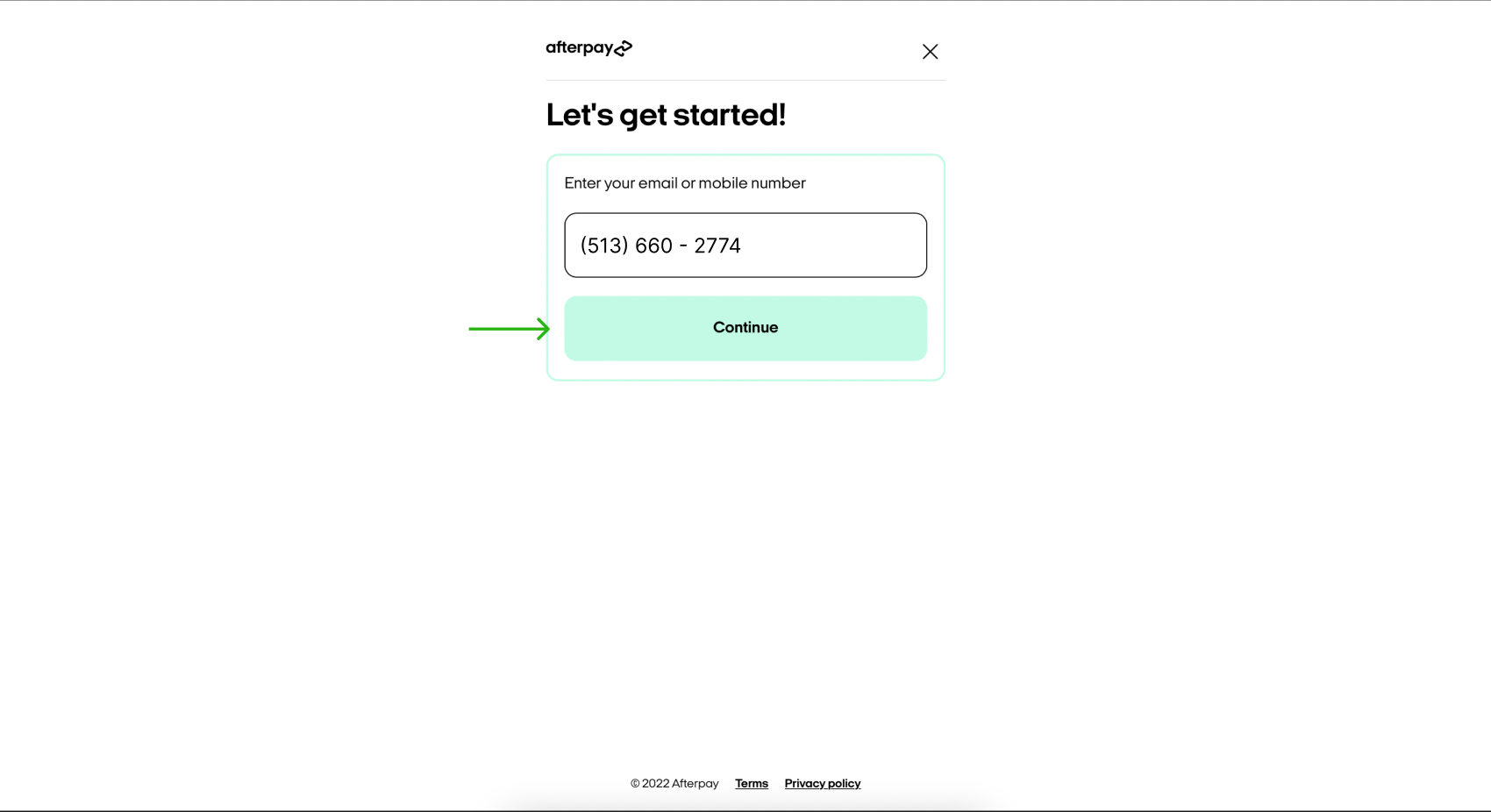

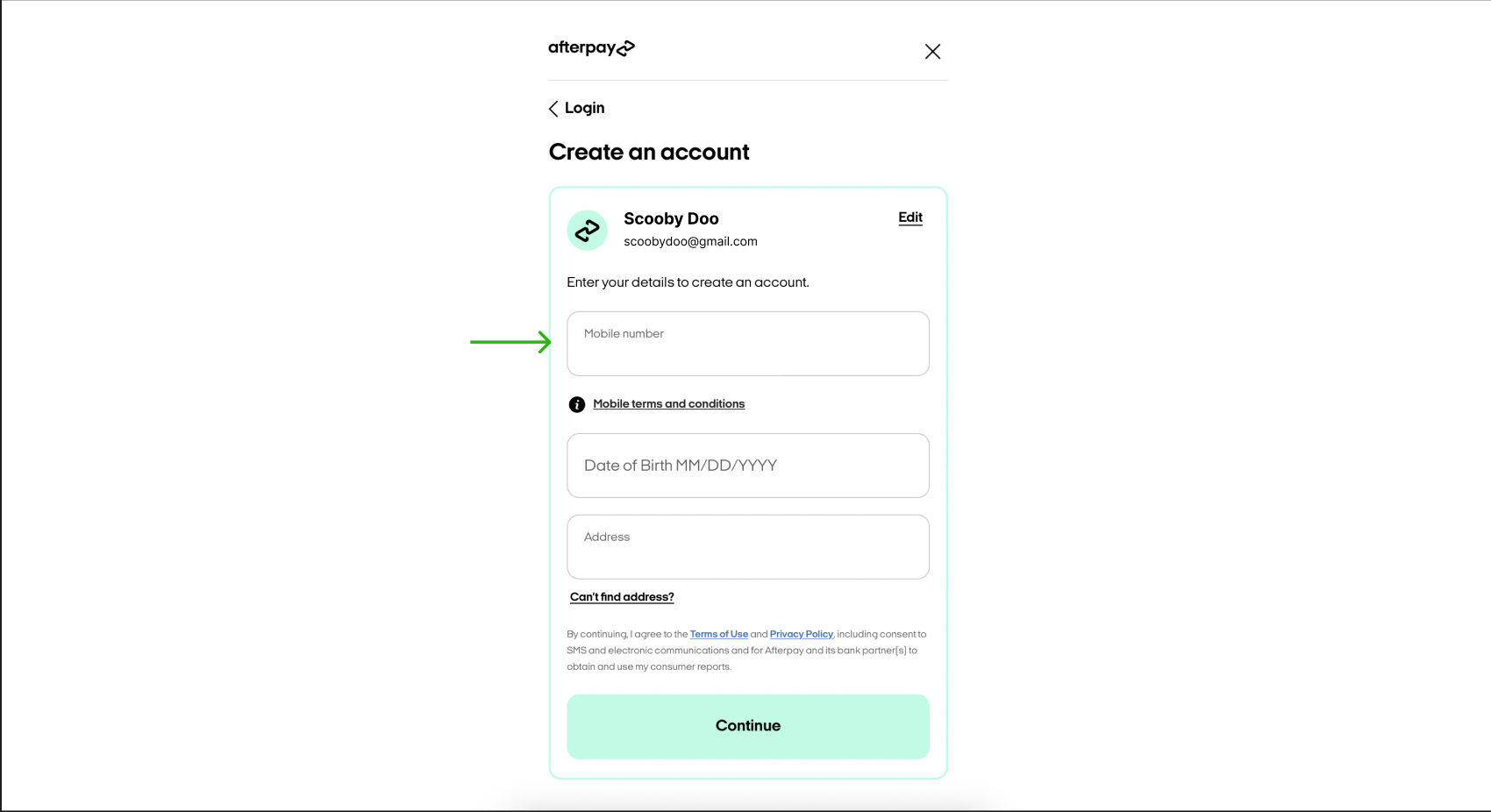

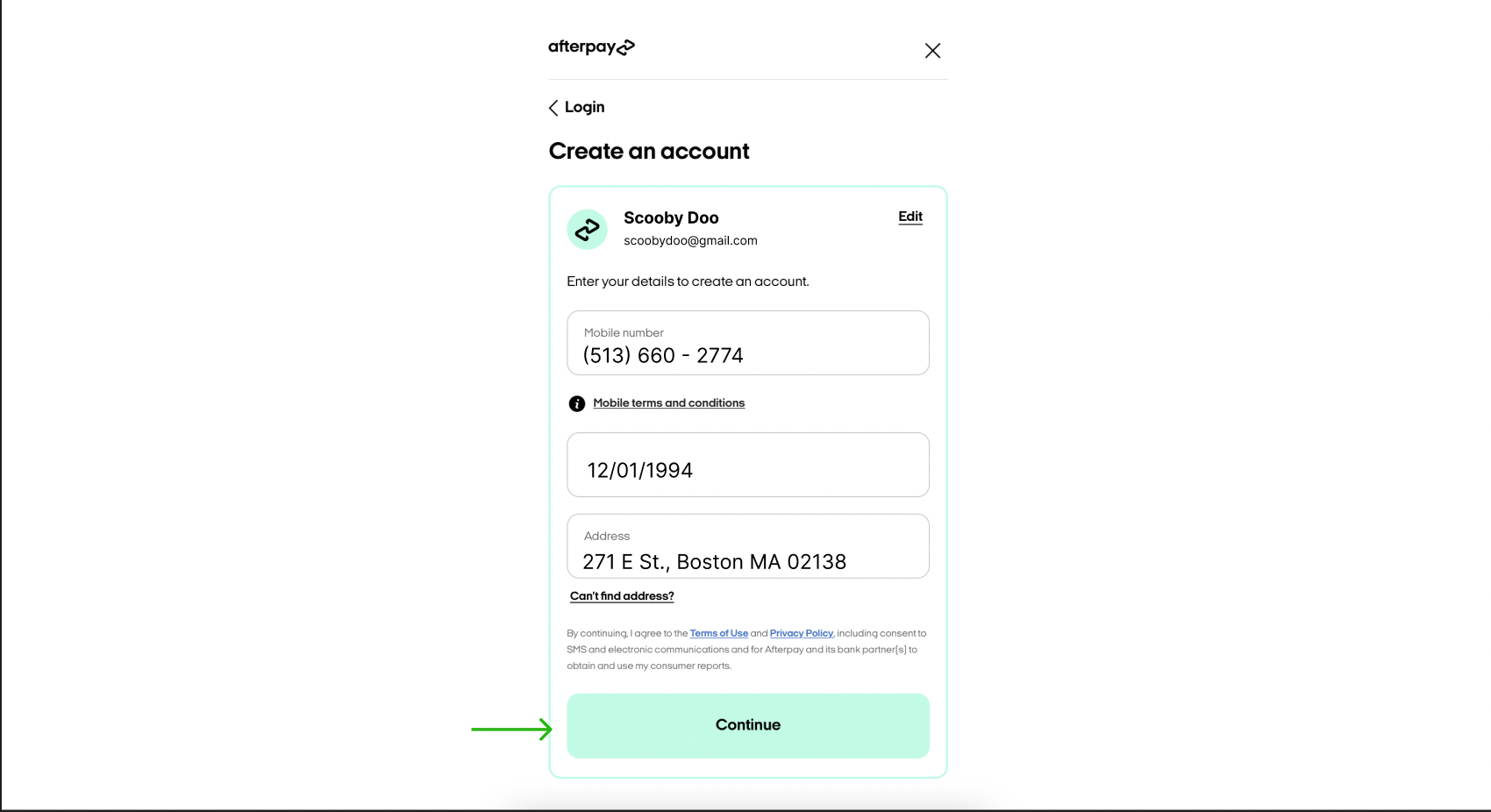

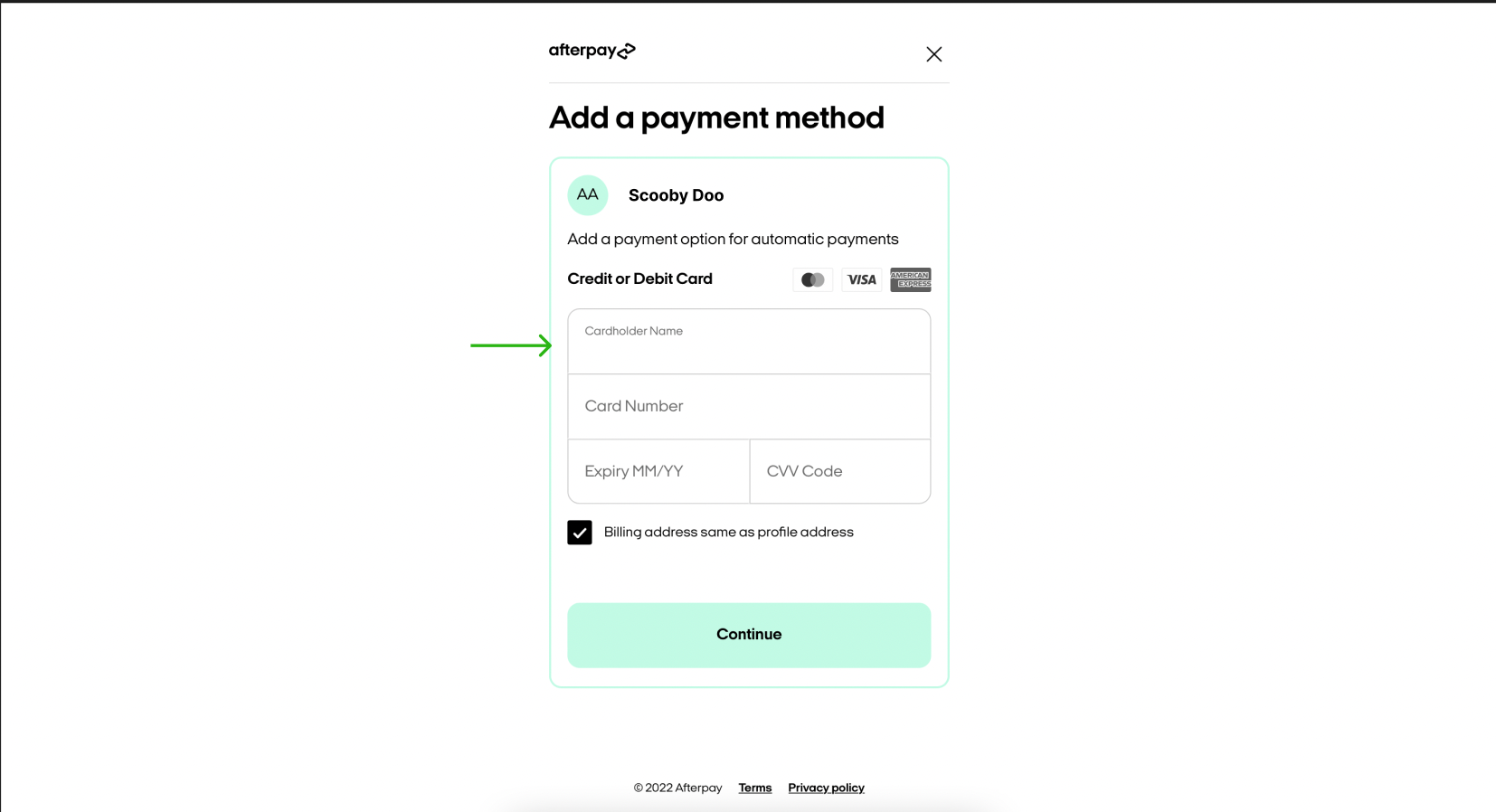

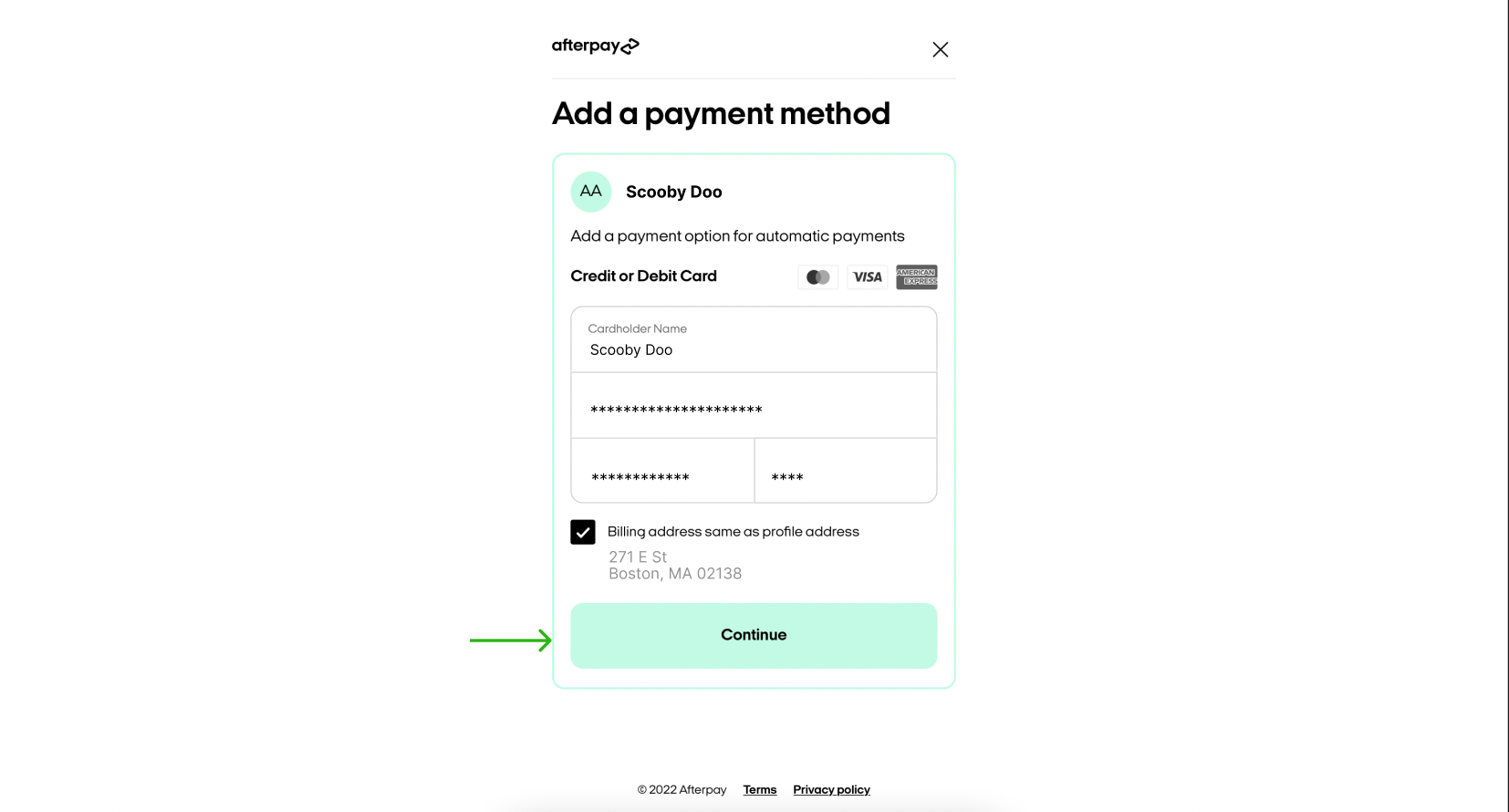

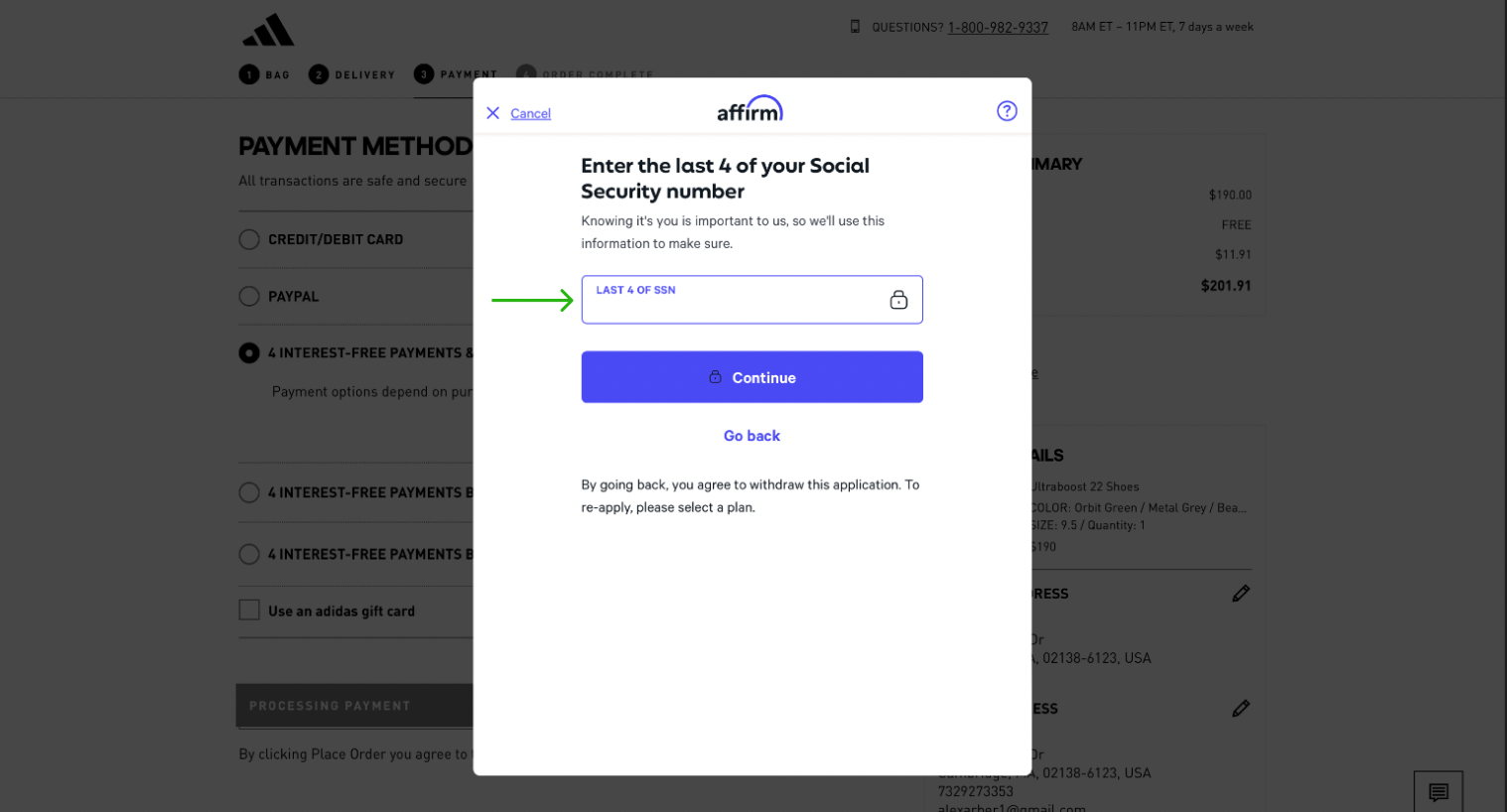

We were required at times to enter valid personal and credit card information to proceed to the next step of the purchasing flow. To maintain anonymity, we:

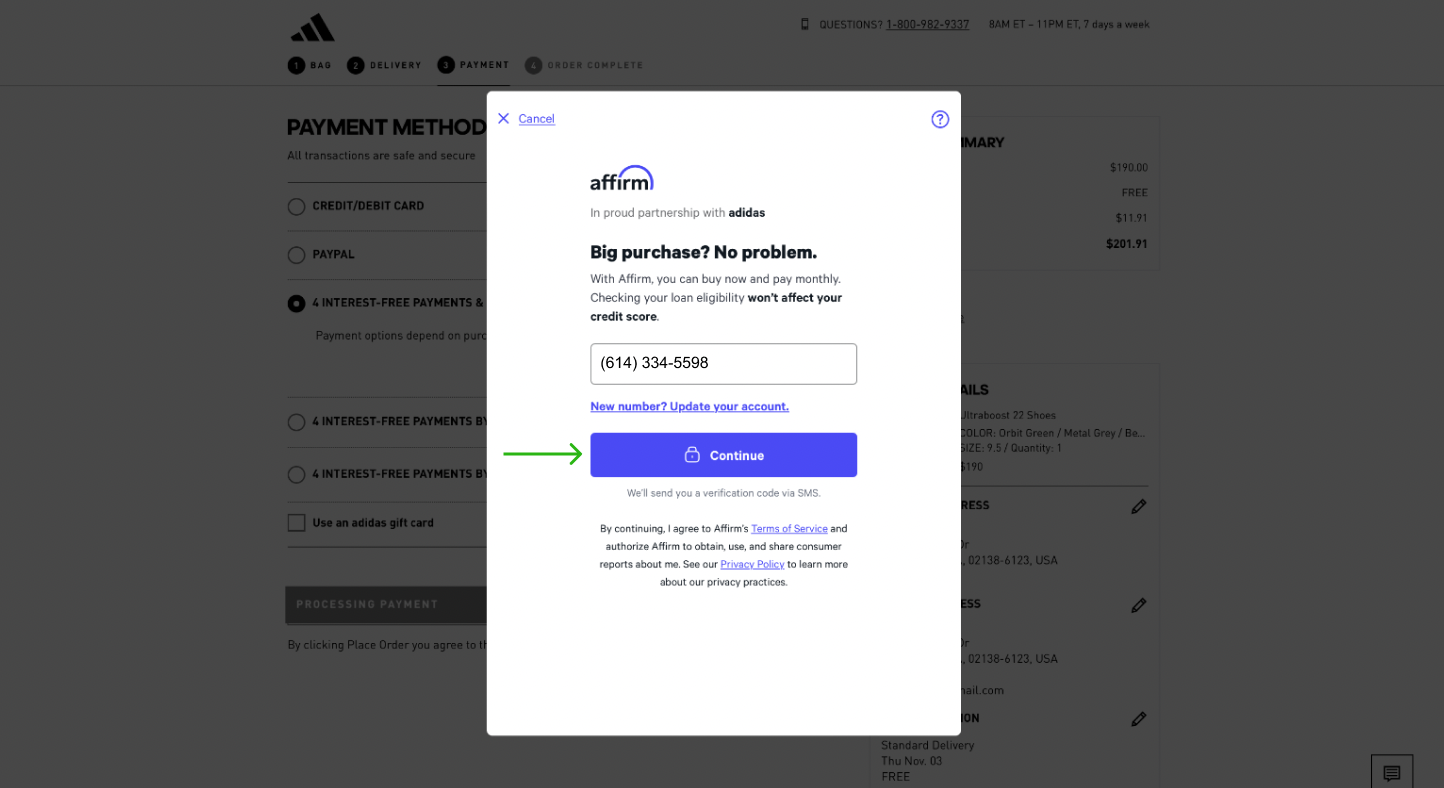

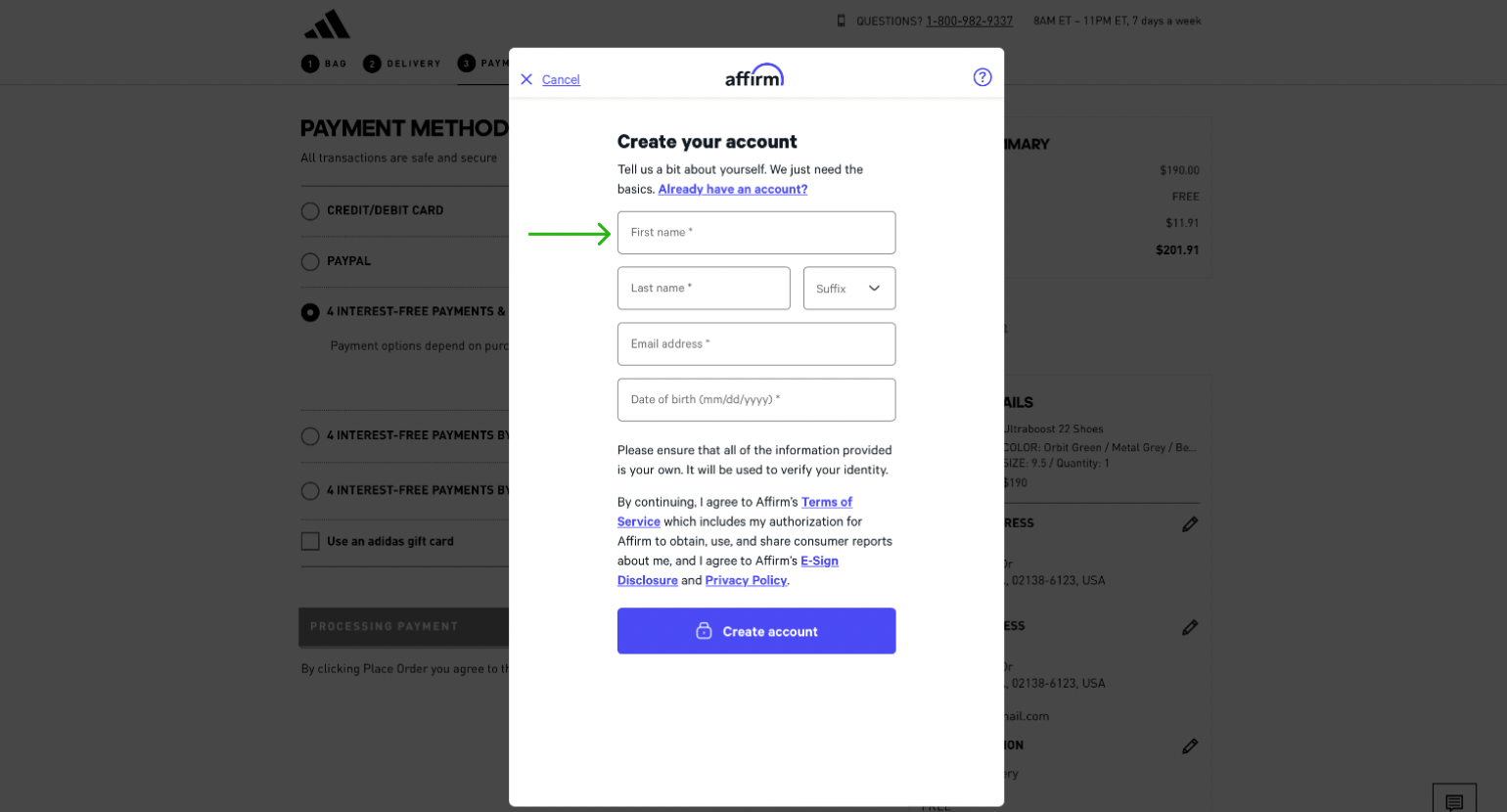

Screenshotted an empty page to later edit the photo with text simulating a person entering their own details; and

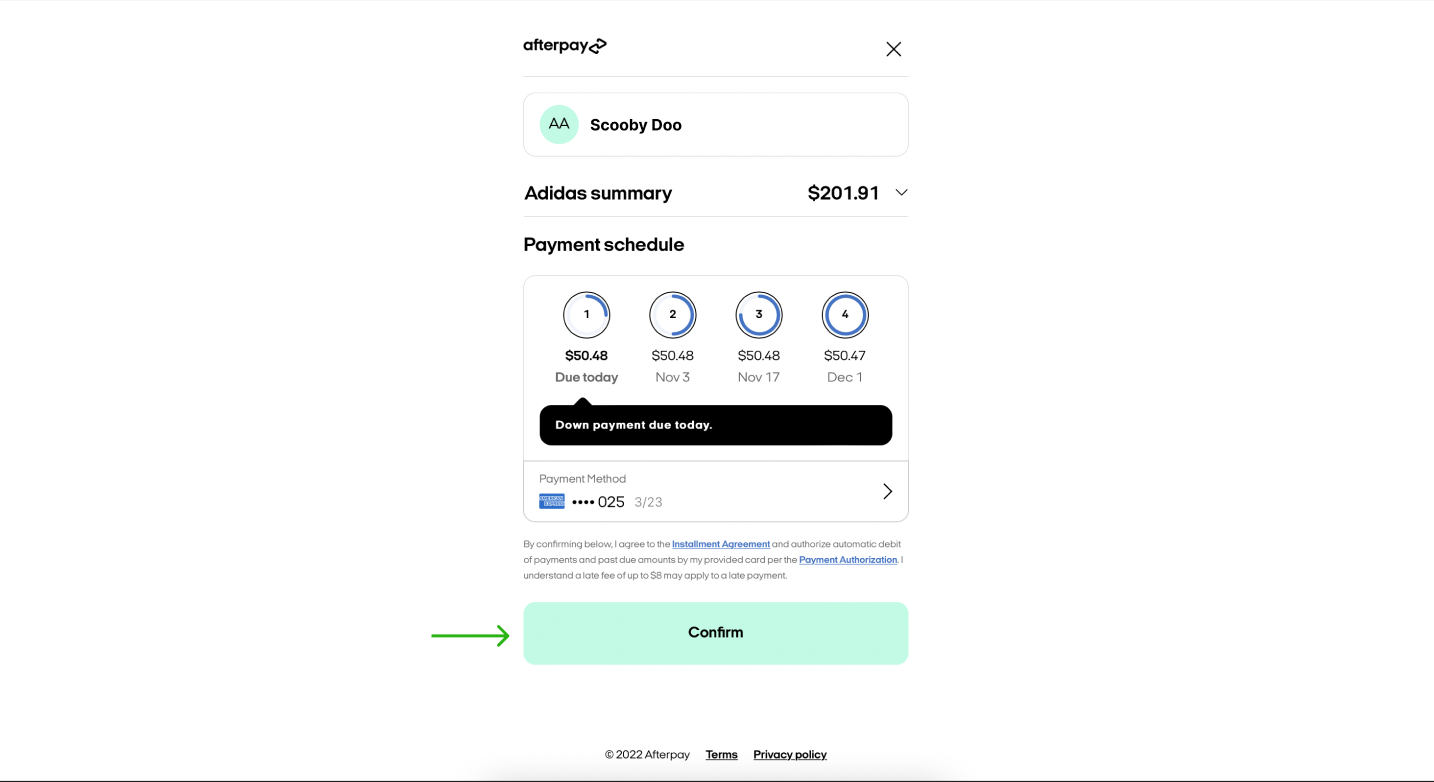

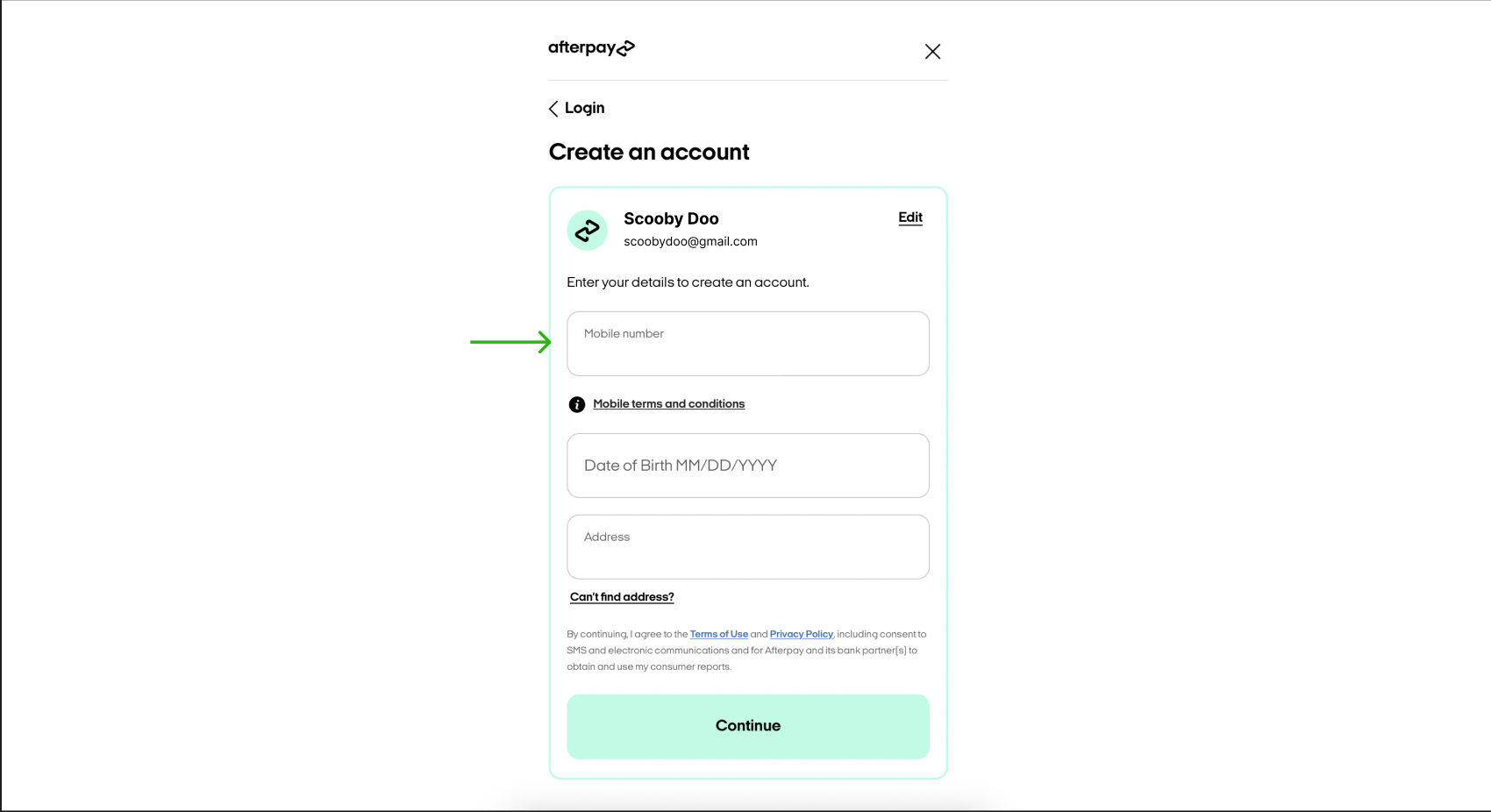

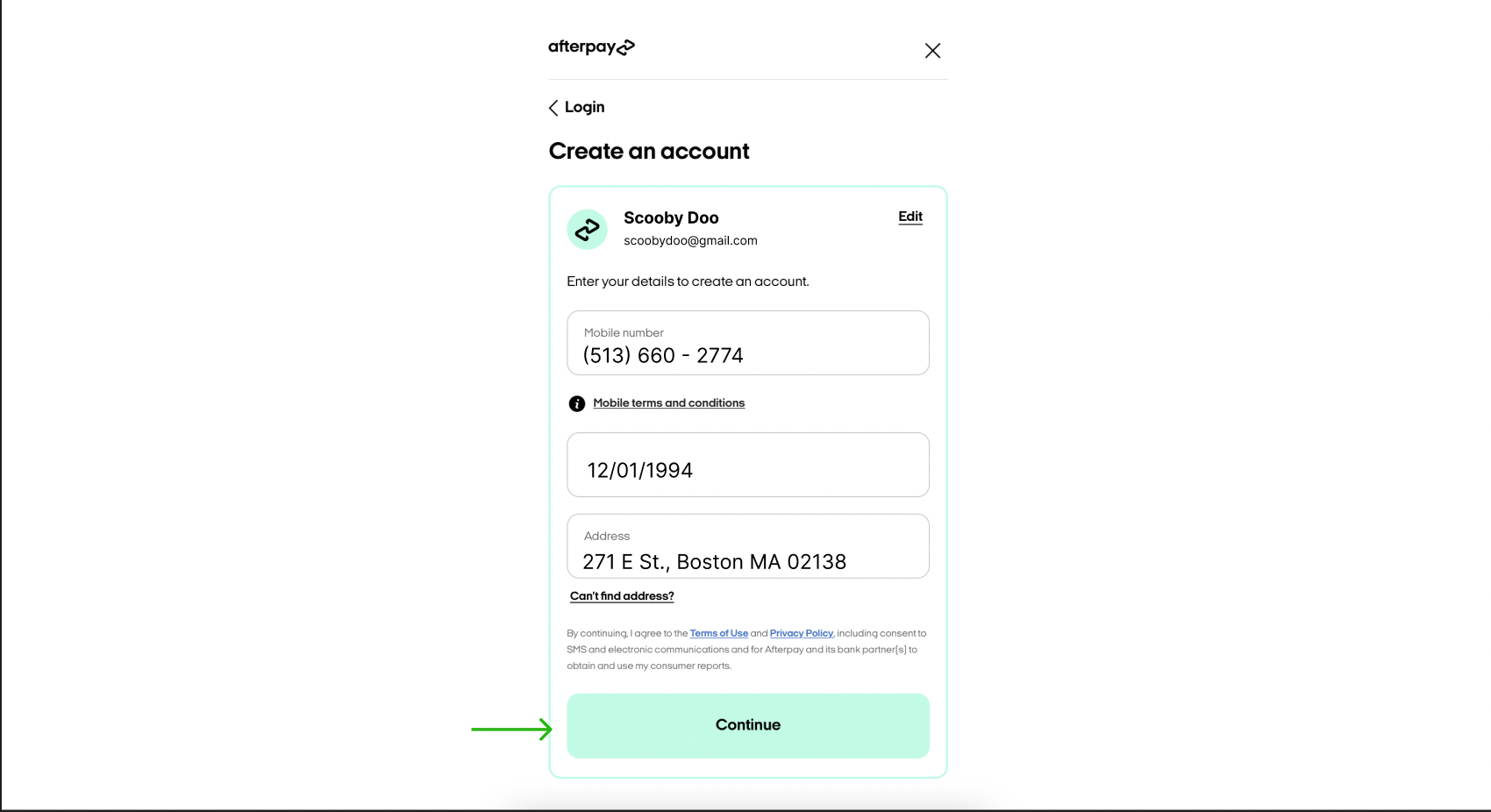

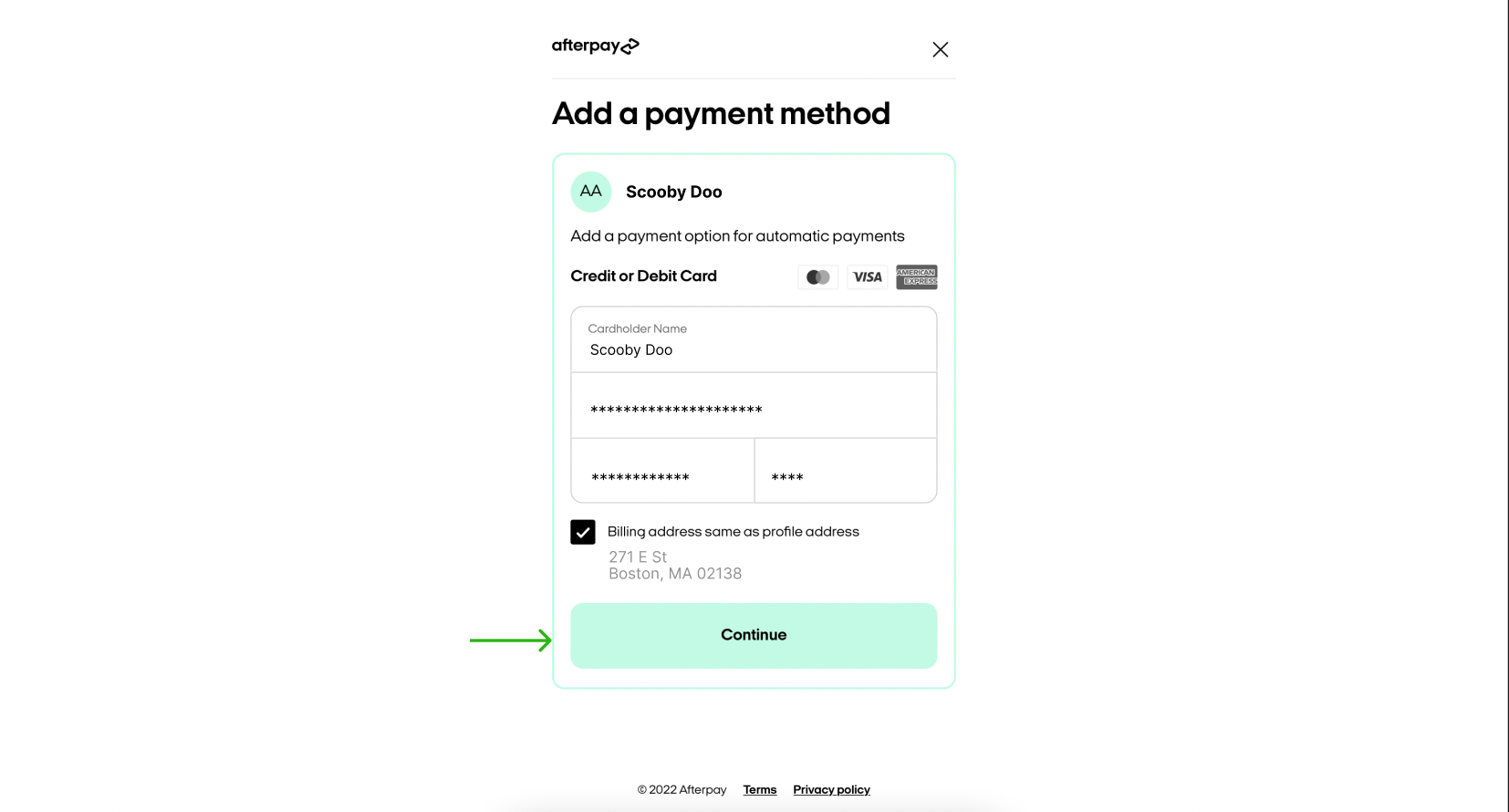

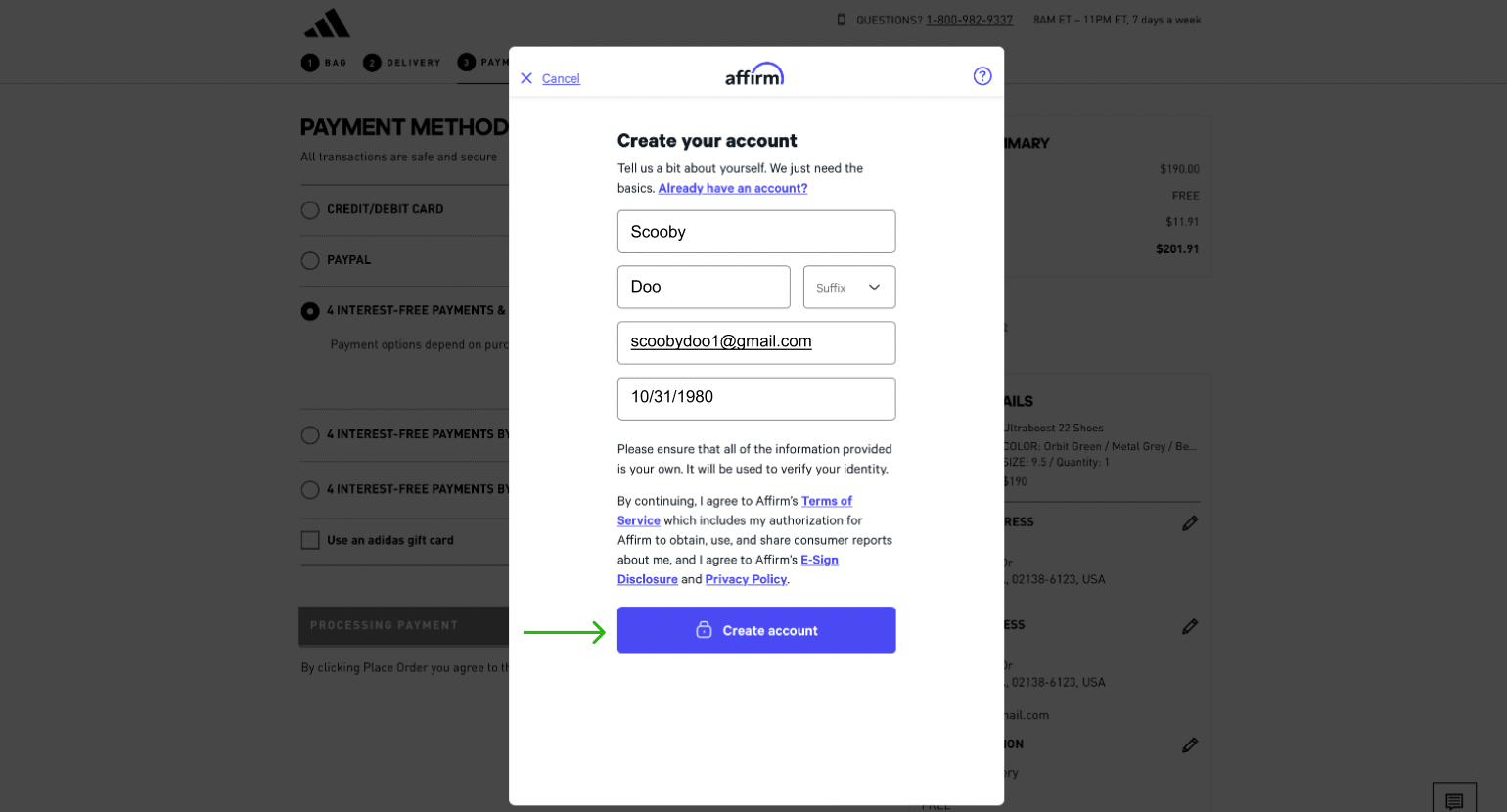

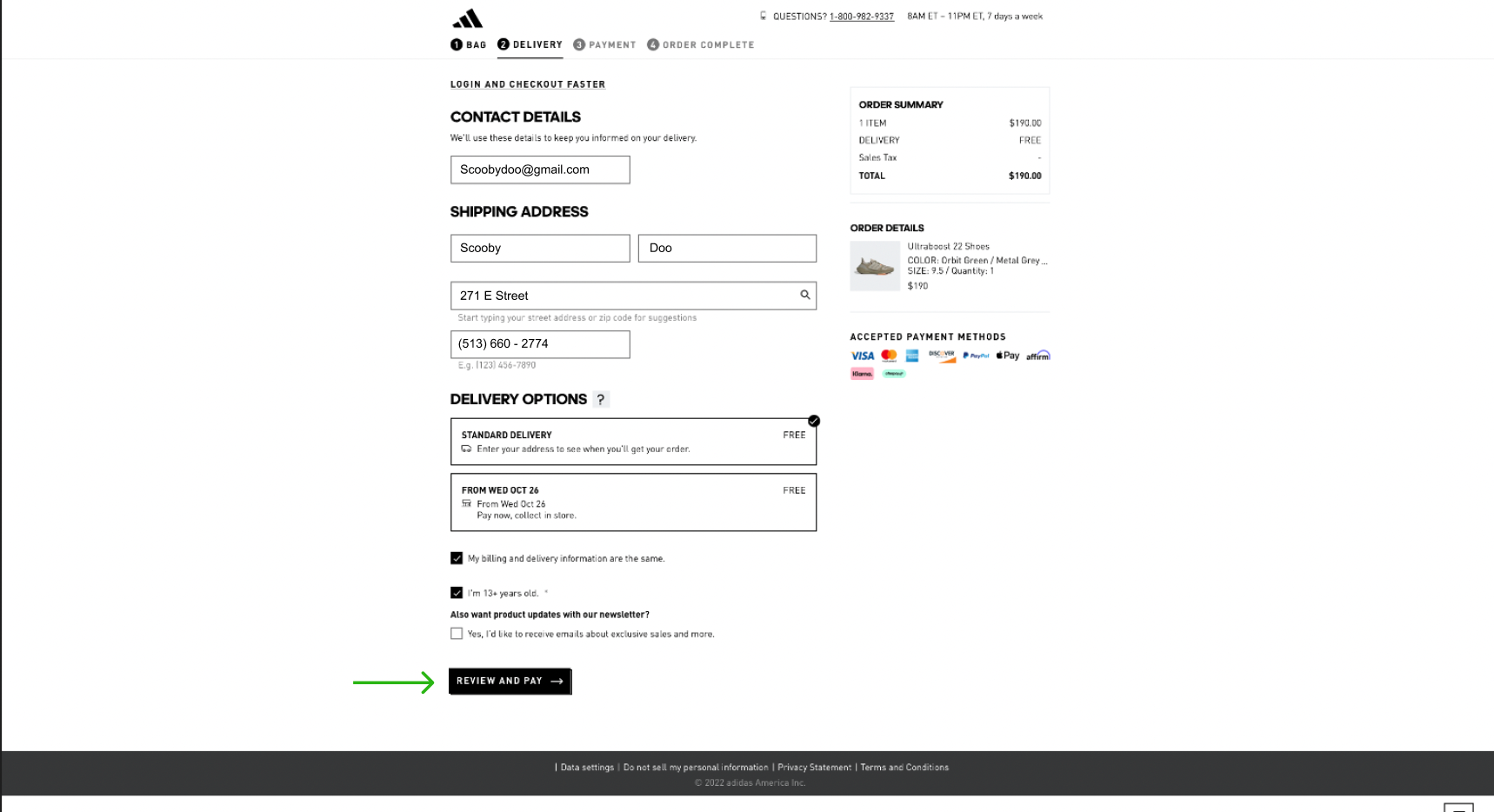

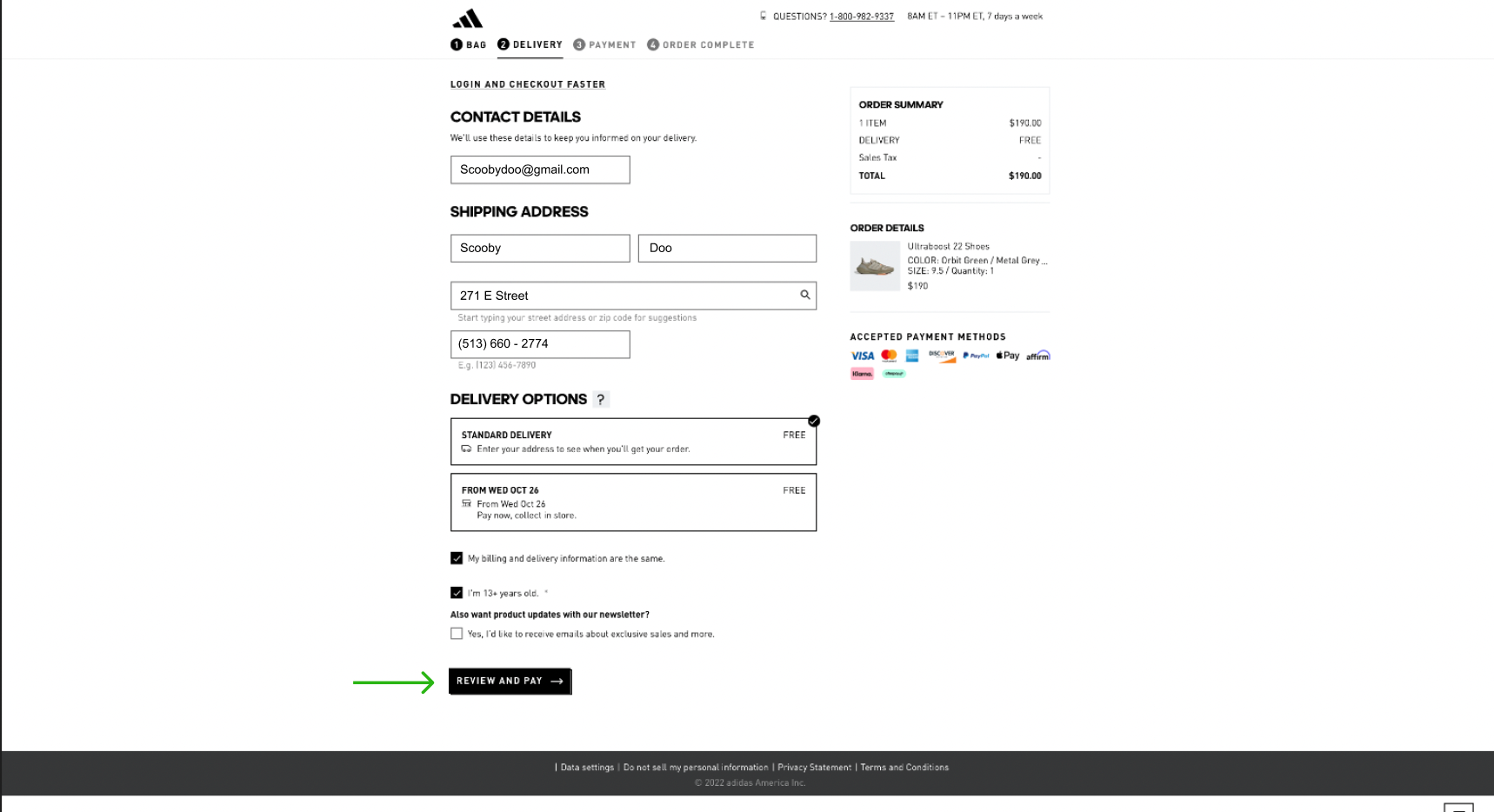

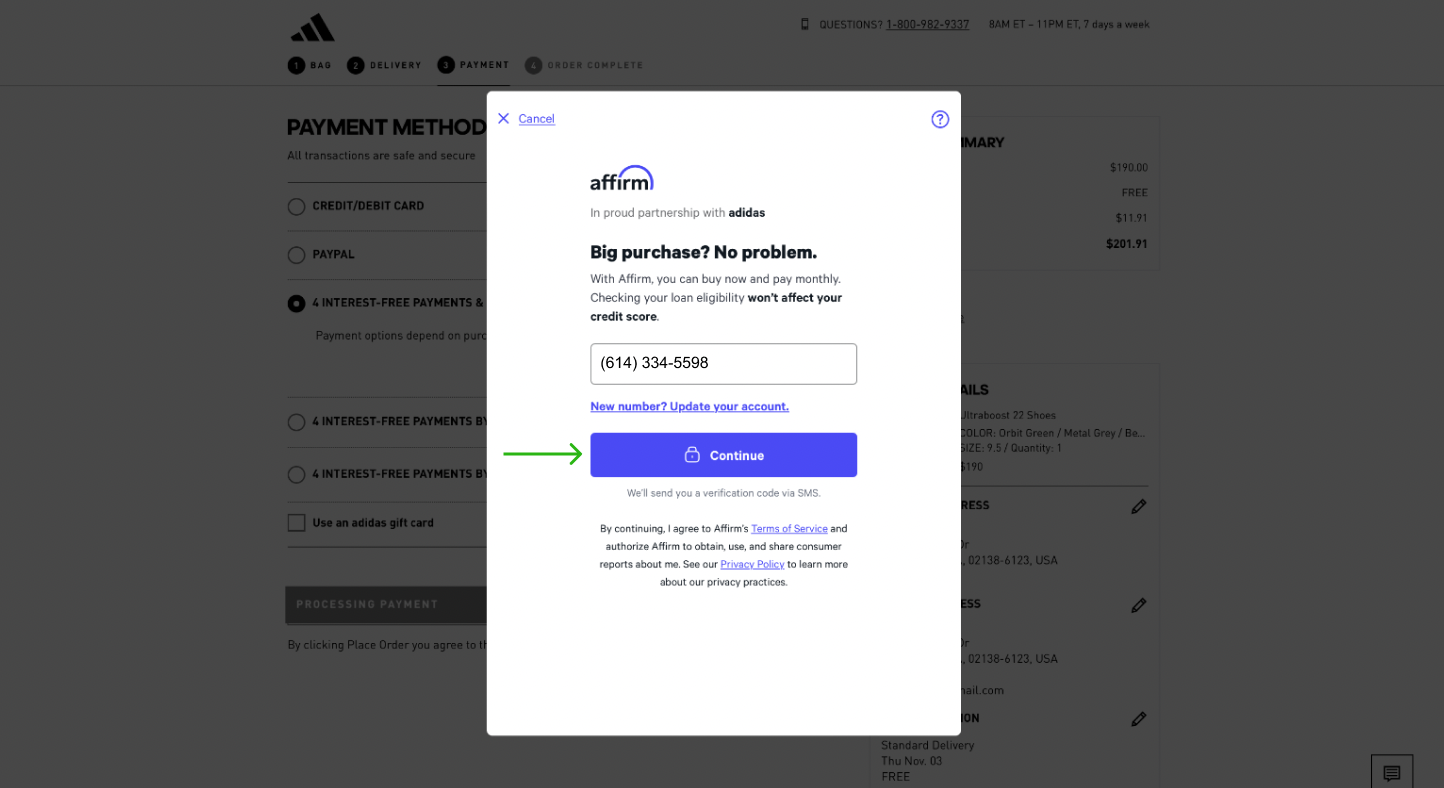

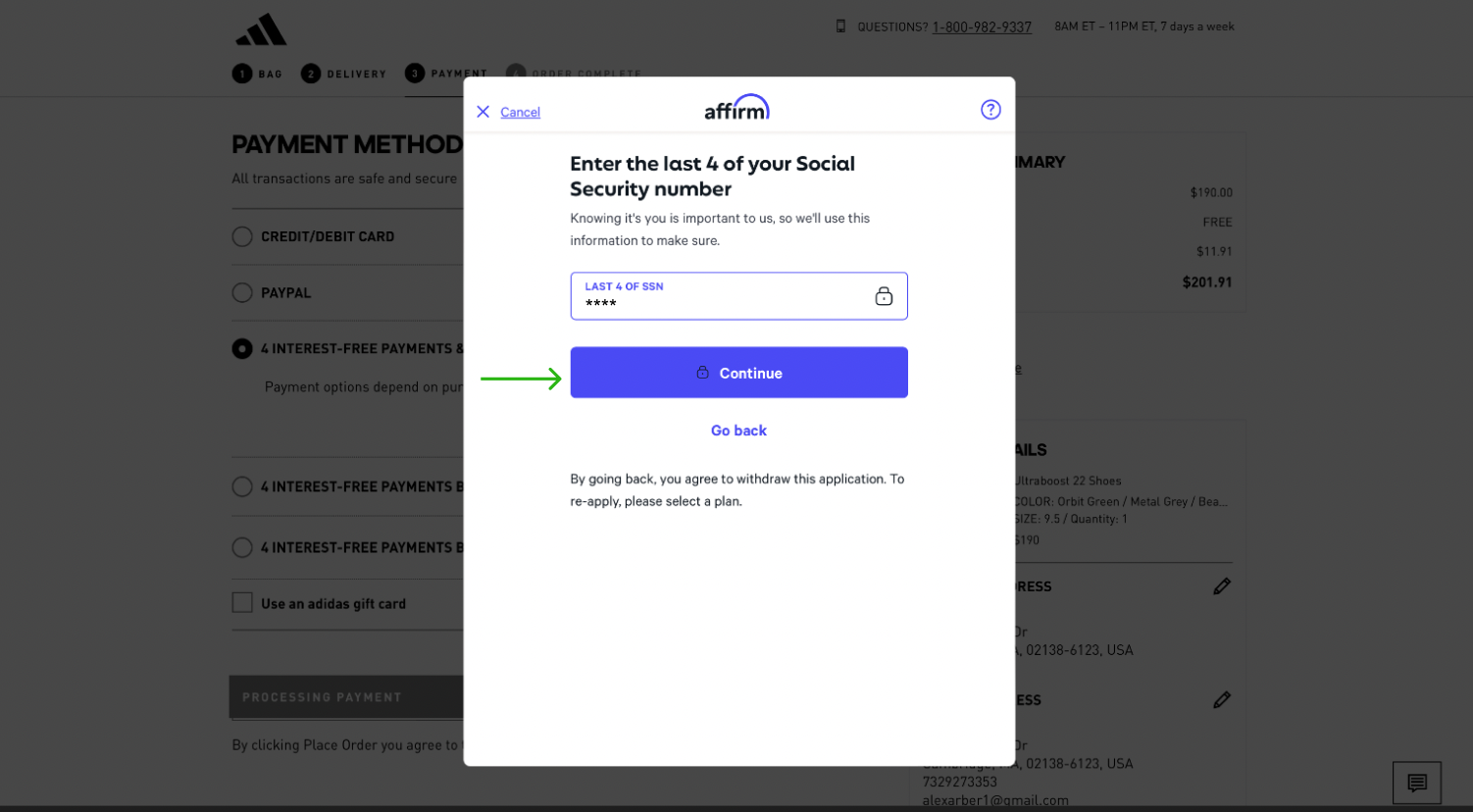

Entered personal information, screenshotted the page, and then edited the photo to remove all personal information so the screen would appear blank and then filled in with a “dummy” consumer, e.g., “Scooby Doo.”

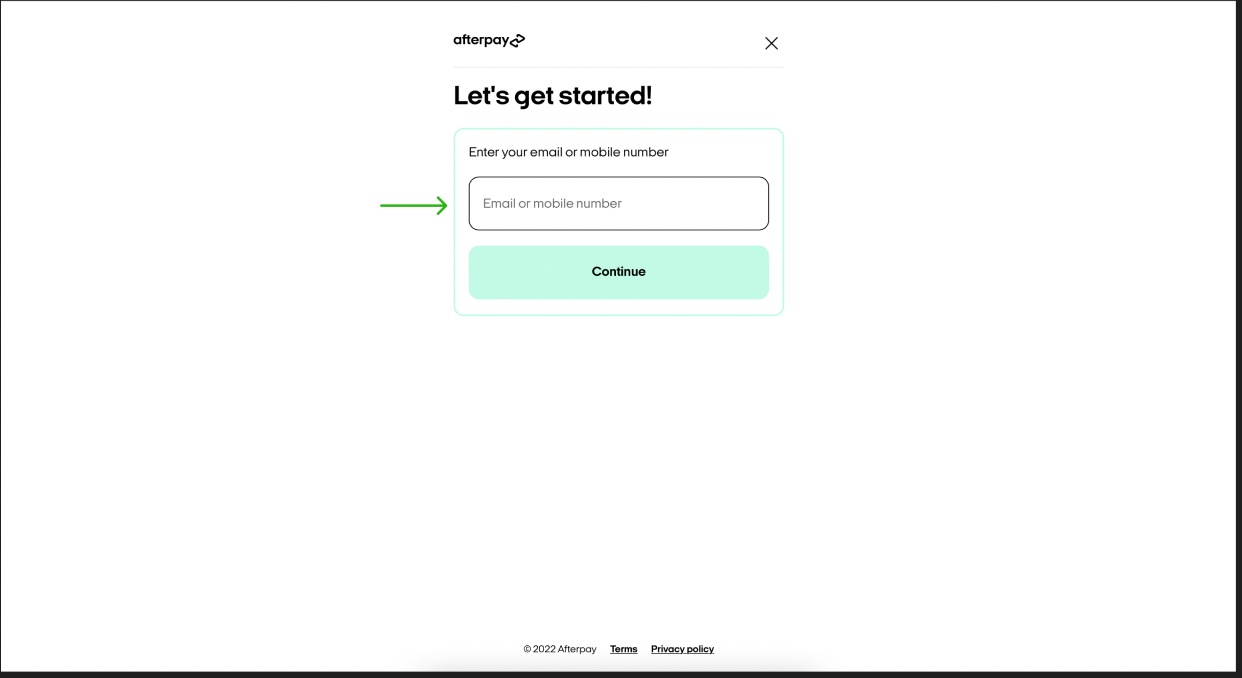

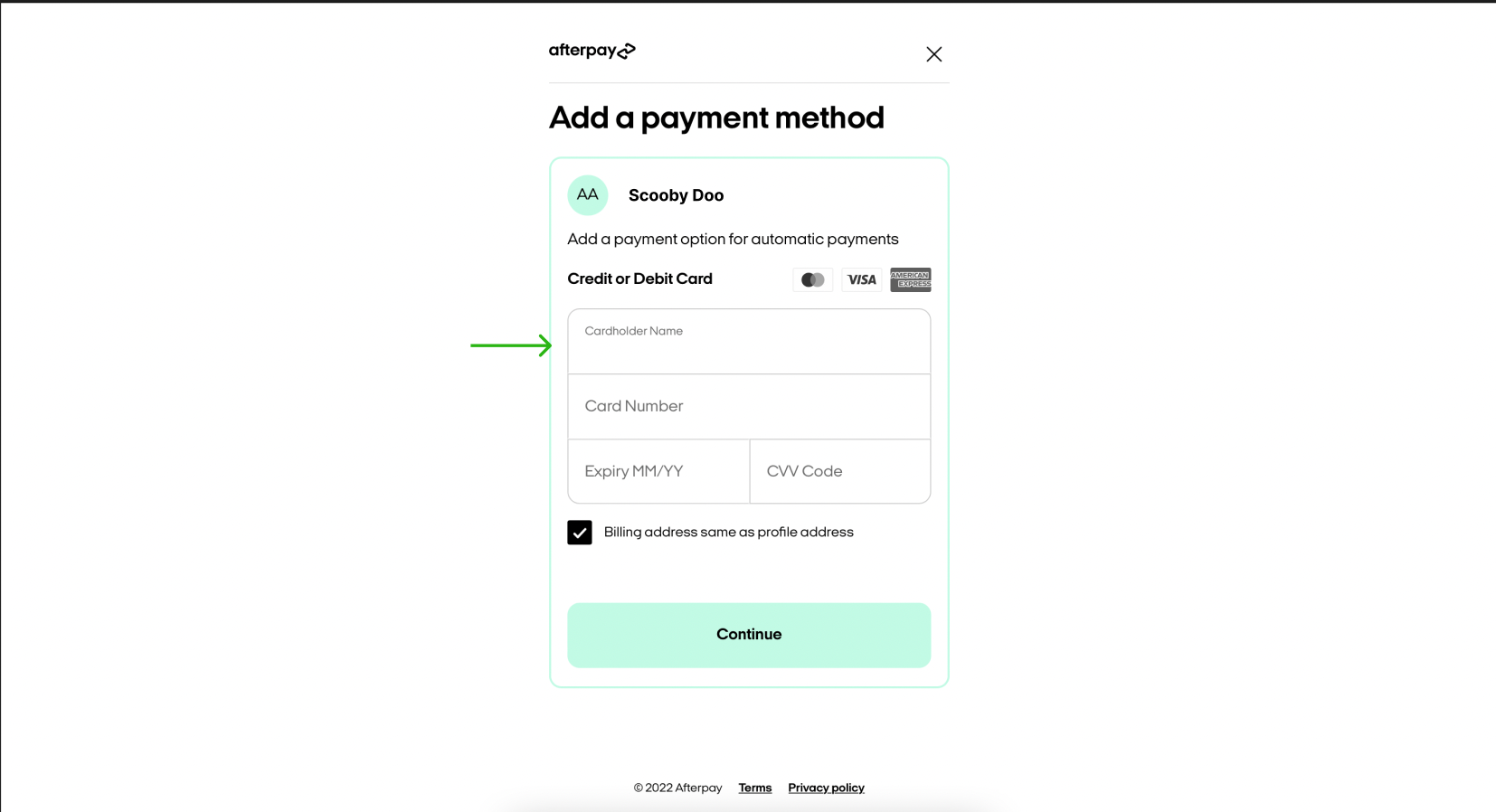

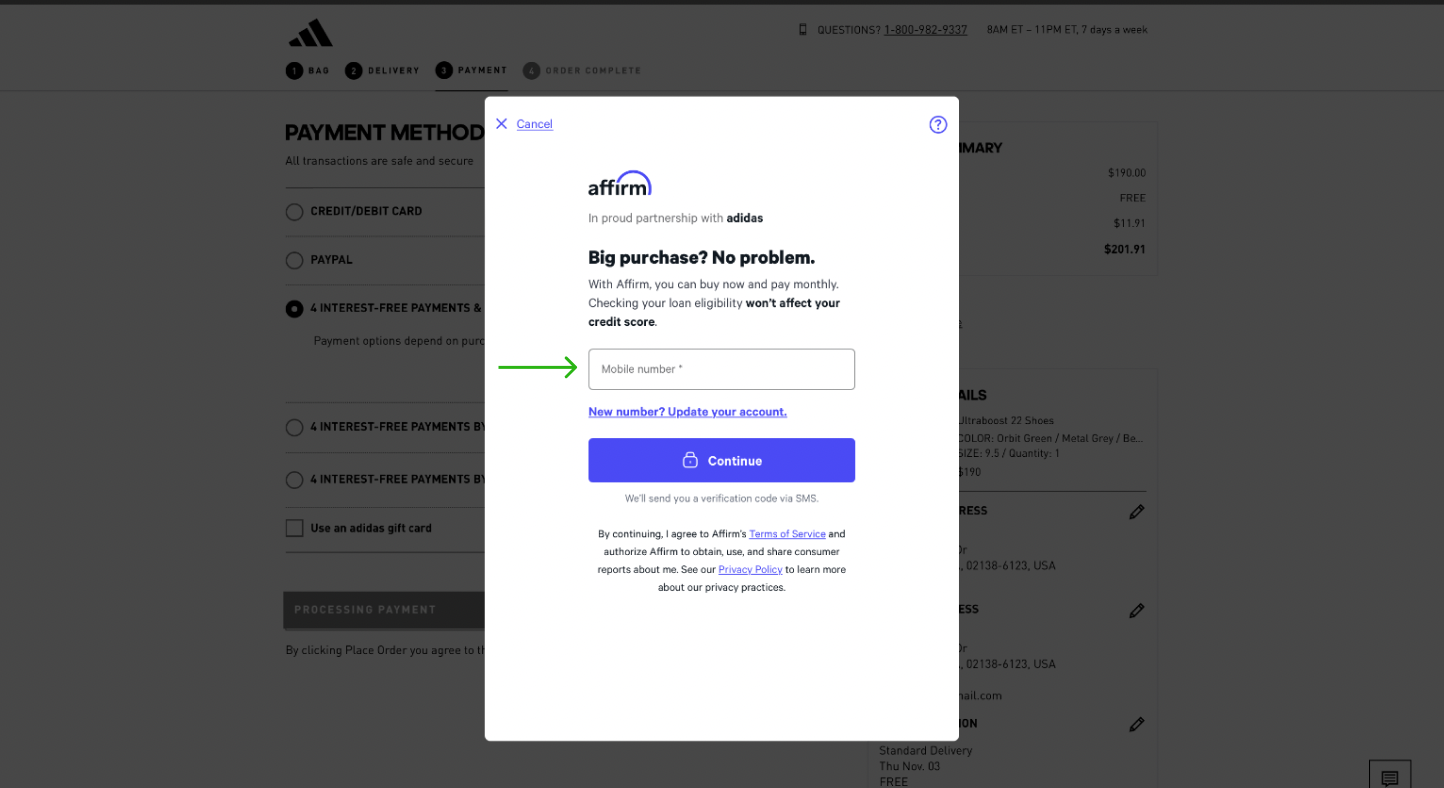

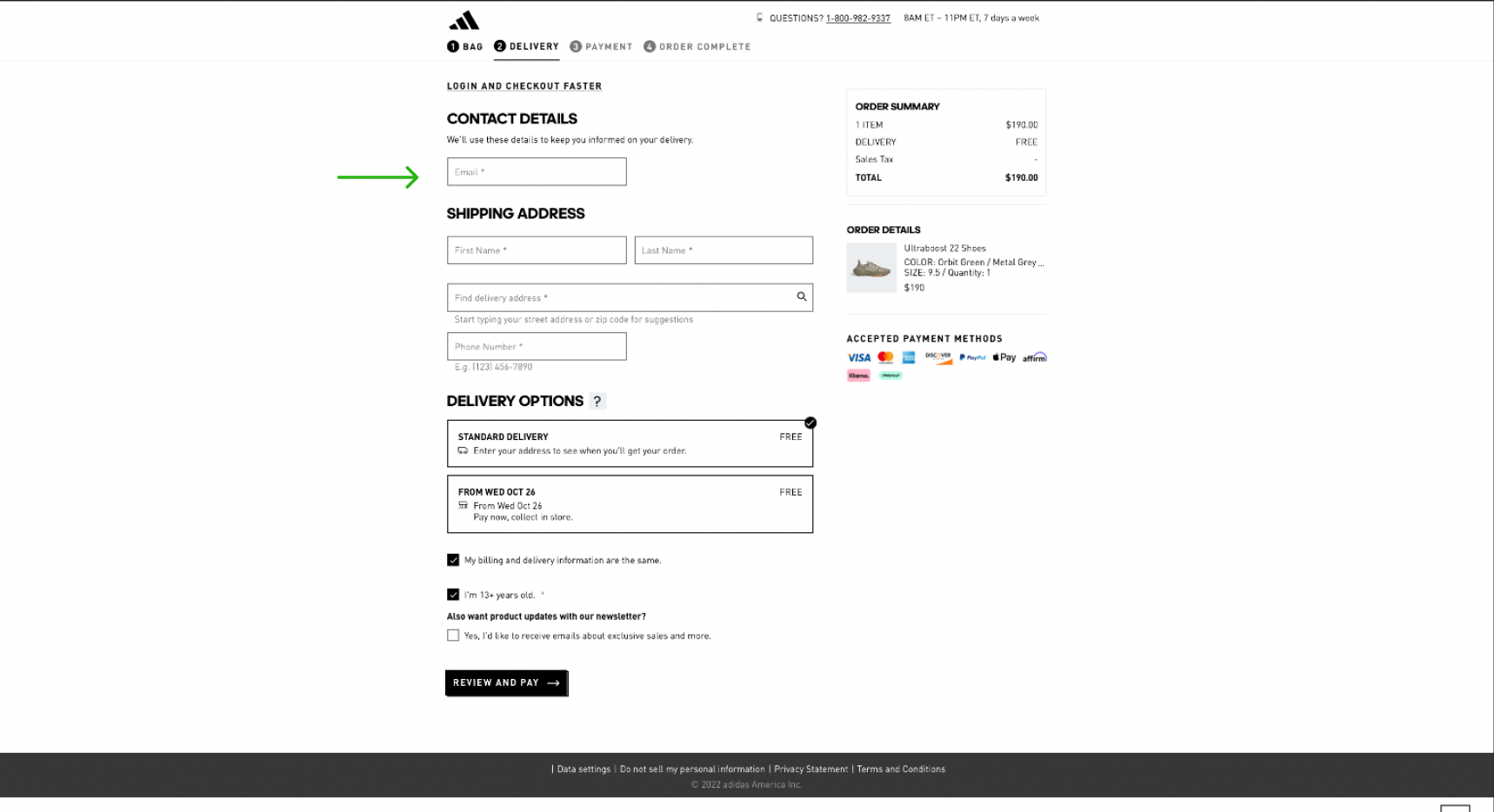

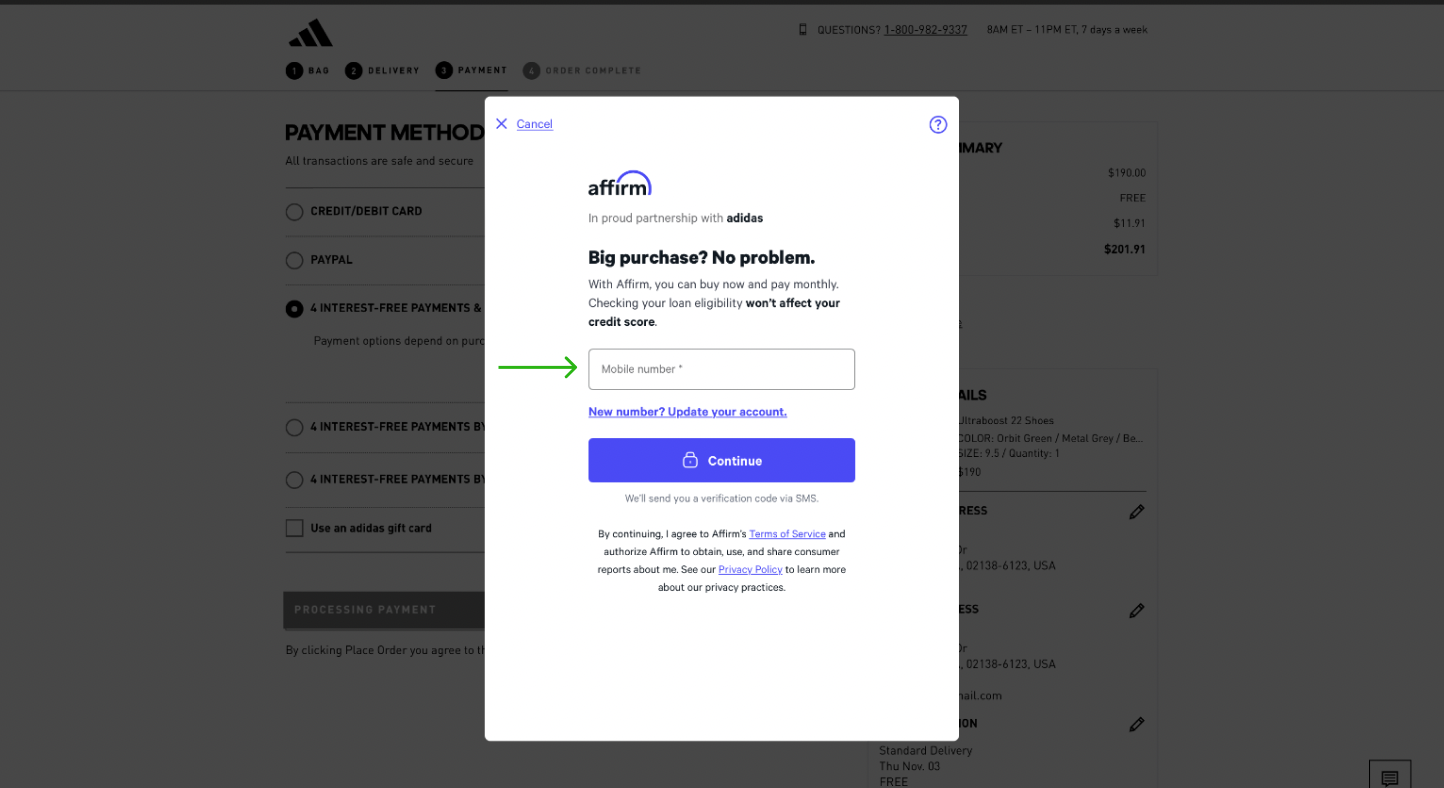

Figure 9. An example of a screenshot for prototyping with empty fields.

Figure 10. An example prototyping screen with information for "Scooby Doo."

After documenting each purchasing flow step with a screenshot, we canceled the order through the merchant to ensure that no items were actually purchased. The BNPL service was informed that we conducted this action and issued a refund.

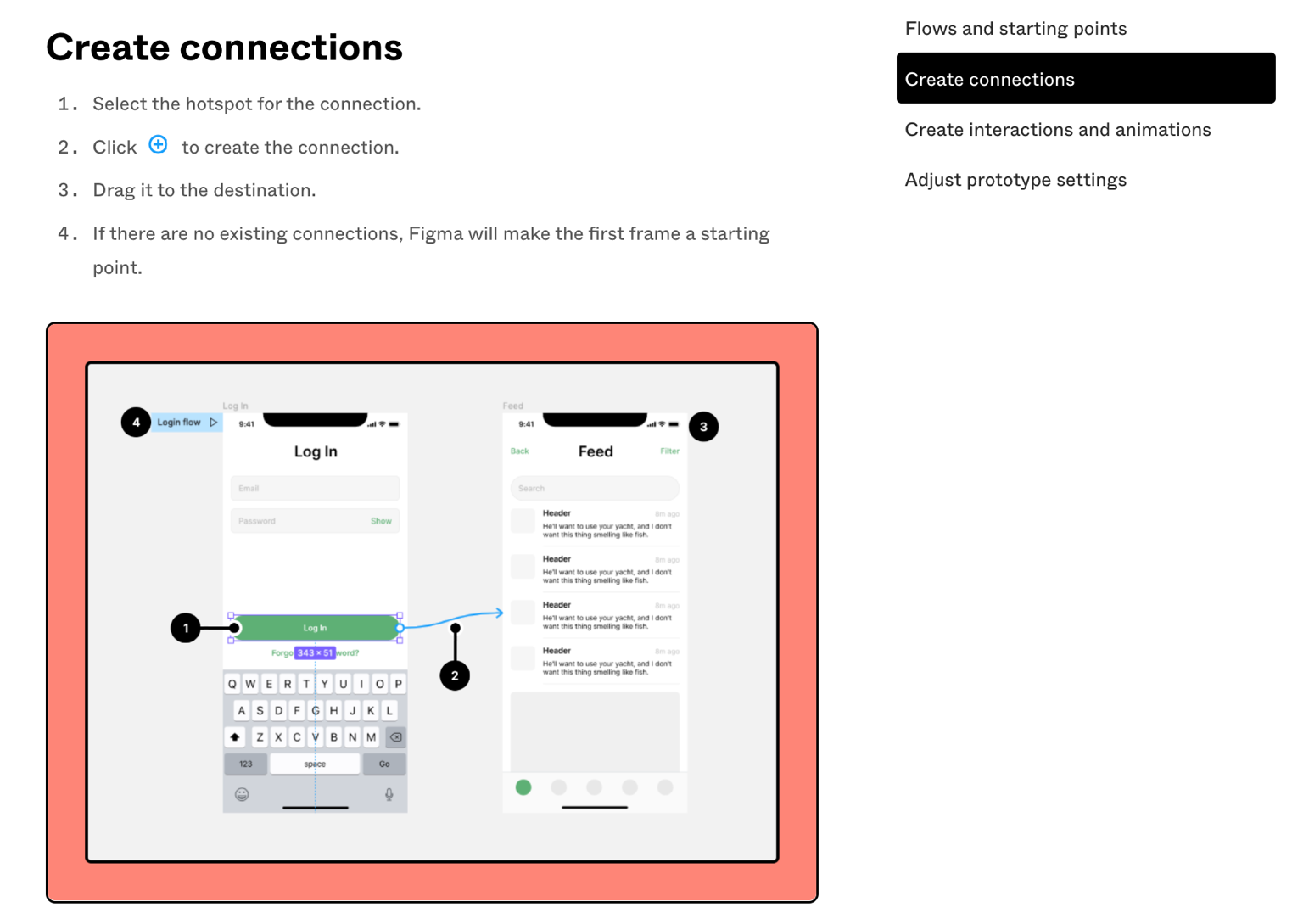

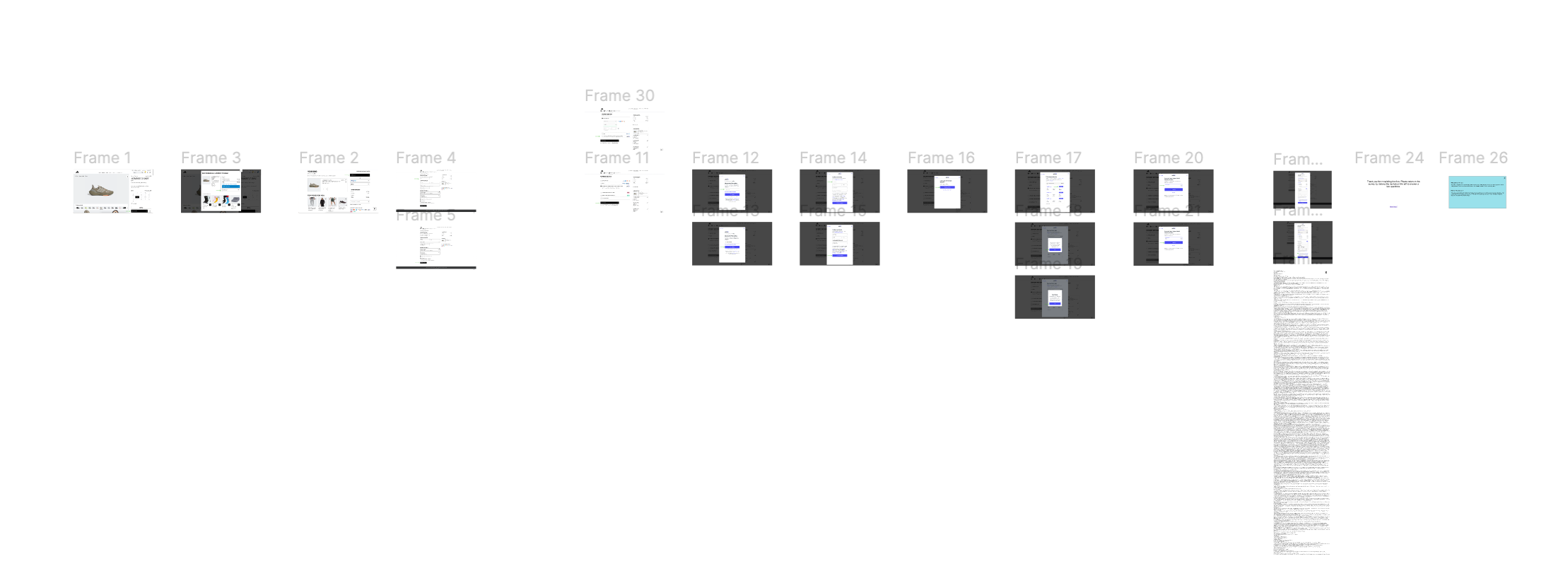

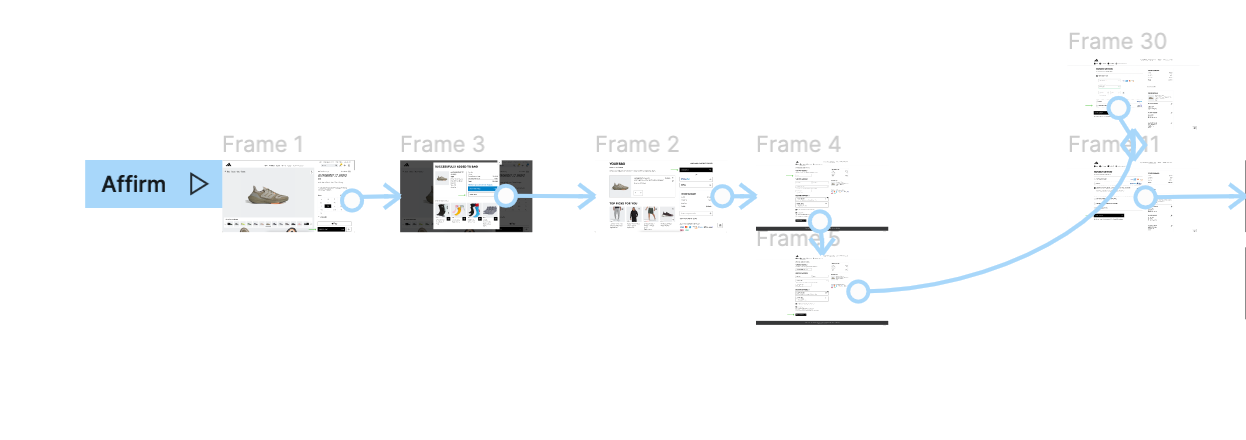

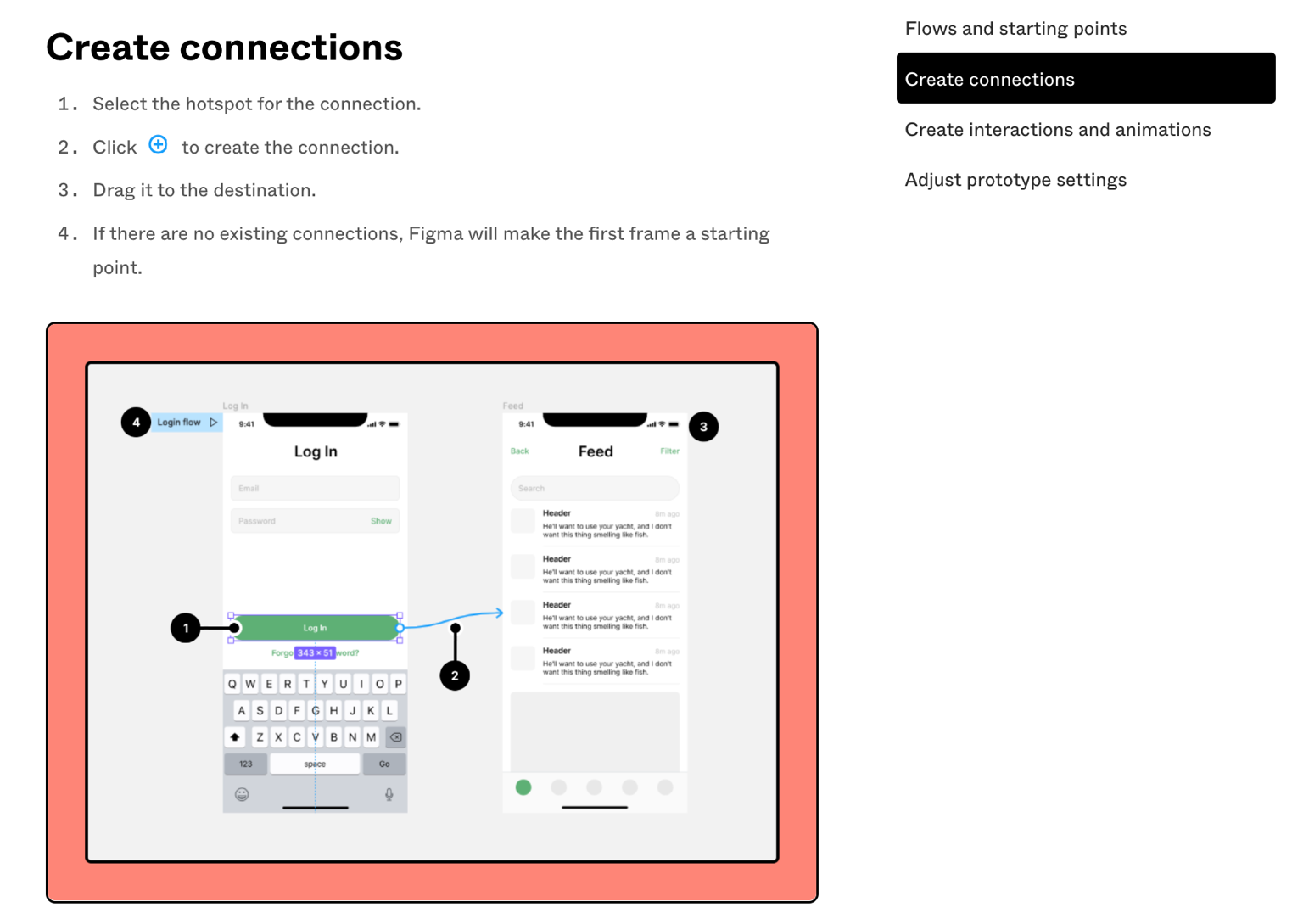

To create the prototype itself, we used the free software tool Figma [39]. Figma was chosen because of its simple integration with the testing service, Maze, its popularity among product designers for prototyping, and the authors’ previous experience using the tool. See Appendix C for more information on how to construct Figma prototypes. We created an account and entered all of the collected screenshots from the BNPL purchasing flows, editing the images as shown in Figures 9 and 10 to hide personal information or to add “dummy” consumer information.

Figure 11. Collected Affirm screenshots added to a Figma file.

We constructed the prototype to mirror an authentic website experience. For example, if clicking “Next” on a website led a user to the next screen, the “Next” button on the screenshot did the same. In this experiment, this was accomplished by filling in “dummy” consumer information line by line as a user clicked on each field, simulating the process of typing in one’s own information.

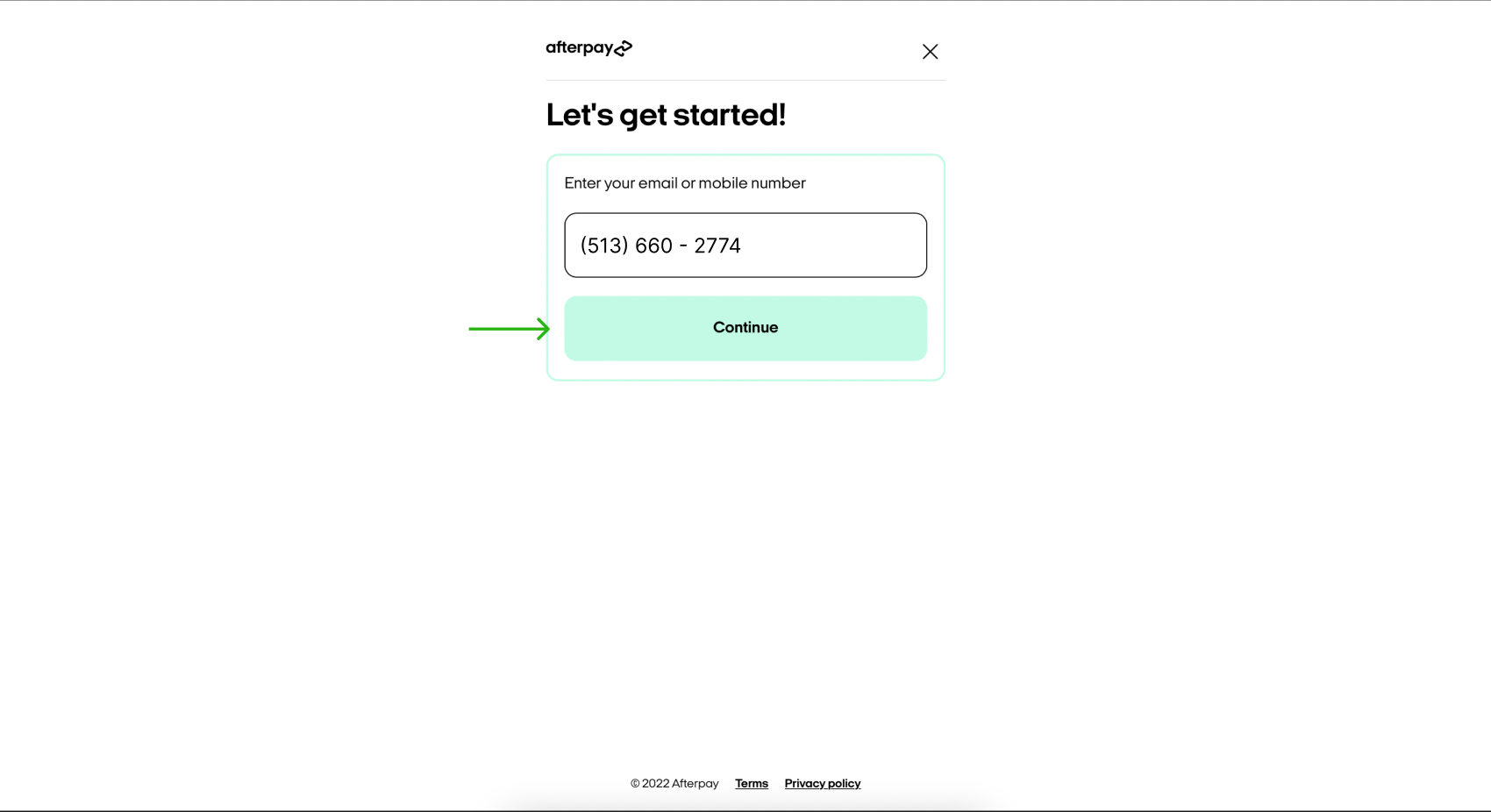

Figure 12. Wiring the prototype for an interactiveexperience.

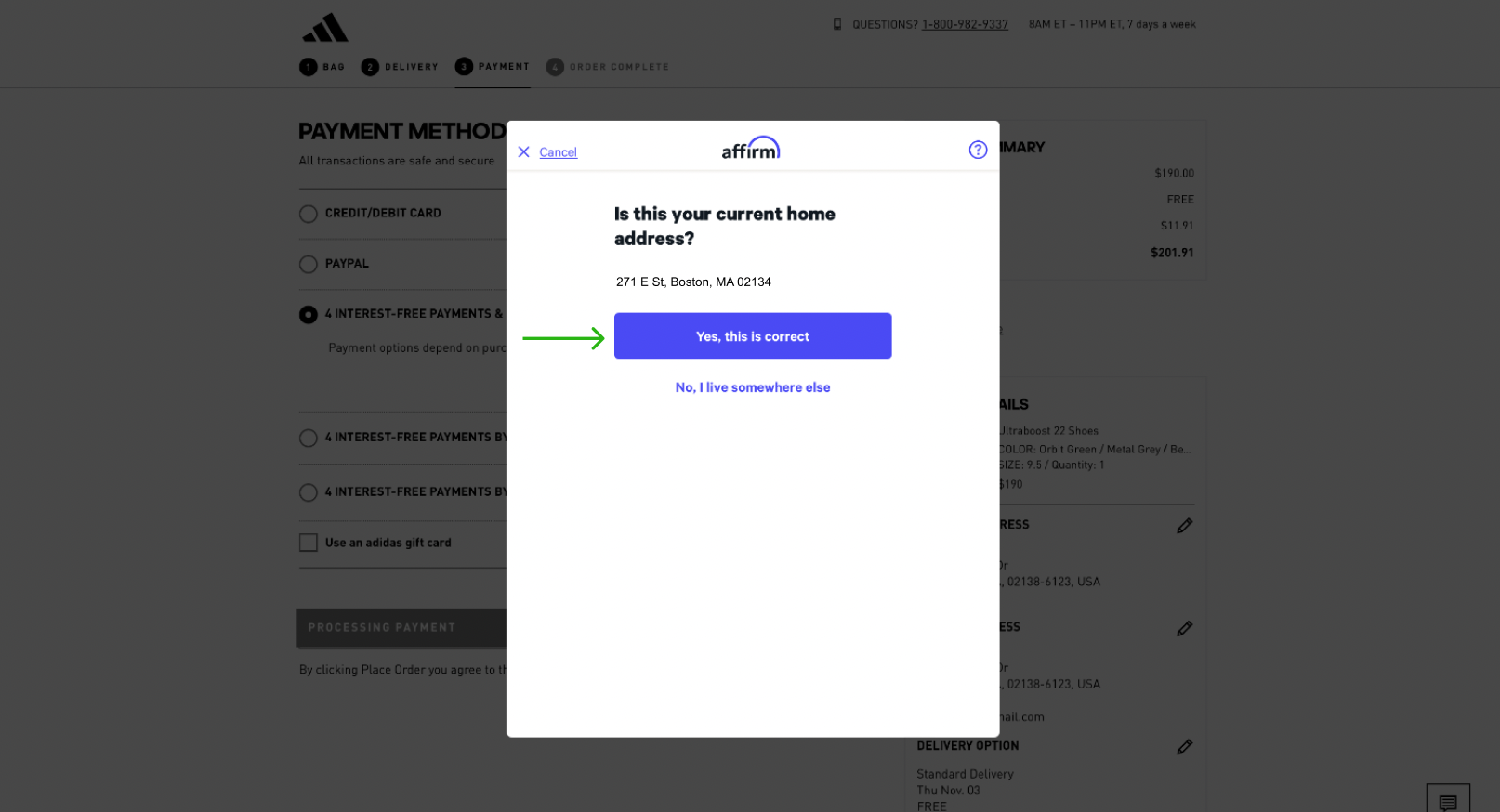

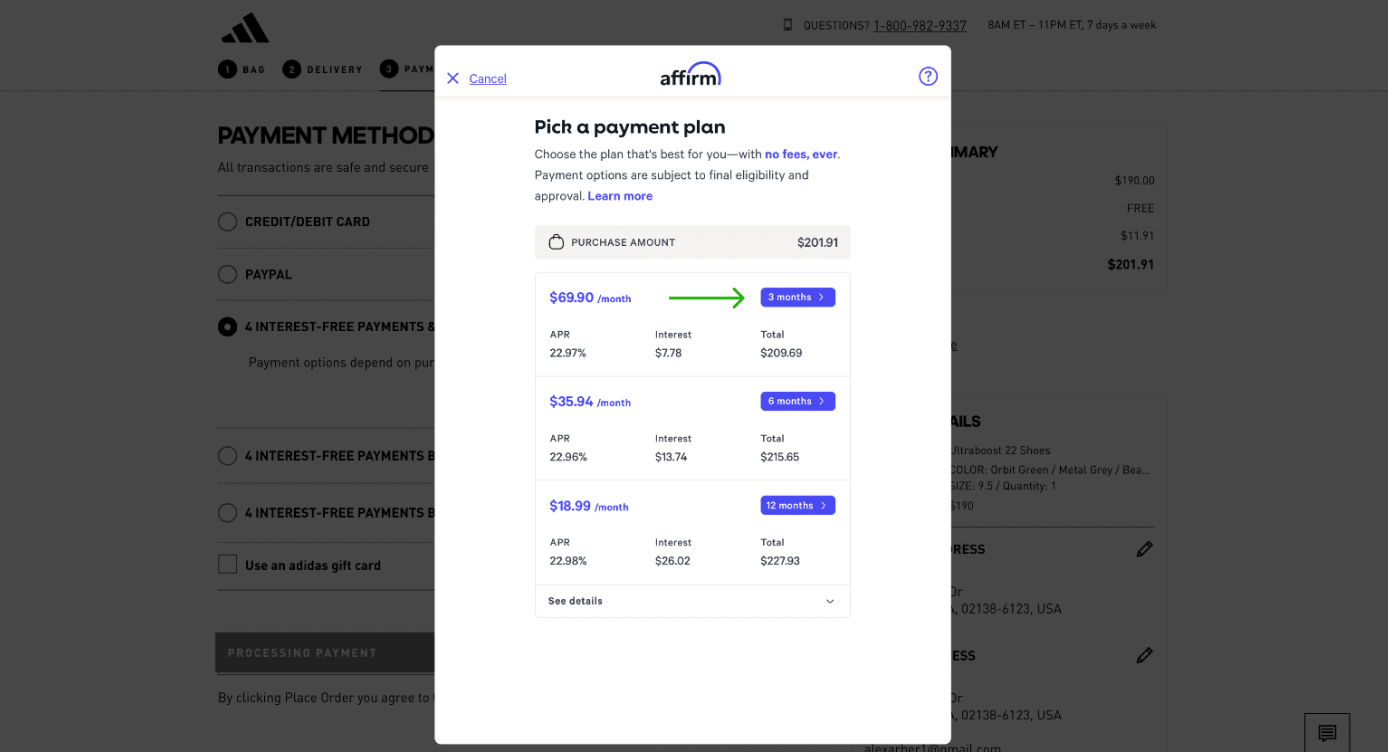

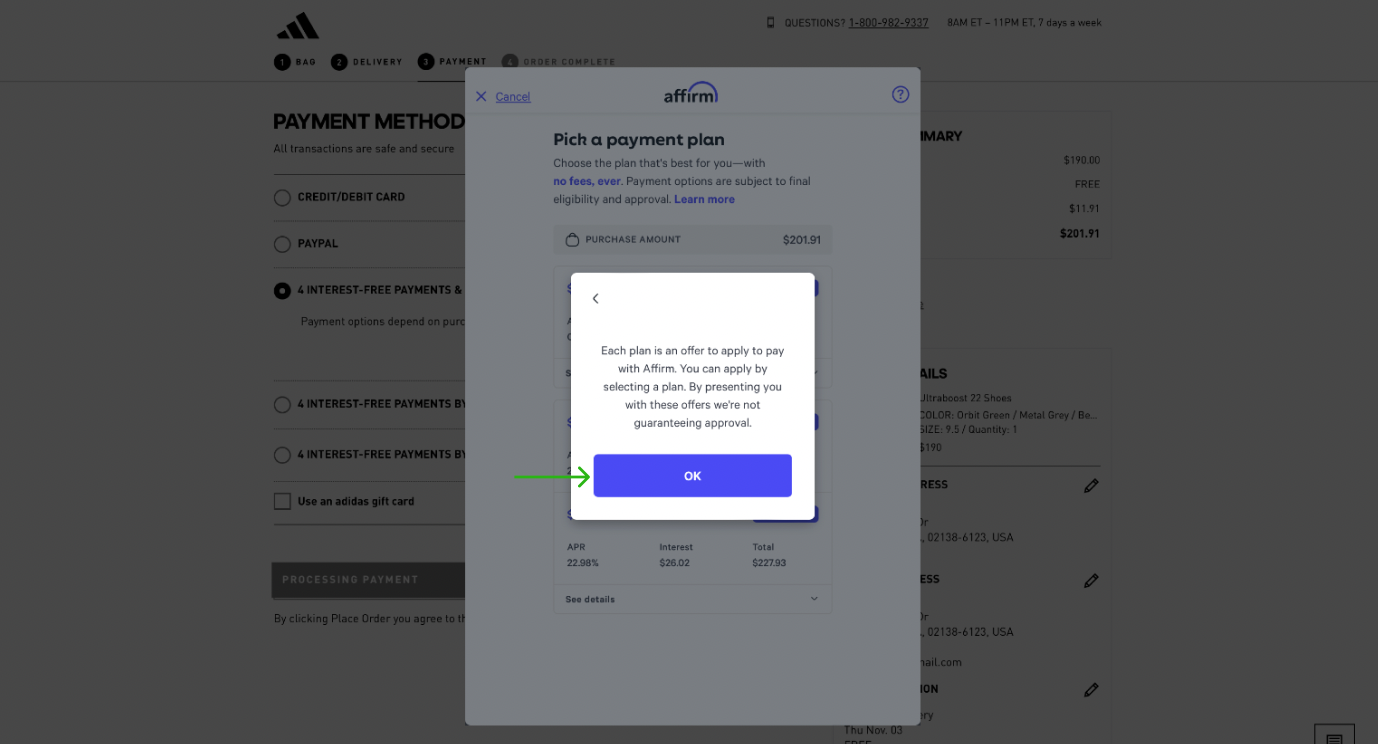

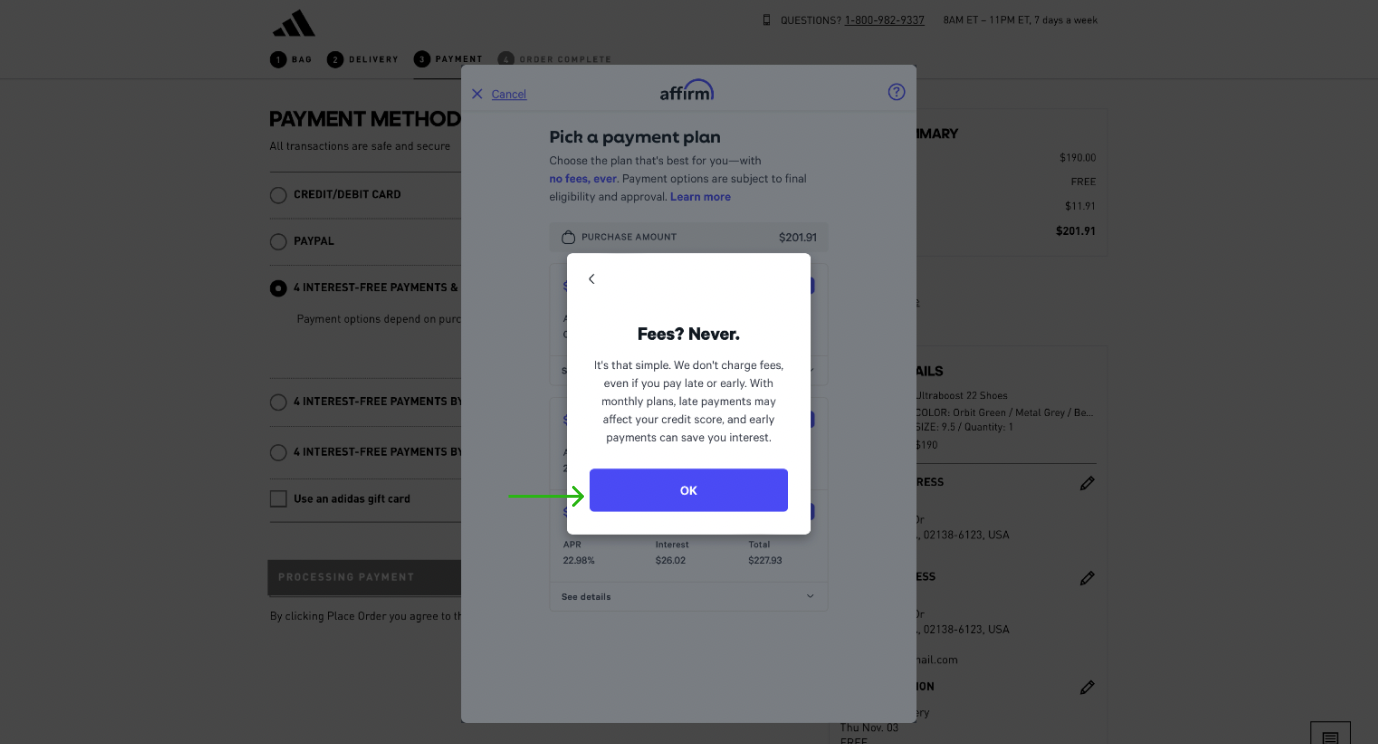

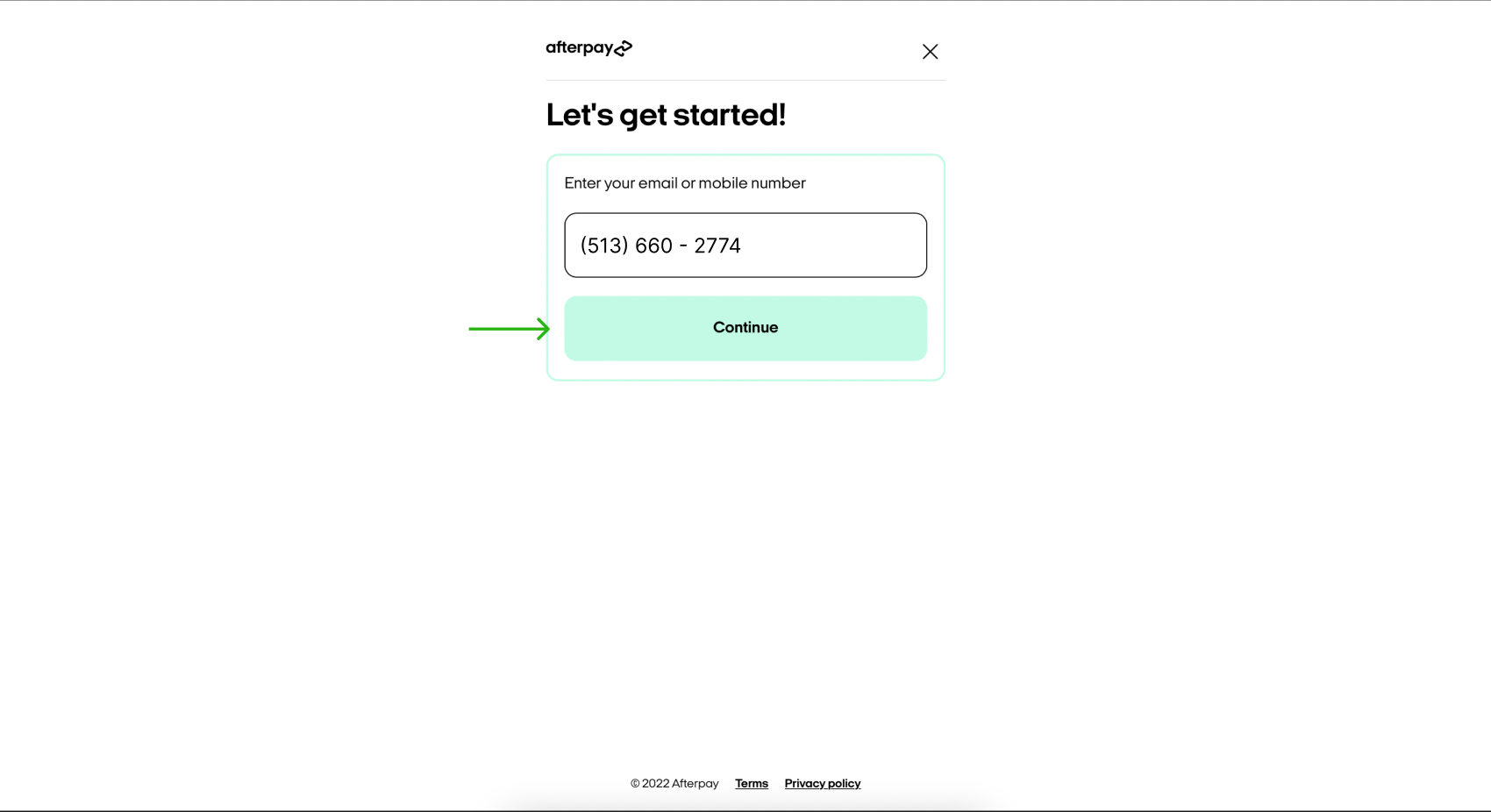

Finally, we added green arrows to the prototype images to guide respondents along a direct path to completing the purchasing flow. These guideposts were added because only certain elements of the images in the prototypes were designed to be “clickable,” meaning that if a respondent were to take an indirect action in the prototype, such as attempting to change the size of the shoe being purchased, they would be unsuccessful.This design choice is standard in usability testing so that the party running the survey can collect targeted results on the element of the prototype they wish to test. As the purpose of this experiment was to collect results on what financial information respondents were able to recall after completing the flow, we determined that it was unnecessary to provide extraneous information to respondents in the prototype.

Figure 13. An example of a green arrow added to a screenshot in the Afterpay prototype that directs survey respondents where to click next.

Creating the Survey

We chose to randomly survey respondents from across the country, asking them to complete these prototypes and answer comprehension questions assessing their understanding of the payment flow process and communicated risks and terms.

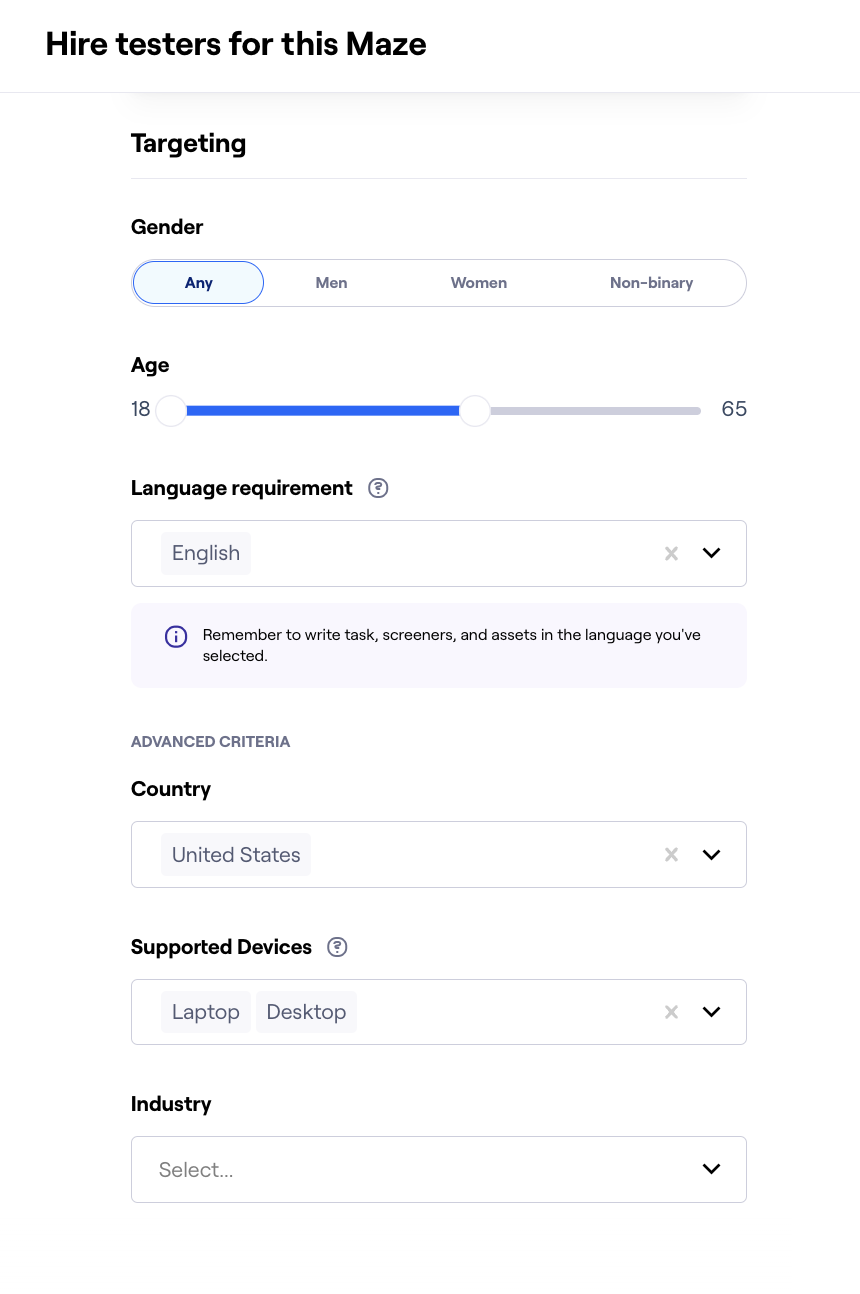

Creating the survey consisted of (1) choosing the demographics of respondents, (2) uploading media, (3) creating questions, and (4) launching the poll.

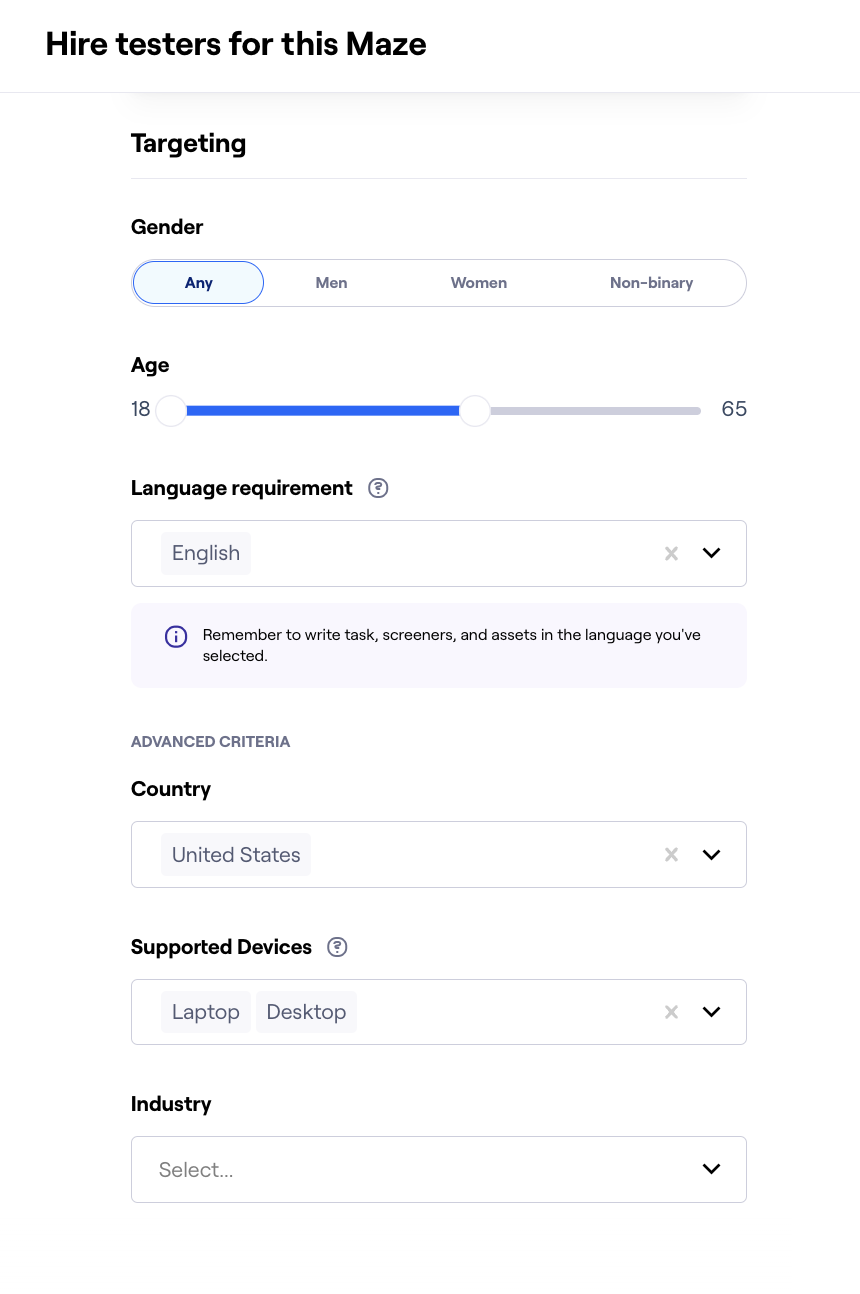

Figure 14. Respondent selection criteria.

The survey was offered to 211 individuals and featured ten questions.Of the total recruited, 102 survey respondents received the Affirm prototype to test, and the other 109 the Afterpay flow. We used Maze’s demographic selection function to narrow the eligibility requirements for our survey respondents. Our experiment targeted U.S. residents between the ages of 18 and 65 (as this age group is most likely to use a BNPL service) [9]. We filtered participants to meet these criteria to ensure we were surveying people who were likely to exhibit at least some degree of familiarity with BNPL services.

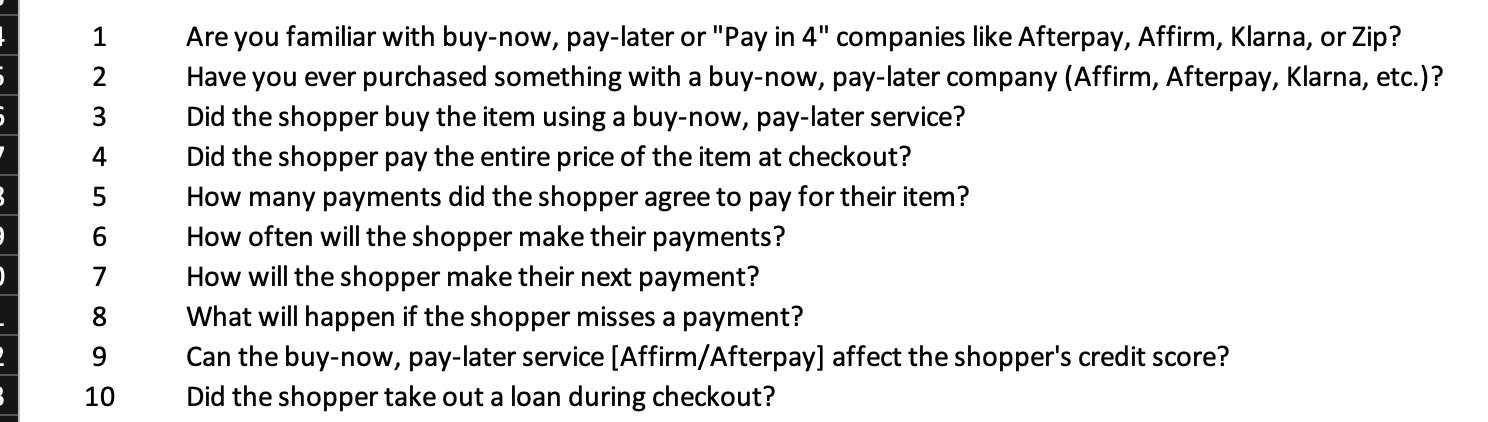

Questions for the poll were drafted to maximize a participant’s understanding of the simulated BNPL experience they just had while minimizing potential bias. We included a few questions about respondents’ prior familiarity with BNPL services and understanding of financial literacy to test whether those factors influenced responses.

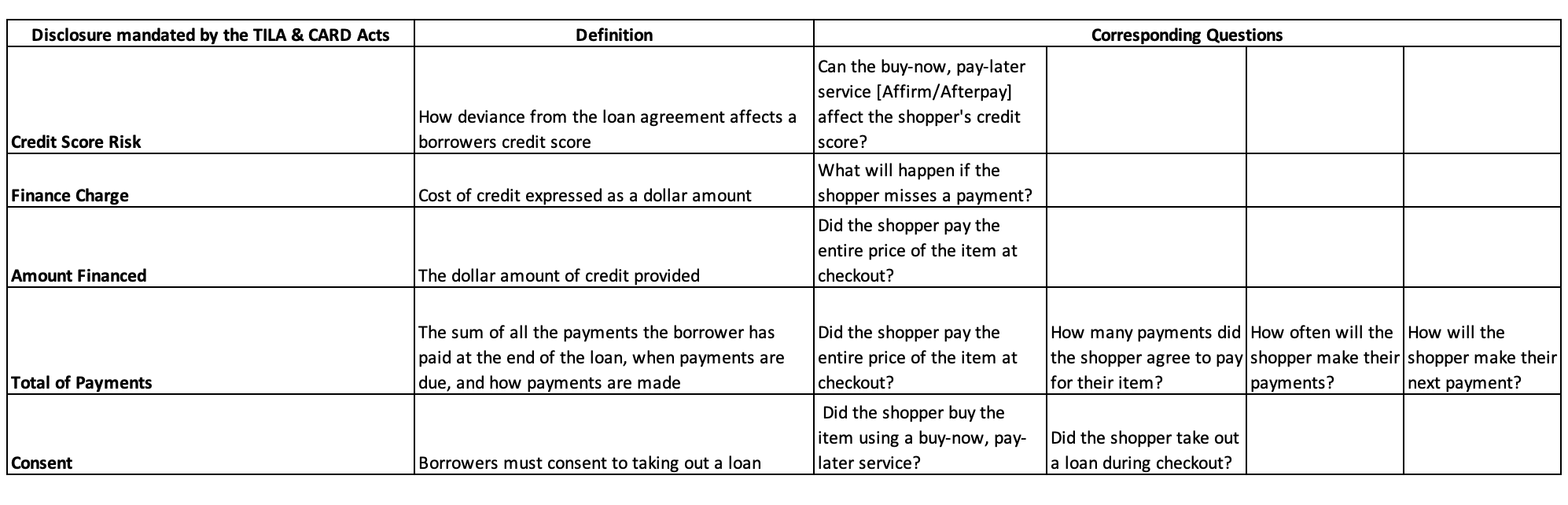

It is admittedly difficult to define what it means for a company to “effectively communicate” the risk associated with their products. Our survey asked a narrower question: Are consumers making BNPL purchases informed adequately enough to use the service without experiencing negative outcomes, such as missing a payment that might lead to a credit score deduction? Specifically, our study tested whether consumers comprehended certain information that would be required to be disclosed by companies regulated under the Truth in Lending and Credit Card Accountability, Responsibility, and Disclosure (CARD) Acts. The Truth in Lending Act was established to protect consumers from predatory lending practices by requiring businesses to disclose loan terms [40]. The CARD Act was passed in 2009 to expand the number of required disclosures and include credit card products under the TILA regulatory framework [29].At the time this study was conducted, these laws did not apply to BNPL services, and, as demonstrated in Appendix A, not all BNPL companies proactively disclosed information that is now mandated by the US government. Our belief was if the BPNL industry is not effectively communicating risks to purchasers, it might be that applying TILA standards could reduce risk from BNPL lending practices. Our study looked at users’ comprehension of risks in this previously unregulated environment to help determine whether regulation might be warranted.

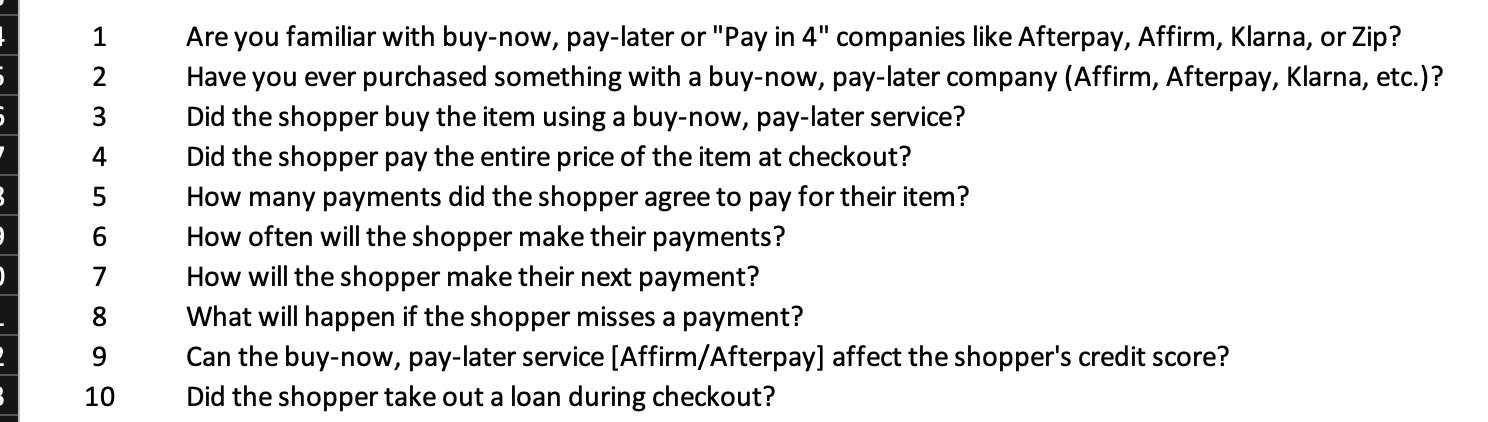

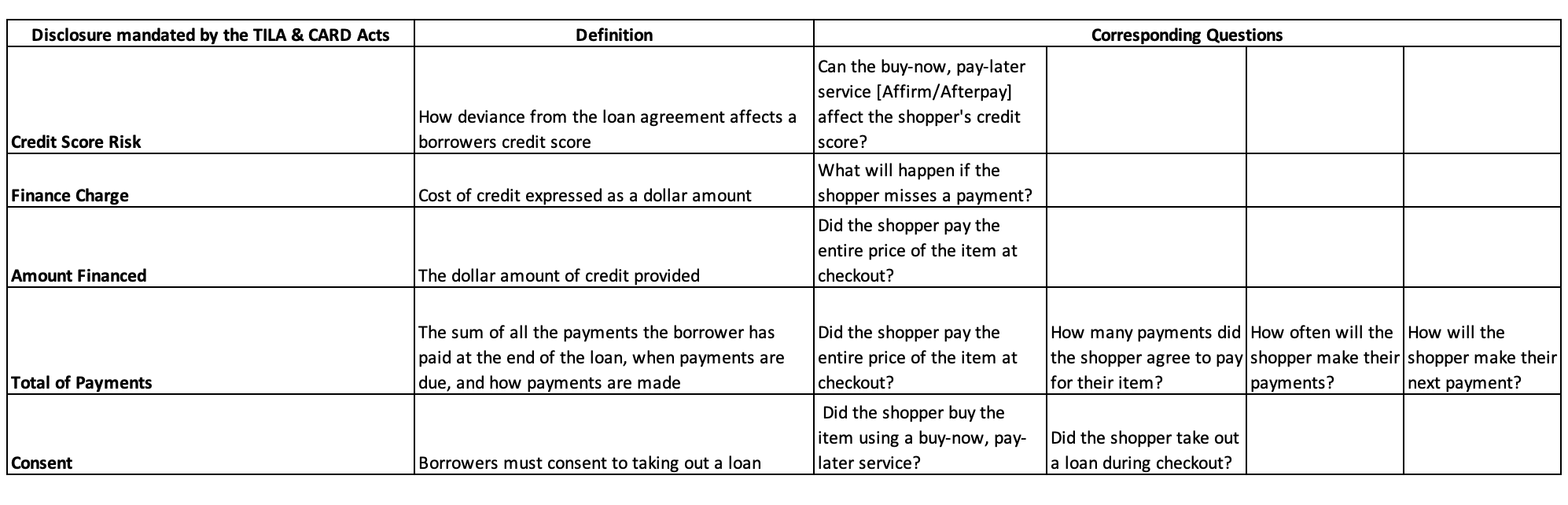

Figure 15. Survey questions; the first two were asked before respondents completed the prototype.

Figure 16. Matrix demonstrating how survey questions aligned with TILA and CARD disclosure requirements.

Results

Survey-wide Preliminary Questions

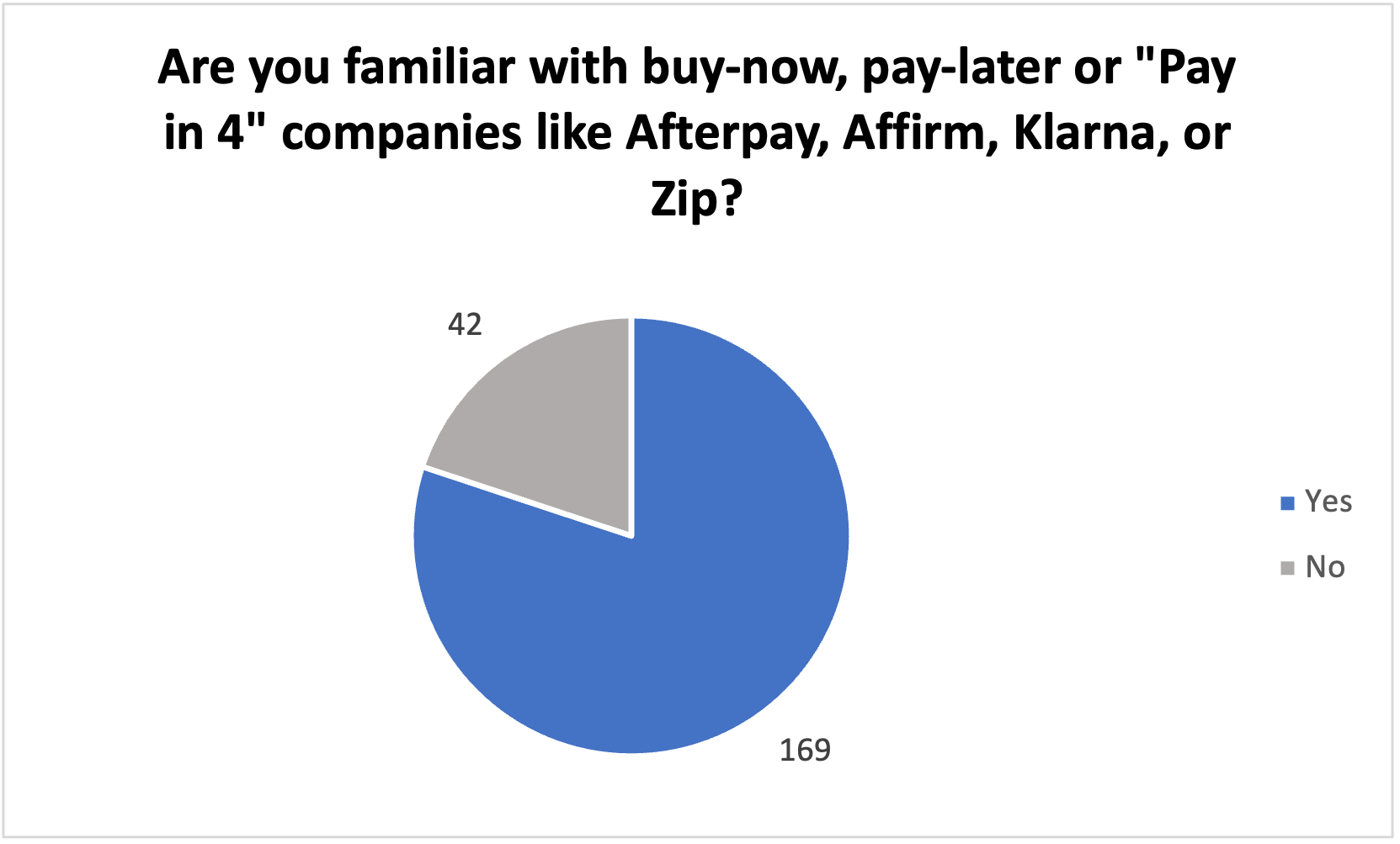

The survey began with 211 respondents. One respondent exited the survey after answering one question, and four exited after answering the second question. As a result, 211 respondents answered the first question, designed to assess their familiarity with BNPL services.

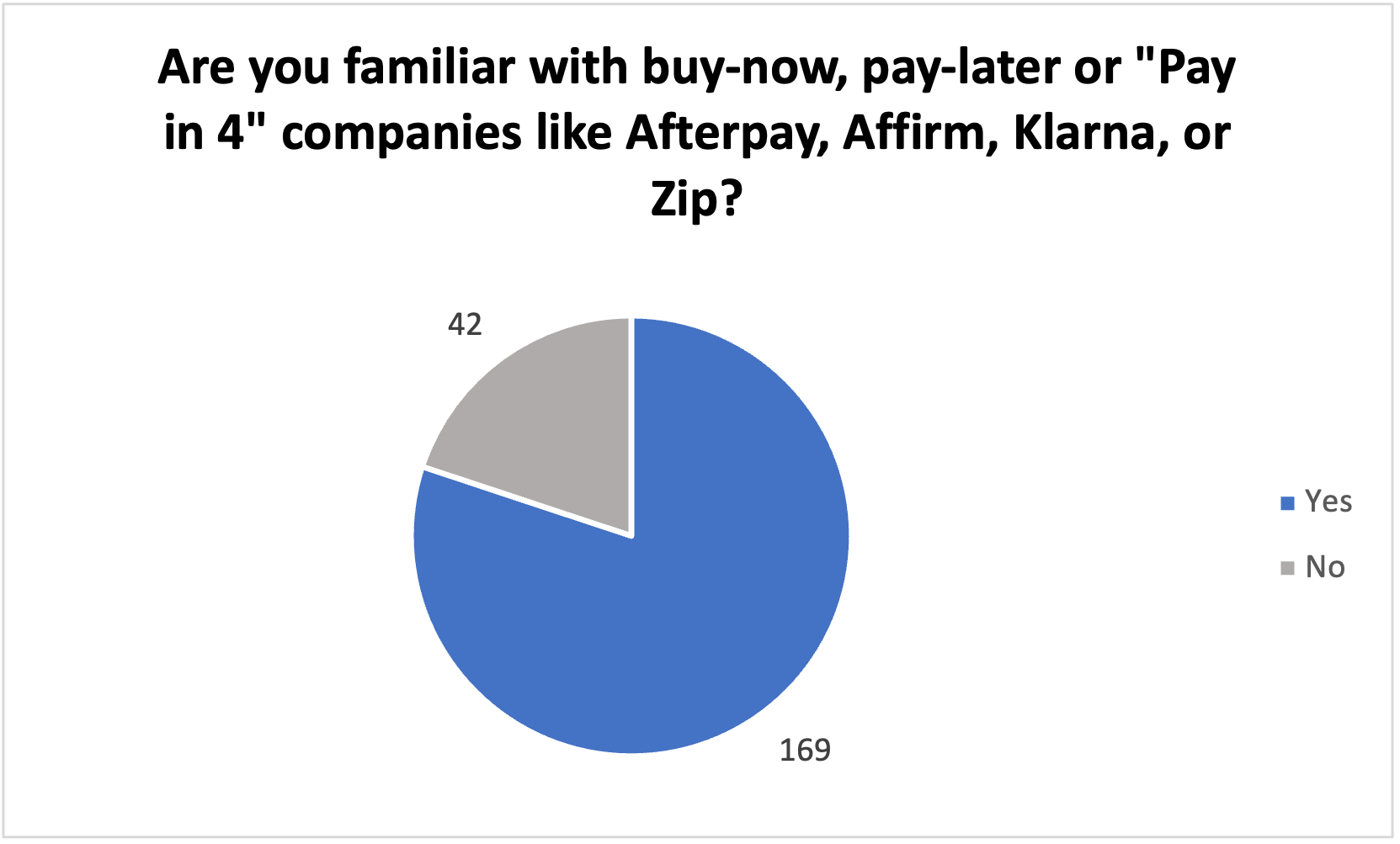

Our findings support media reports that BNPLs are well known and frequently used. We found that 80% of respondents considered themselves familiar with BNPL companies like Affirm, Klarna, Afterpay, or Zip (formerly Quadpay) (Figure 17). This value was similar among the Afterpay and Affirm survey respondent groups. Of respondents who were eventually shown the Affirm prototype, 83% reported familiarity; 77% of respondents who were eventually shown the Afterpay prototype reported familiarity.

Figure 17. User knowledge of BNPL companies.

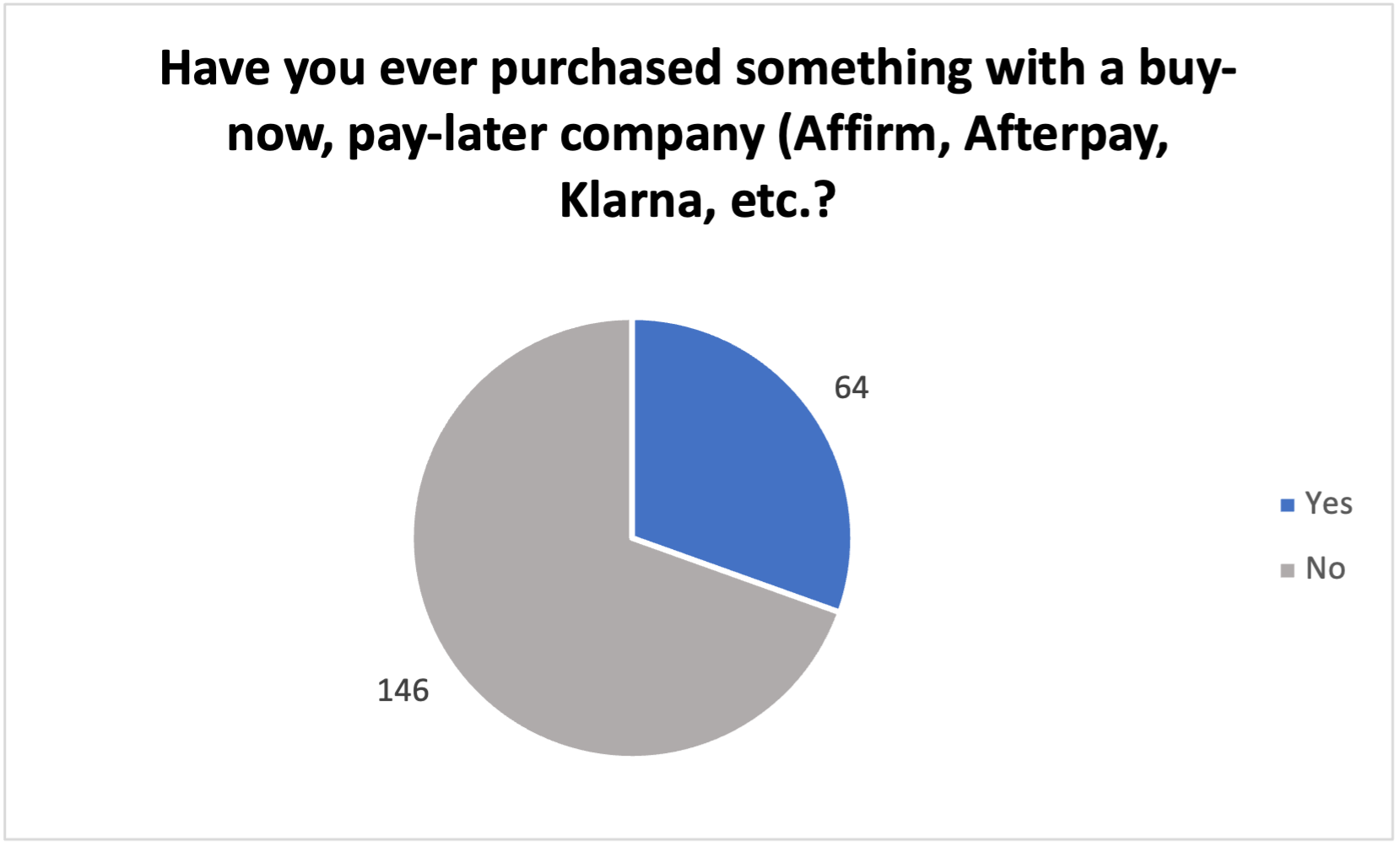

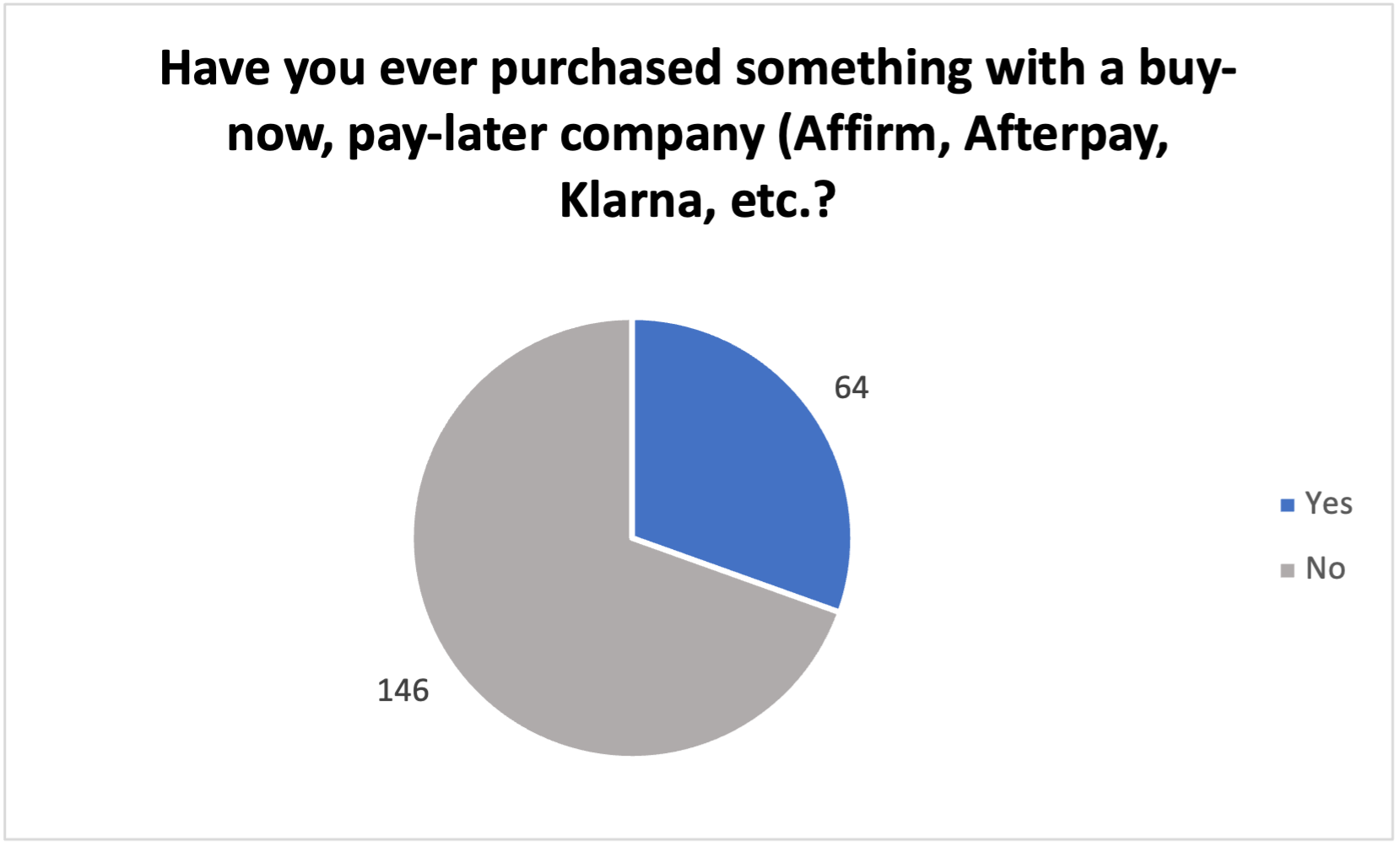

Sixty-four respondents—30% of the 210 answering thequestion—acknowledged having made a purchase using a BNPL service at some point in the past (Figure 18). The remaining respondents had not used a BNPL service to make a payment. This value was similar between respondents for both BNPL providers: 33% of respondents who were eventually shown the Affirm prototype reported experience using BNPL, and 28% of respondents who were eventually shown the Afterpay prototype reported experience using BNPL.

Figure 18. Respondents’ prior use of BNPL services.

Comprehension of Payment Process

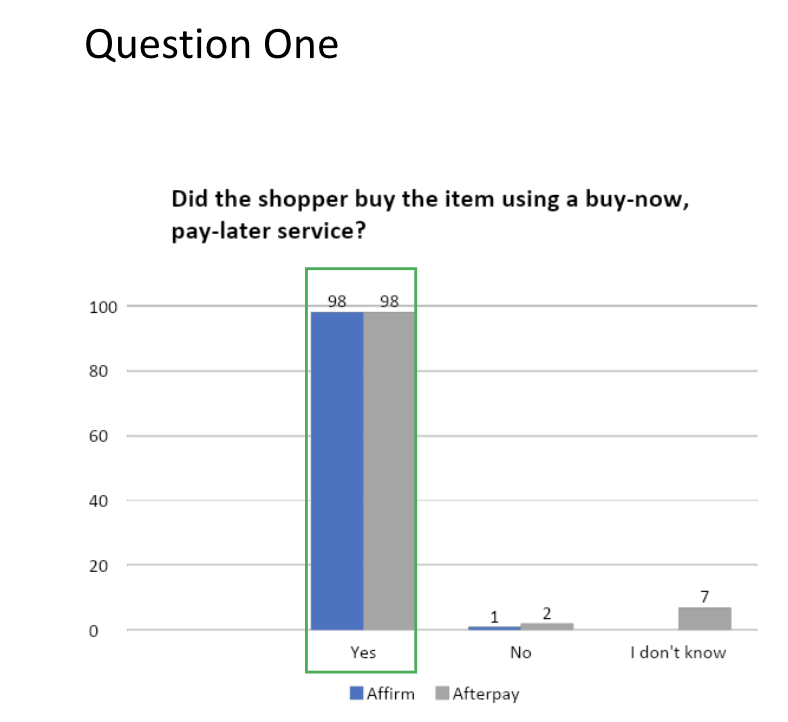

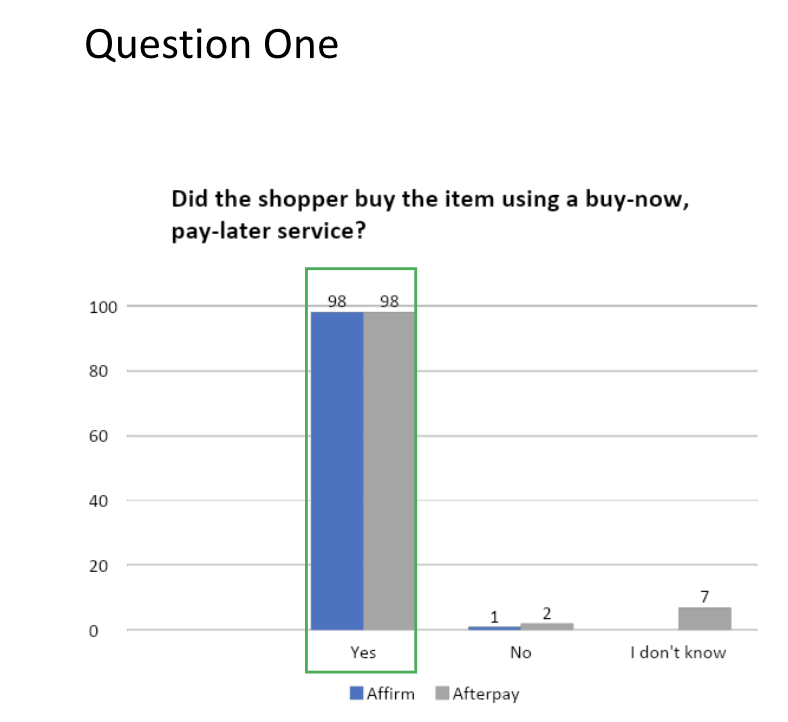

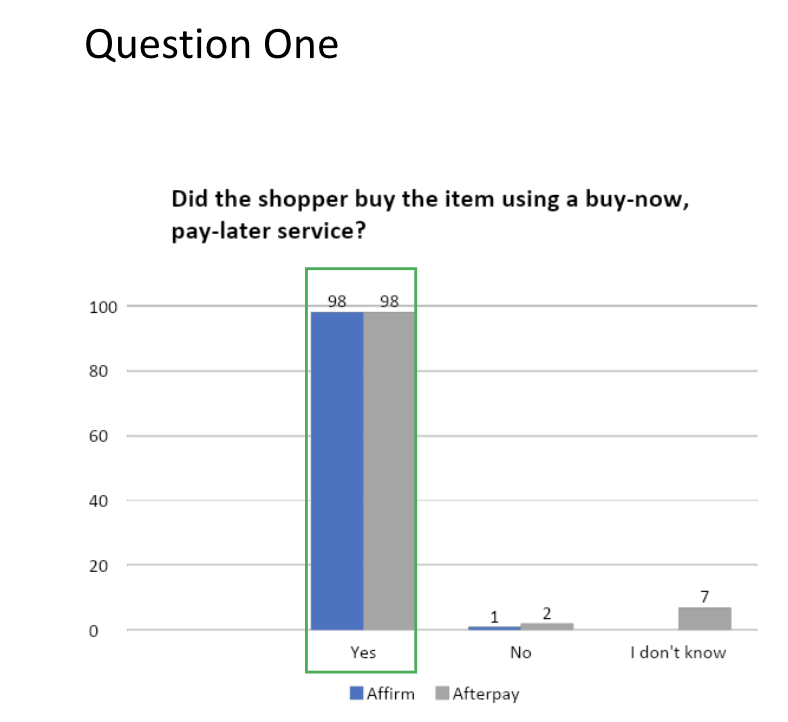

After answering the two preliminary questions, respondents were randomly split into two groups and guided through either the Affirm or the Afterpay payment flow prototype. After viewing the payment flows, both groups were asked to respond to Question One (Figure 19), which was intended to assess whether the respondents paid at least some attention to the payment prototype. At this point in the survey, 99 respondents remained in the Affirm subset, of whom 98—about 99%—correctly responded that the prototype displayed a BNPL service. Of the 107 Afterpay respondents, 92% responded correctly, and 7% were unsure if the prototype depicted a BNPL service. No respondents in the Affirm group were unsure.

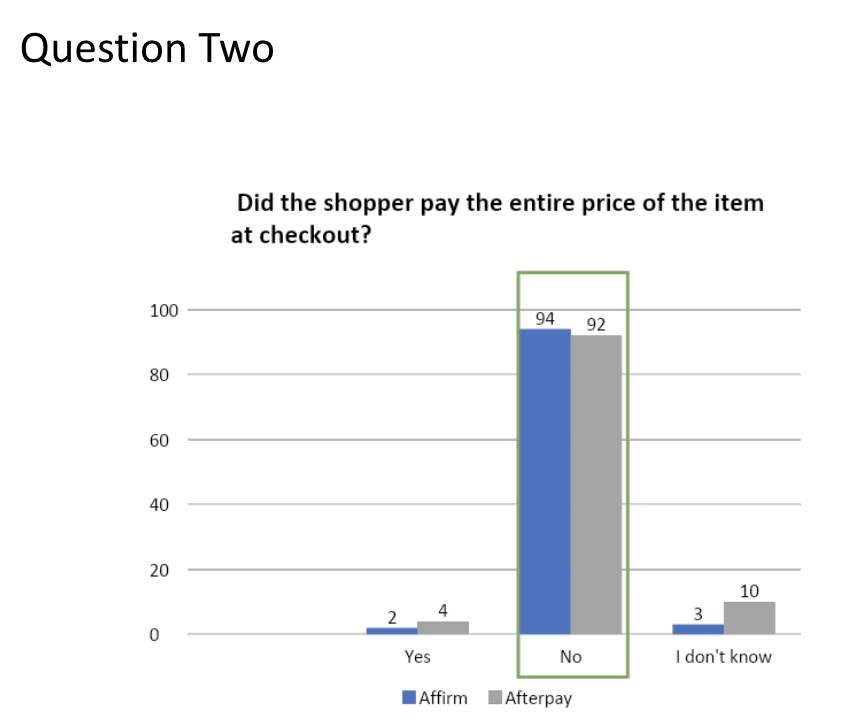

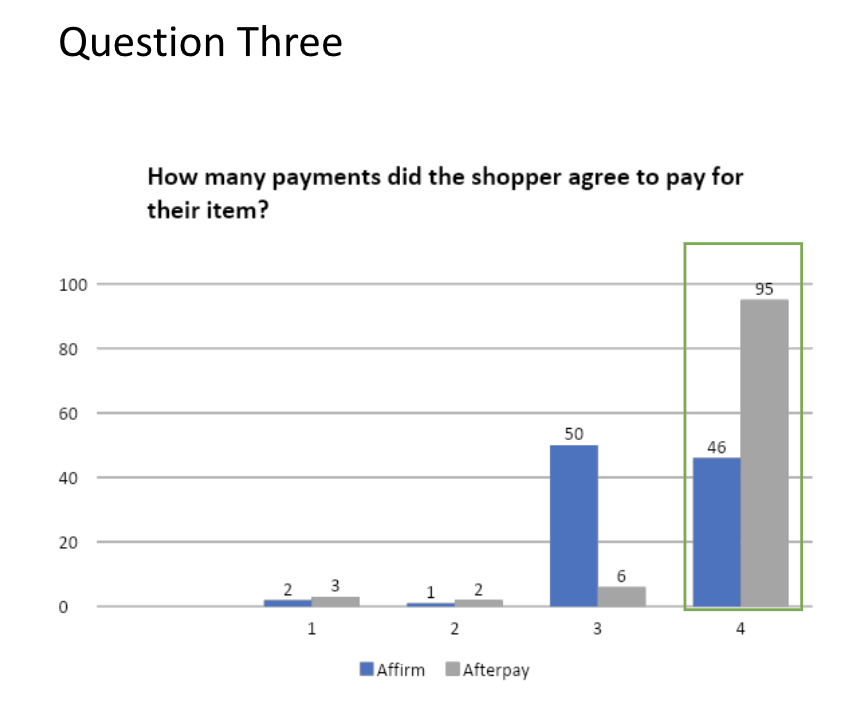

In the following figures, correct answers are outlined in green, and the labels on the bars refer to numbers of responses. In two cases, the correct answers differed depending on which BNPL service was shown.

Figure 19. Testing initial engagement.

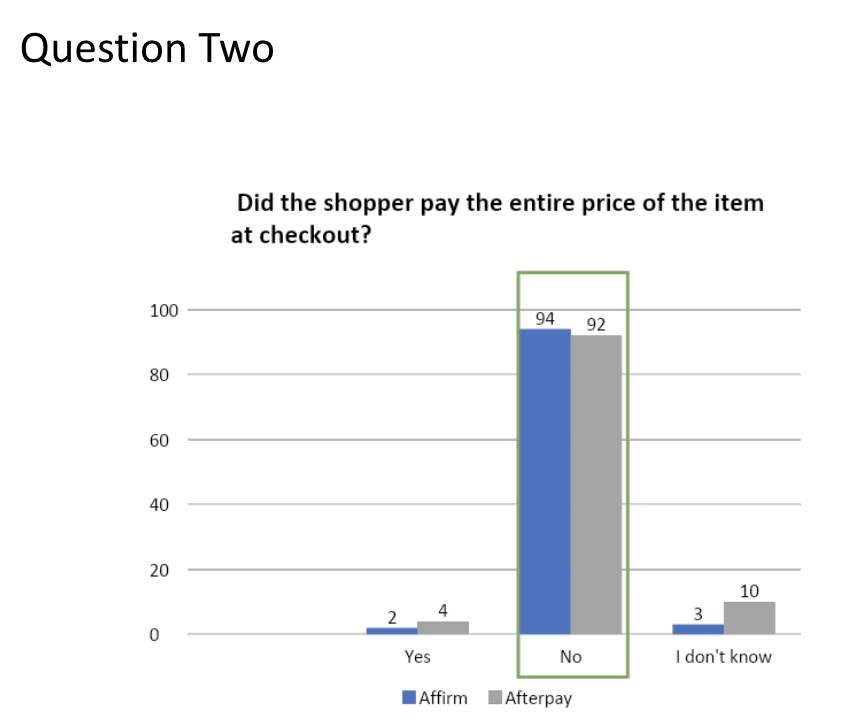

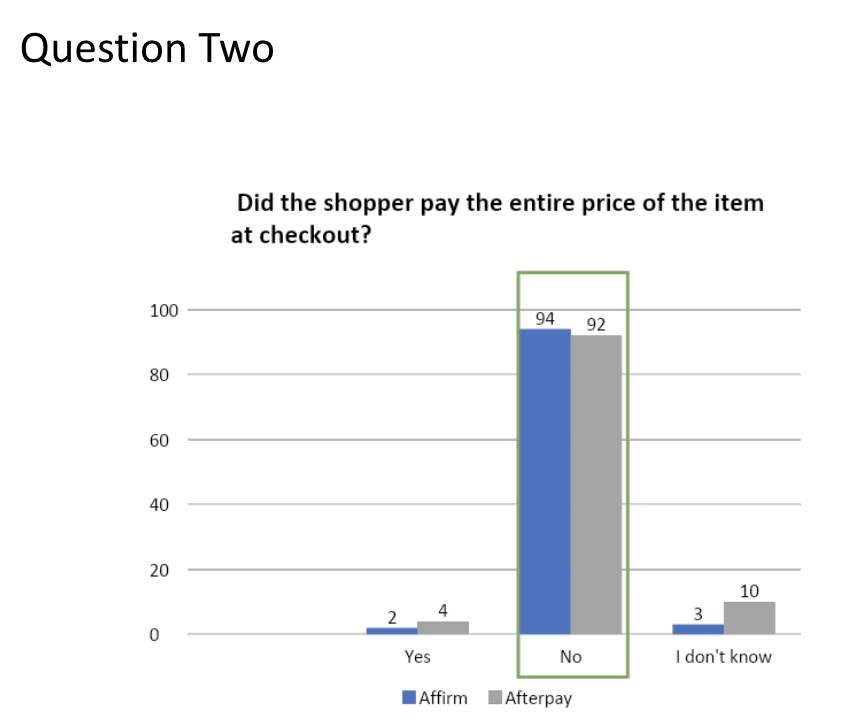

Question Two assessed respondents’ understanding of the shopper’s payment amount. Of Affirm respondents, 95% correctly answered that the shopper did not pay the item’s full price at checkout. A lower percentage of Afterpay respondents, 87%, answered correctly. Ten Afterpay respondents—9%—were unsure, and 4% answered incorrectly, versus 3% unsure and 2% incorrect for Affirm.

Figure 20. Responses about payment amount.

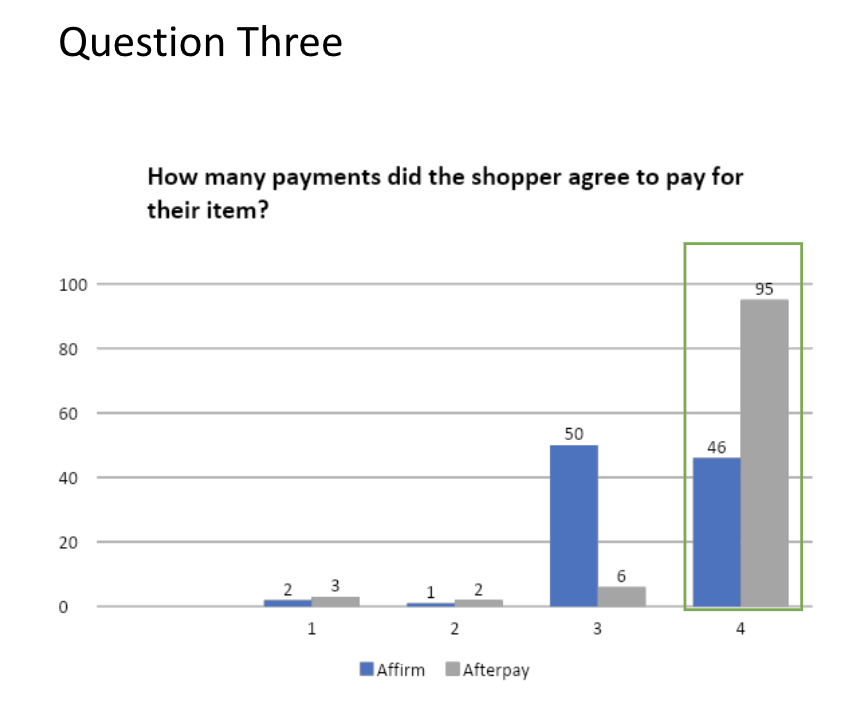

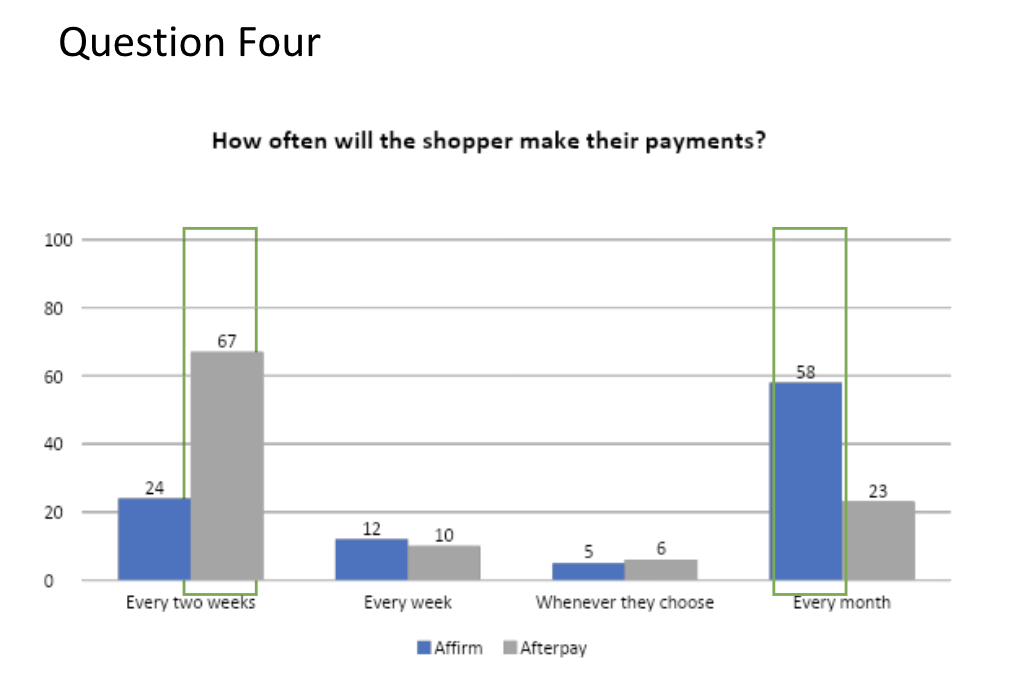

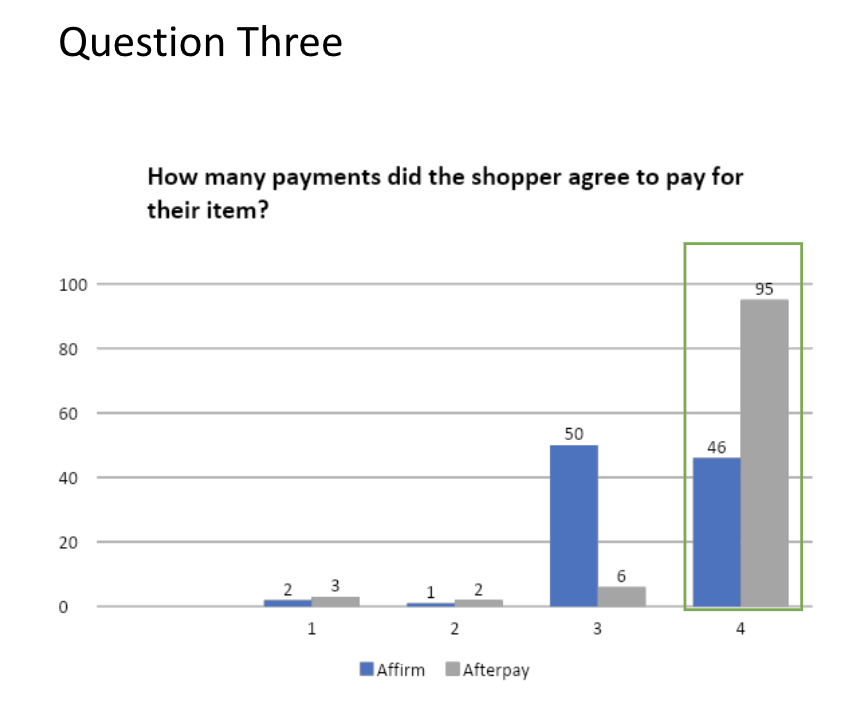

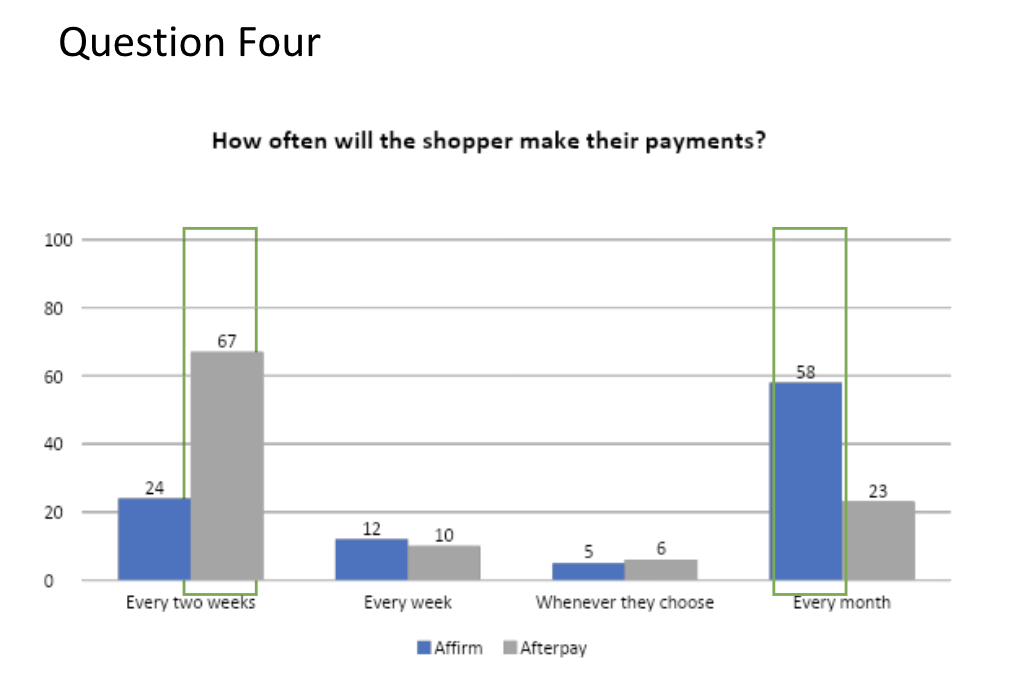

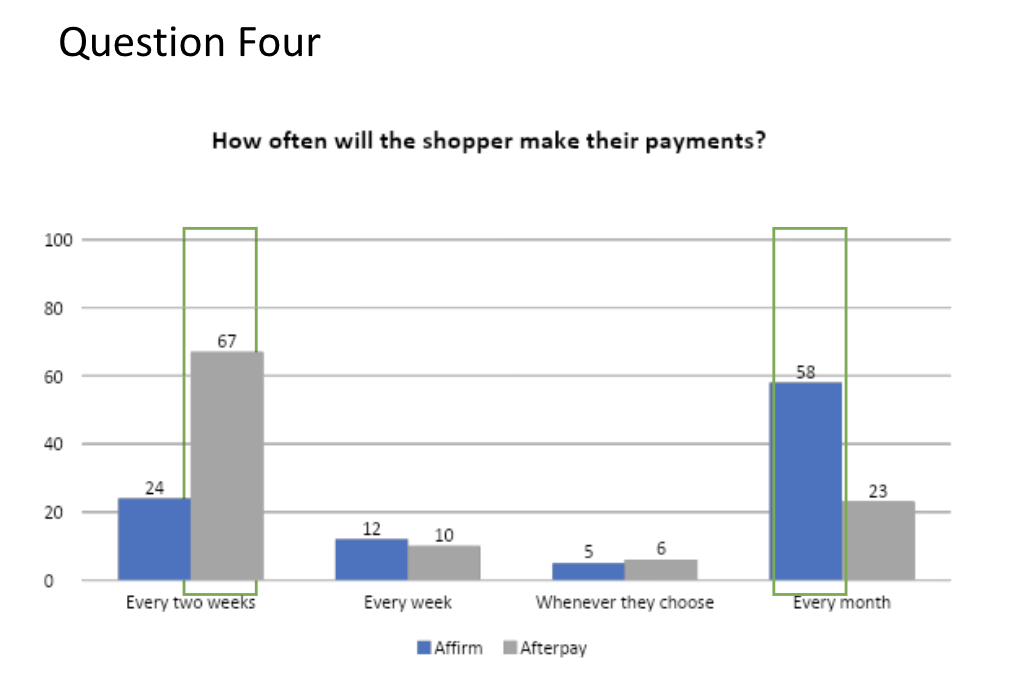

Respondents in the two groups also exhibited different levels of comprehension of the number (Figure 21) of payment installments. Only 46% of Affirm respondents correctly identified the number of payments to which the shopper agreed, while 90% of Afterpay respondents answered correctly. Fifty Affirm respondents incorrectly answered that the shopper agreed to three payments, whereas 46 Affirm respondents correctly answered that the shopper agreed to four payments. This discrepancy can likely be attributed to a lack of clarity in the way Affirm describes its payment plan structure. In the Affirm purchasing flow, users are informed that by accepting the terms of their installment agreement they are committing to pay three future installments, in addition to the 25% payment they are required to make at checkout. Afterpay’s flow states that their customers are committing to making four payments to purchase the item, including the initial payment. Our results indicate that Afterpay’s presentation of the number of installments required for a loan, which includes a graphic with an icon for each of the four payments, is more effective than Affirm’s.Afterpay respondents also fared slightly better than Affirm respondents in their understanding of the frequency of payments (Figure 22). Of Affirm respondents, 59% answered correctly (monthly payments), versus 63% of Afterpay respondents answering correctly (biweekly payments).

Figure 21. Responses about number of paymentinstallments.

Figure 22. Responses about payment frequency.

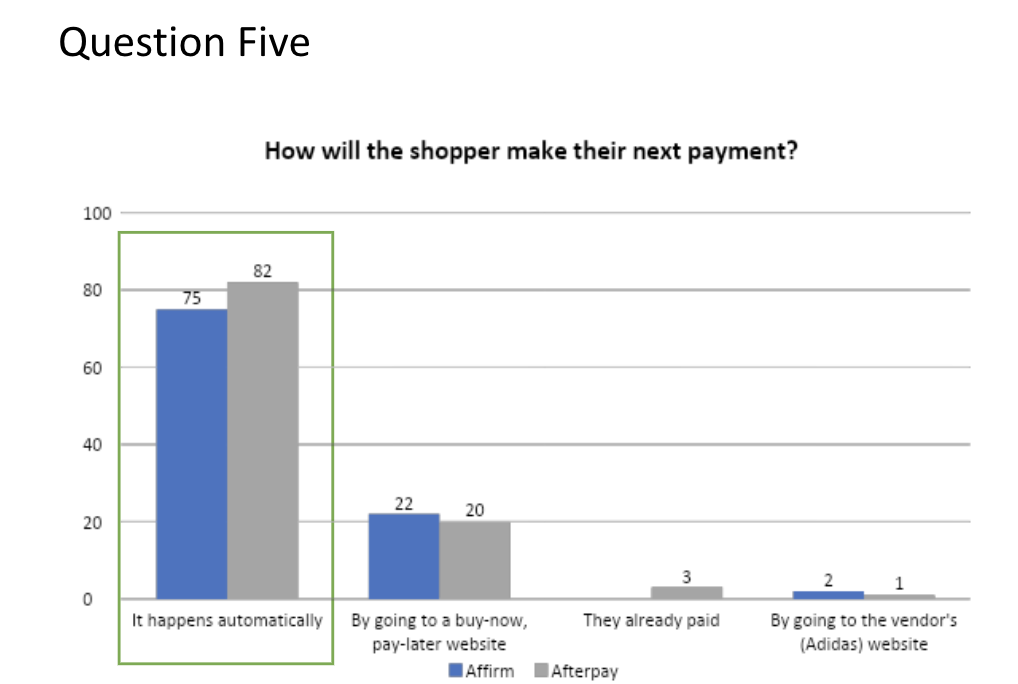

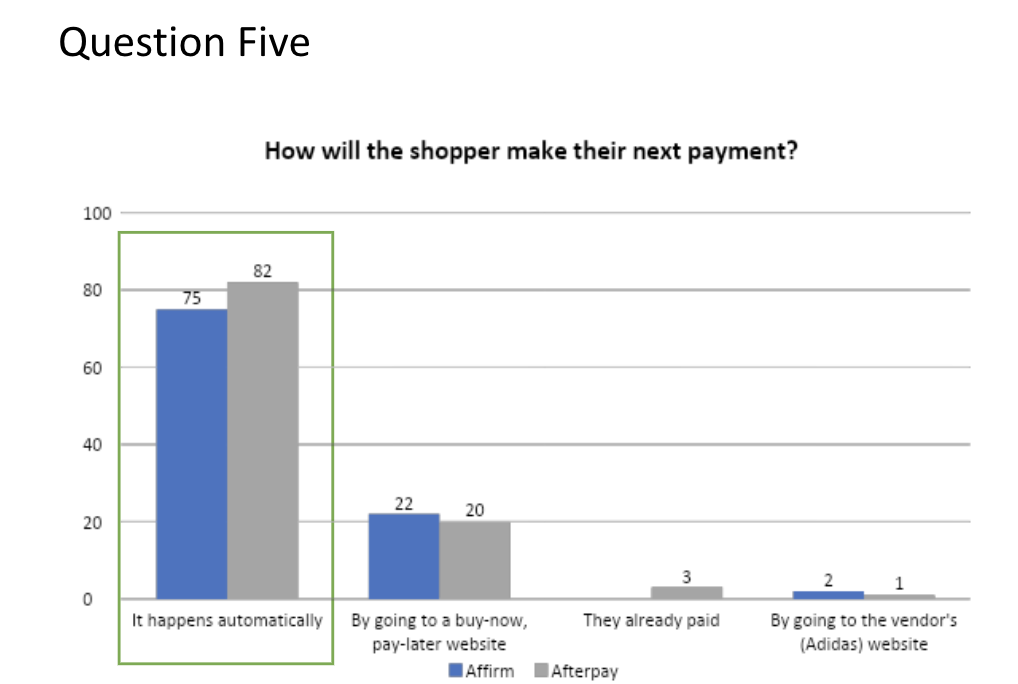

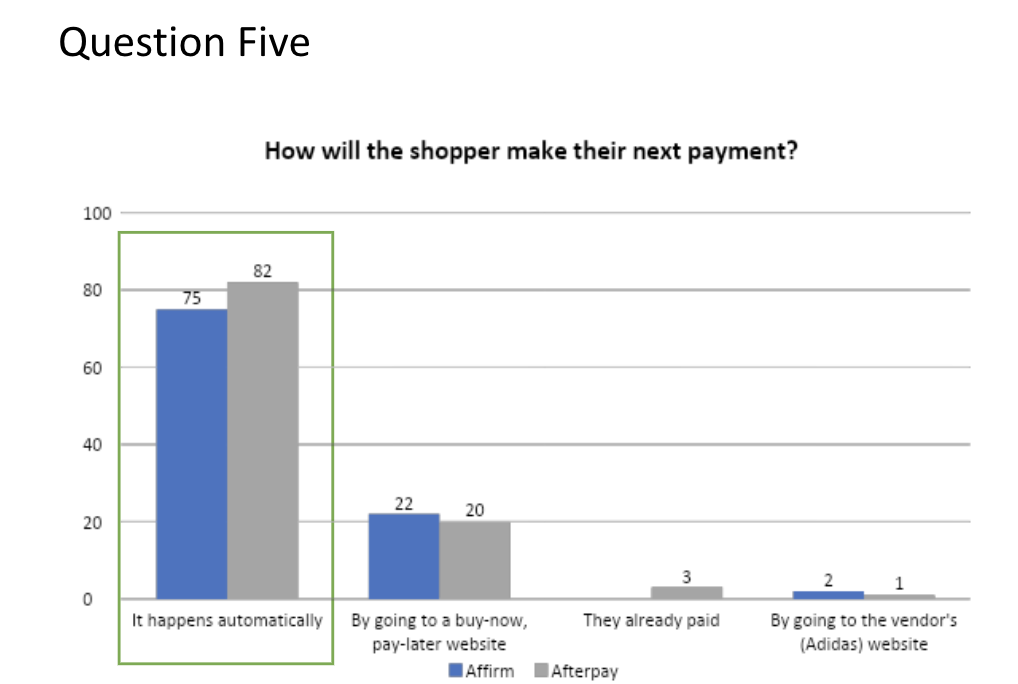

The screens in our experiment indicated that payment would take place via automatic payments using the shopper’s payment card. Of Affirm respondents, 24% answered incorrectly regarding how payments would be made (Figure 23). Another 22% incorrectly answered that the shopper would navigate to the BNPL service’s website to pay, and 2% incorrectly answered that the shopper would pay via the vendor’s (Adidas’) website.Afterpay respondents performed similarly, with 23% of respondents answering incorrectly; 19% answered that the shopper would pay via the vendor’s website, and 1% (1 respondent) answered that the shopper would pay via the vendor’s website. Three (3%) Afterpay respondents answered that the shopper already paid. No respondents interacting with the Affirm prototype selected this answer.

Figure 23. Responses about payment method.

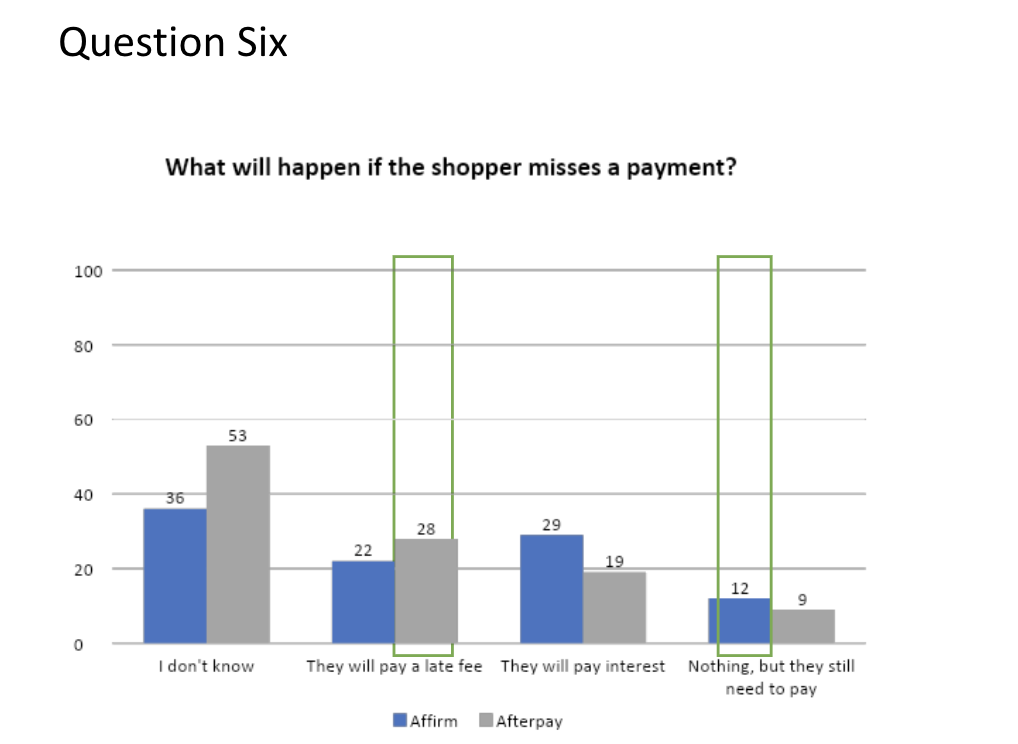

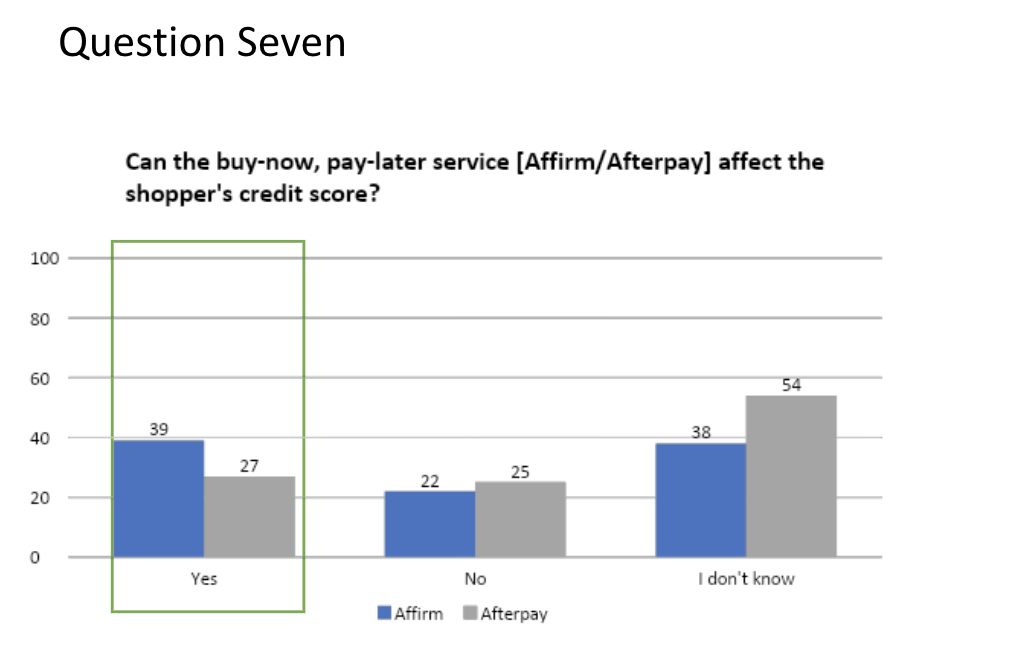

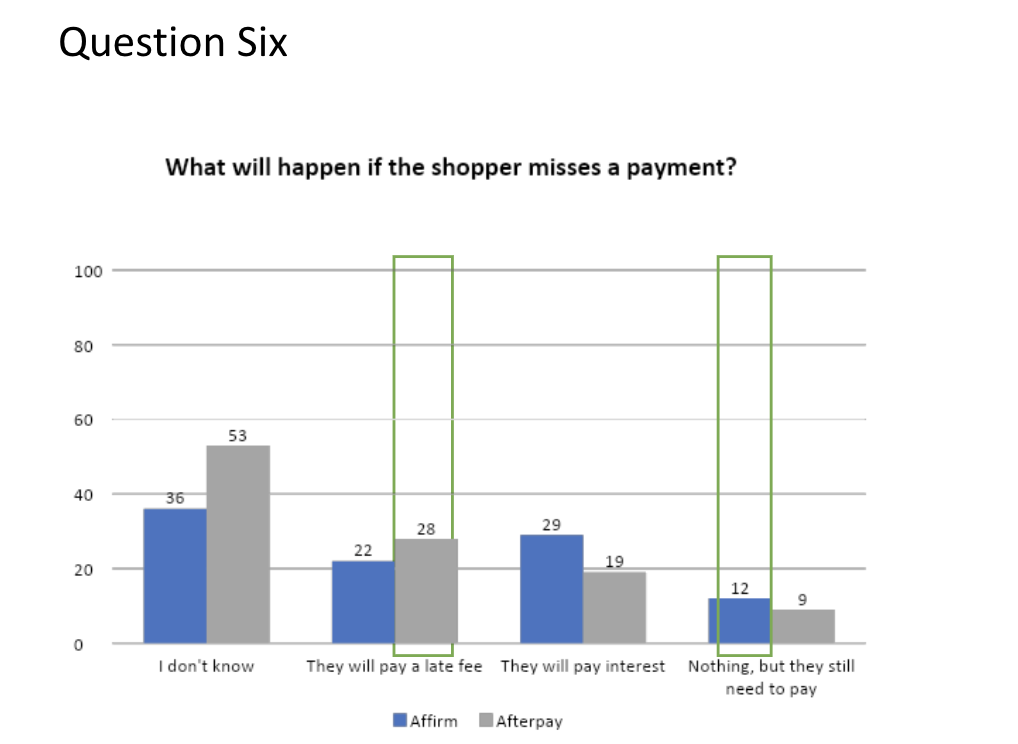

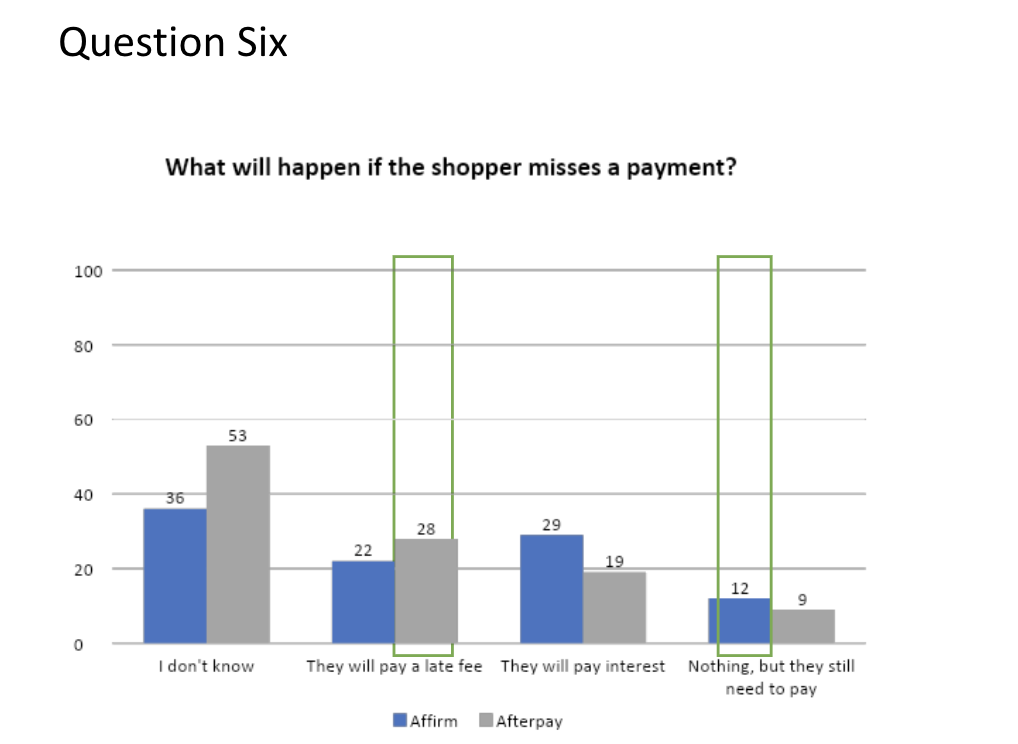

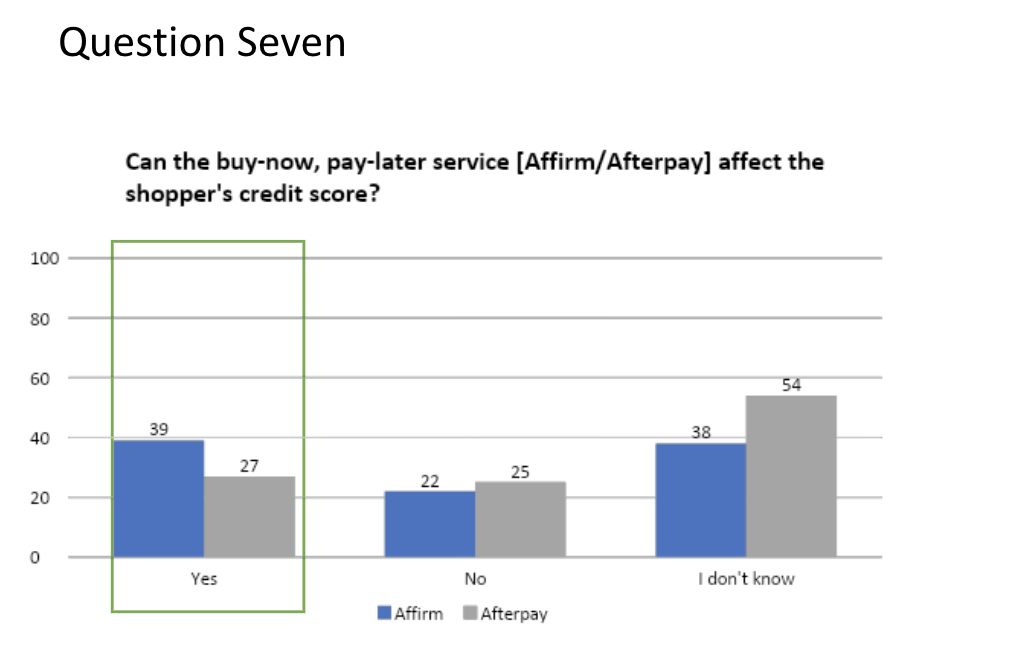

Comprehension of Financial Repercussions

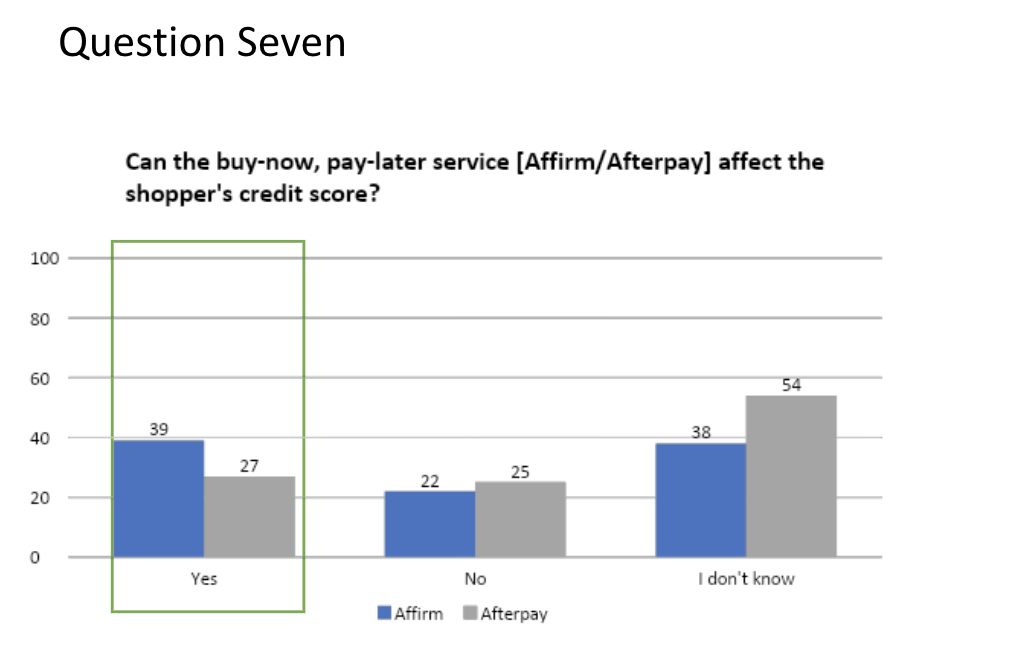

Many respondents testing the BNPL services exhibited a lack of understanding of the financial repercussions of missing payments. Of Affirm respondents, 88% were unsure or incorrect about the repercussions of missing payments (Figure 24). Similarly, 76% of Afterpay respondents were unsure or incorrect. (In the BNPL flow, Affirm respondents had seen a notice advertising that Affirm imposes “no fees” but that late payments “may affect your credit score”; Afterpay respondents had been advised that a late fee might apply.) Furthermore, only 39% and 25% of Affirm and Afterpay respondents, respectively, were aware that BNPL usage can affect the shoppers’ credit scores (Figure 25). 38% of Affirm respondents were unsure, while 51% of Afterpay respondents were unsure.

Figure 24. Responses about consequences of a missed payment.

Figure 25. Responses about credit impact of using a BNPL service.

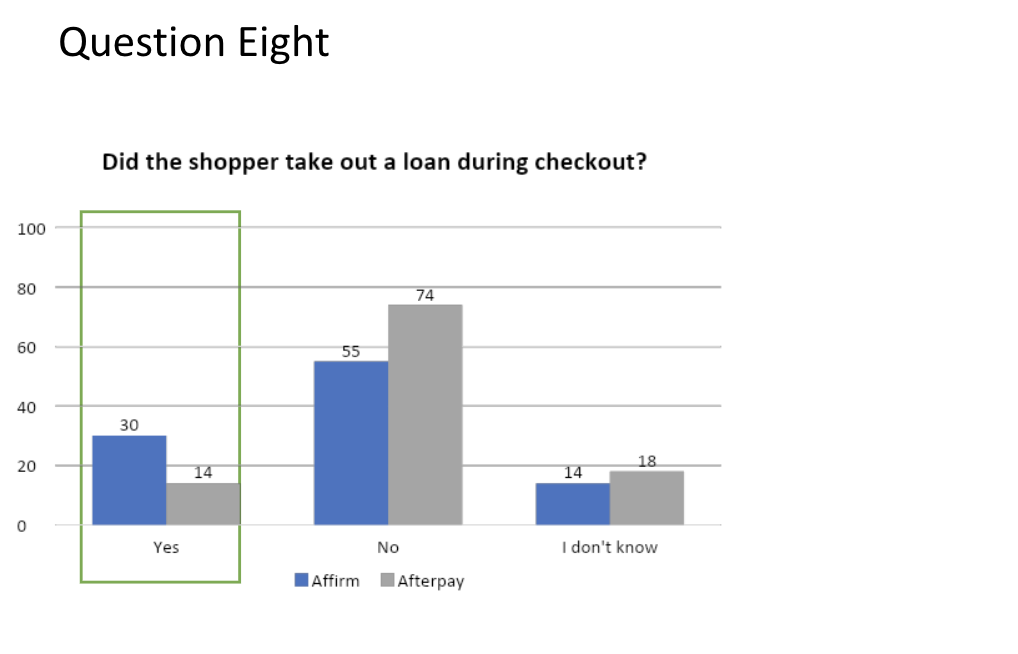

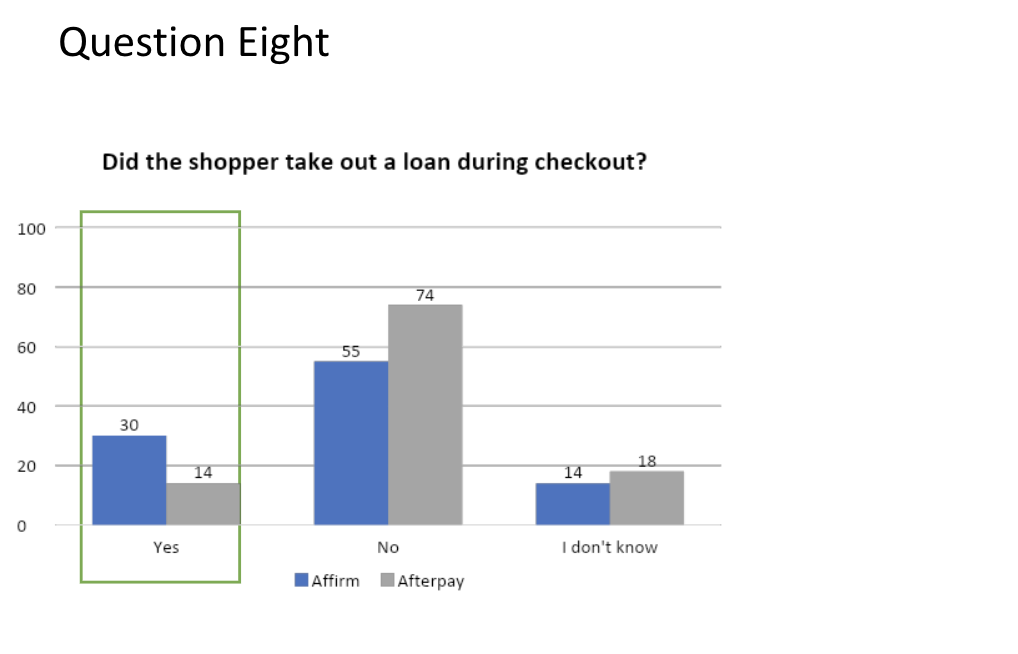

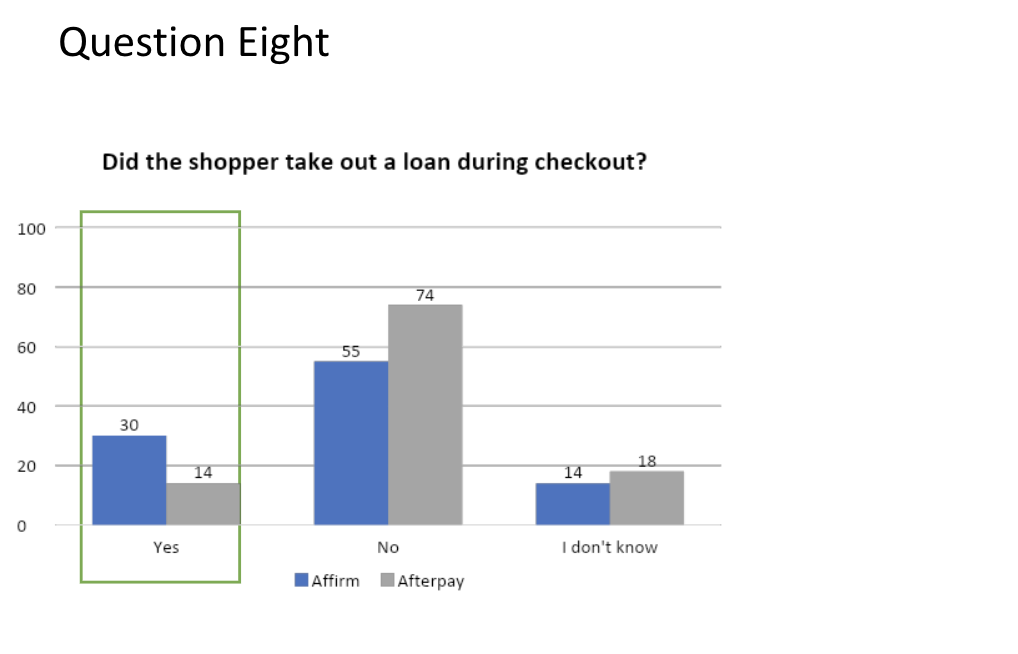

Regarding whether BNPL usage constitutes taking out a loan, 30% of Affirm respondents correctly answered yes. Only 13% of Afterpay respondents answered correctly (Figure 26). Another 14% of Affirm respondents and 17% of Afterpay respondents were unsure. We believe the differences may result from the fact that a screen in Affirm’s payment flow states that the borrower will pay interest, which may have indicated to respondents that Affirm is a loan product. However, neither purchasing flow explicitly informs customers that they will be taking out a loan.

Figure 26. Responses about whether BNPL arrangements are loans.

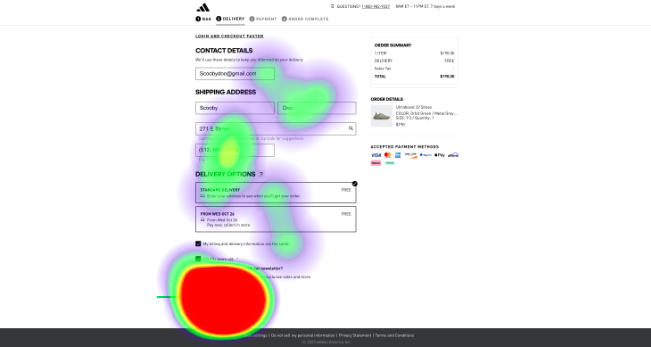

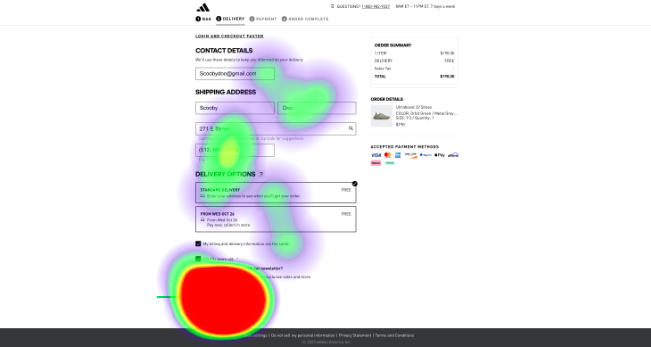

The prototype service also enabled us to monitor the location and frequency of respondents’ clicks on the screen. On the “Contact Details” page during the Adidas checkout process, Afterpay respondents’ click patterns congregated on the shipping address, delivery options, and “Review and Pay” components (Figure 27). One Affirm respondent and zero Afterpay respondents clicked and viewed the optional disclosures hyperlink (Appendix B).

Figure 27. Example heatmap showing user click patterns focused on the “Review and Pay” button (red area).

Discussion

Statistical Analysis

Our experiment challenges the null hypothesis that consumers are informed of the terms of the loans to which they agree when using a BNPL service. These findings support the claim that, in 2022, BNPL companies insufficiently communicated certain risks associated with using their products to their consumers. When surveyed on questions regarding the potential impact of BNPL on financial health that corresponded to disclosures mandated by other lending products regulated under the TILA and CARD acts, respondents demonstrated a significant lack of understanding. These questions included:

Did the shopper take out a loan?

% accurate response for Affirm respondents: 30%

% accurate response for Afterpay respondents: 13%

How many payments did the shopper agree to?

% accurate response for Affirm respondents: 46%

% accurate response for Afterpay respondents: 90%

How often will the shopper make their payments?

% accurate response for Affirm respondents: 59%

% accurate response for Afterpay respondents: 63%

How will the shopper pay for their next payment (ex: automatically, via website, etc.)?

% accurate response for Affirm respondents: 76%

% accurate response for Afterpay respondents: 77%

Could missing a payment hurt the person’s credit score?

% accurate response for Affirm respondents: 39%

% accurate response for Afterpay respondents: 25%

The statistical significance of our findings is demonstrated in Figure 28. An asterisk symbolizes statistical significance at p < 0.05.

| Question | z-value | p-value |

|---|

| 1. Did the shopper buy the item using a buy-now, pay-later service? | 2.4695 | 0.01352 * |

|---|

| 2. Did the shopper pay the entire price of the item at checkout? | 2.0126 | 0.04444 * |

|---|

| 3. How many payments did the shopper agree to pay for their item? | -6.6636 | < 0.00001 * |

|---|

| 4. How often will the shopper make their payments? | -0.6779 | 0.4965 |

|---|

| 5. How will the shopper make their next payment? | -0.2705 | 0.78716 |

|---|

| 6. What will happen if the shopper misses a payment? | -2.4795 | 0.01314 * |

|---|

| 7. Can using the buy-now, pay-later service Affirm affect the shopper's credit score? | 2.132 | 0.03318 * |

|---|

| 8. Did the shopper take out a loan during checkout? | 2.9791 | 0.00288 * |

|---|

Figure 28. Table of statistical significance parameters.

We employed a two-tailed z-test to evaluate the statistical significance of our results. We found the responses to six of the eight survey questions statistically significant; that is, we feel confident in rejecting the null hypothesis for those questions and concluding that the distributions of responses are not purely attributable to chance.

Based on these tests, we feel most confident in the findings in questions 3 and 8, which exemplify the lowest p-values. For example, Question 3’s p-value of less than 0.00001 may be interpreted to mean that there is a less than a 0.001% chance that our findings are purely due to chance. Conversely, answers to questions 4 and 5 were statistically insignificant with p-values of 0.4965 and 0.7872, respectively. Future analyses could reassess the topics evaluated in these questions (payment frequency and timing) in greater detail.

Limitations

Several limitations might constrain interpretations of these findings, namely sample size, potential bias in survey design and respondent demographics, and the characteristics of usability tests.First, a sample size of only 205 might not be large enough to extrapolate conclusions from these results. Further caution is needed with between-group comparisons because each of the groups consisted of roughly 100 participants. While these sample sizes proved sufficient in determining several statistically significant outcomes, future studies might incorporate larger sample sizes to increase statistical power and make between-group comparisons.

Second, we are mindful of potential bias among the 205 survey respondents. On Maze, while survey respondents are unable to view the topic of a survey before they participate, it is possible that respondents facing economic distress might be more likely to participate in online surveys to supplement their income. This effect would influence the demographic makeup of this study’s participants. Past experiences with BNPL may have also influenced respondents’ answers. Our survey found that 80% of respondents considered themselves familiar with BNPL services, and 30% acknowledged using BNPL services before. It is possible that some respondents may have relied on their past BNPL experiences, including experiences with different BNPL services, to answer these survey questions. This bias would result in an overrepresentation of respondents’ understanding of BNPL terms because they may have personally experienced the checkout process, payment mechanisms, and in some cases, financial repercussions. If respondents assumed their past experiences with BNPL are representative of all BNPL services, they might have neglected to read all terms in the prototype flow or conflated their past experiences with the screens they were presented. To control for these effects, an ideal study would exclusively include respondents who have never completed a BNPL transaction. Moreover, respondents were required to access the survey via the Internet, which might introduce sampling bias favoring individuals who are younger and technologically literate.

Similarly, the nature of usability tests innately constrains our findings. It is impossible to replicate the high stakes of real-life financial decisions in an online survey. The prototype model is useful to increase respondents’ engagement because of its clickable and interactive components, but we could not present a perfect replica of the purchasing process. For example, our prototypes included guide arrows, offered intermittent verbal instructions, and auto-filled typed inputs like address and credit card information. Future analyses could reduce these compliance guardrails to better mimic the natural purchasing process.

Future Research

As noted above, increasing the respondent sample size would increase statistical power and reduce the effects of potential demographic biases. Our study consisted of two tests: 1) a survey of Afterpay and 2) a survey of Affirm BNPL payment flows. Each of these tests could constitute a freestanding, independent study, but we find the dual nature offers useful comparative insights. Future researchers could conduct similar tests for single BNPL providers like Klarna [24] or for multiple providers in comparative analyses. Additionally, researchers could investigate the marketing practices of BNPL providers: do they overtly market their services to subprime, young, or financially inexperienced borrowers? Moreover, researchers could explore which BNPL vendors are associated with particular types of shopping opportunities, like luxury goods versus consumer household goods. Do these BNPL vendors exhibit different transparency practices or impose different penalties for missed payments?

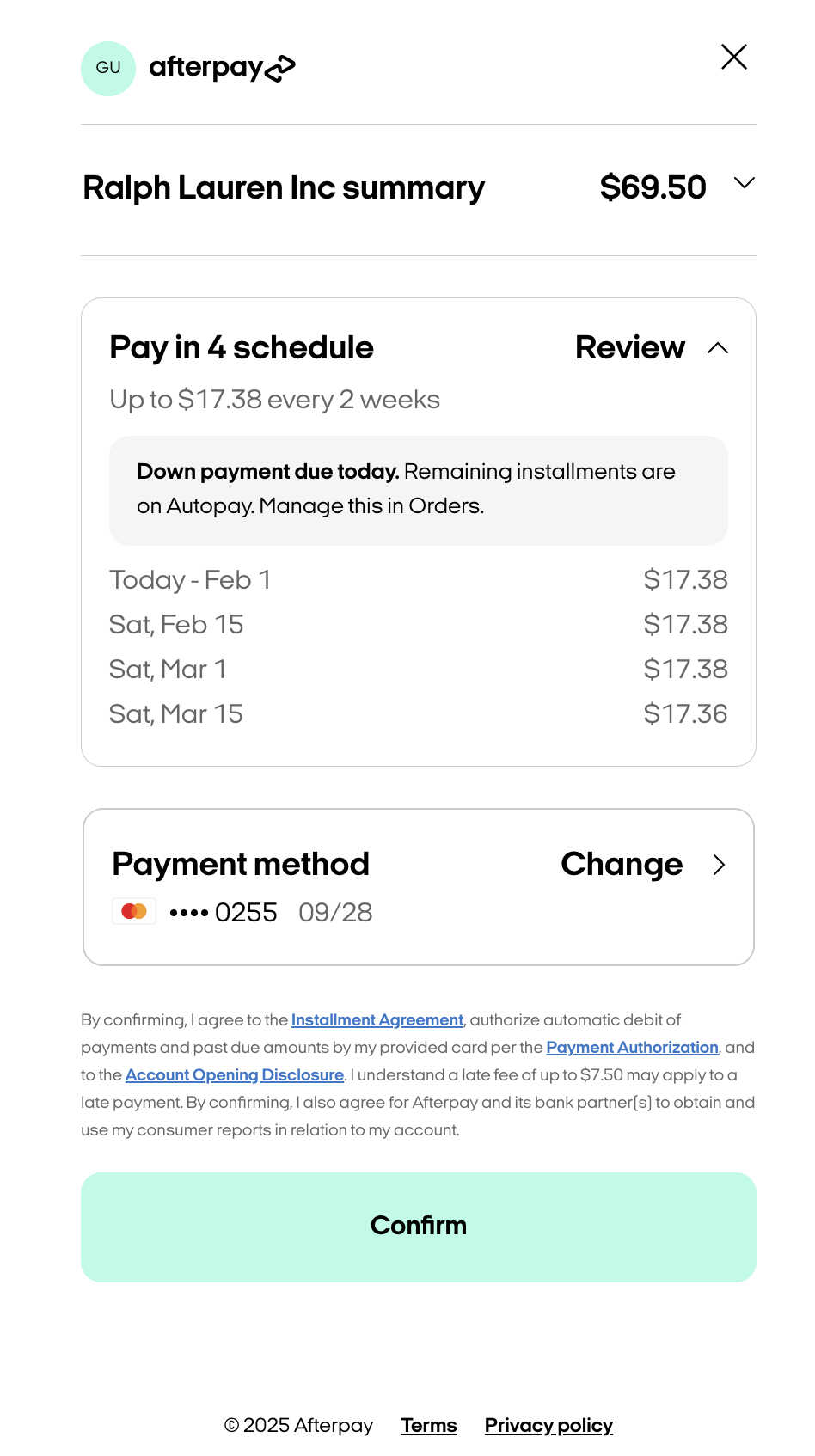

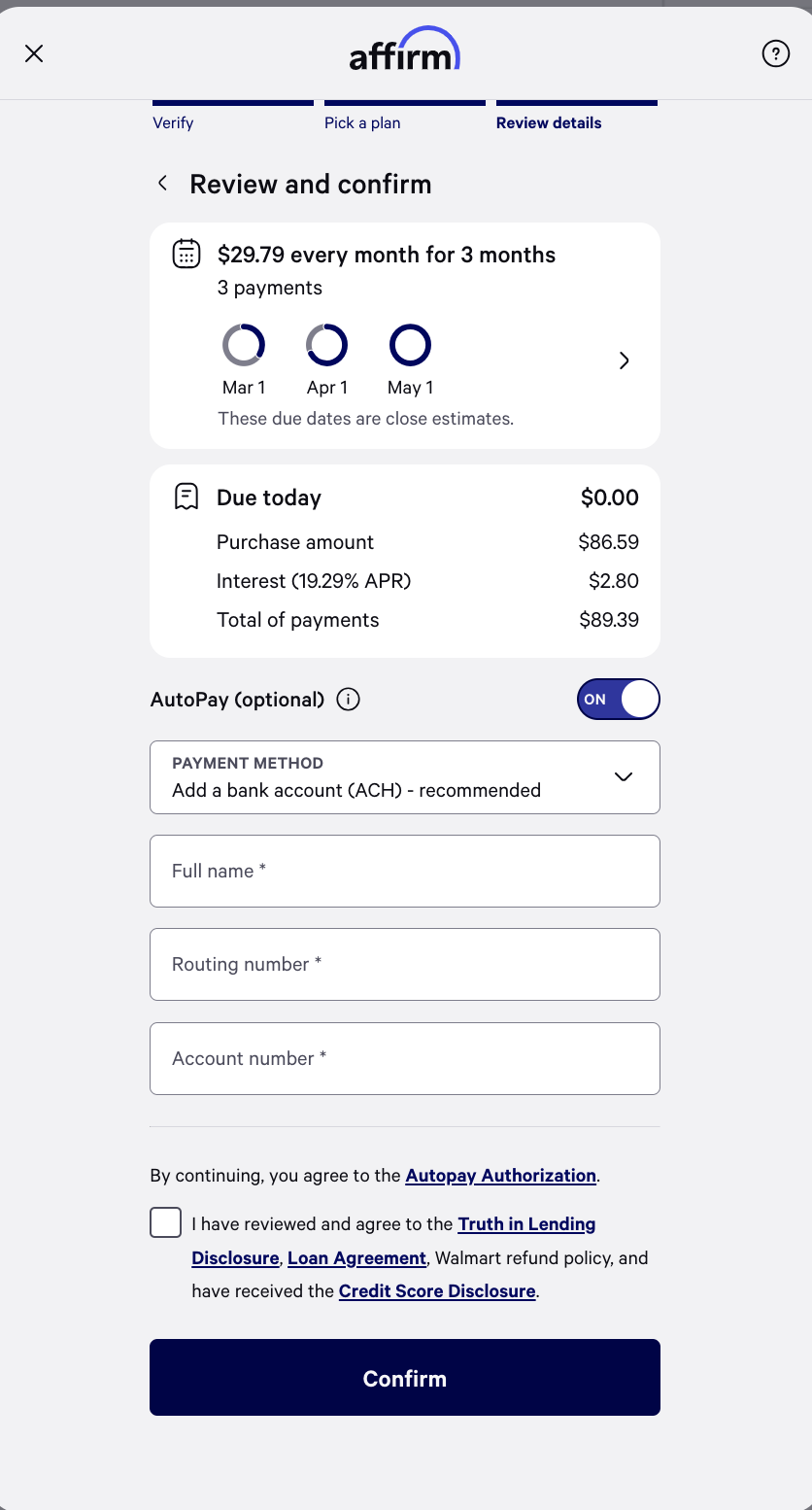

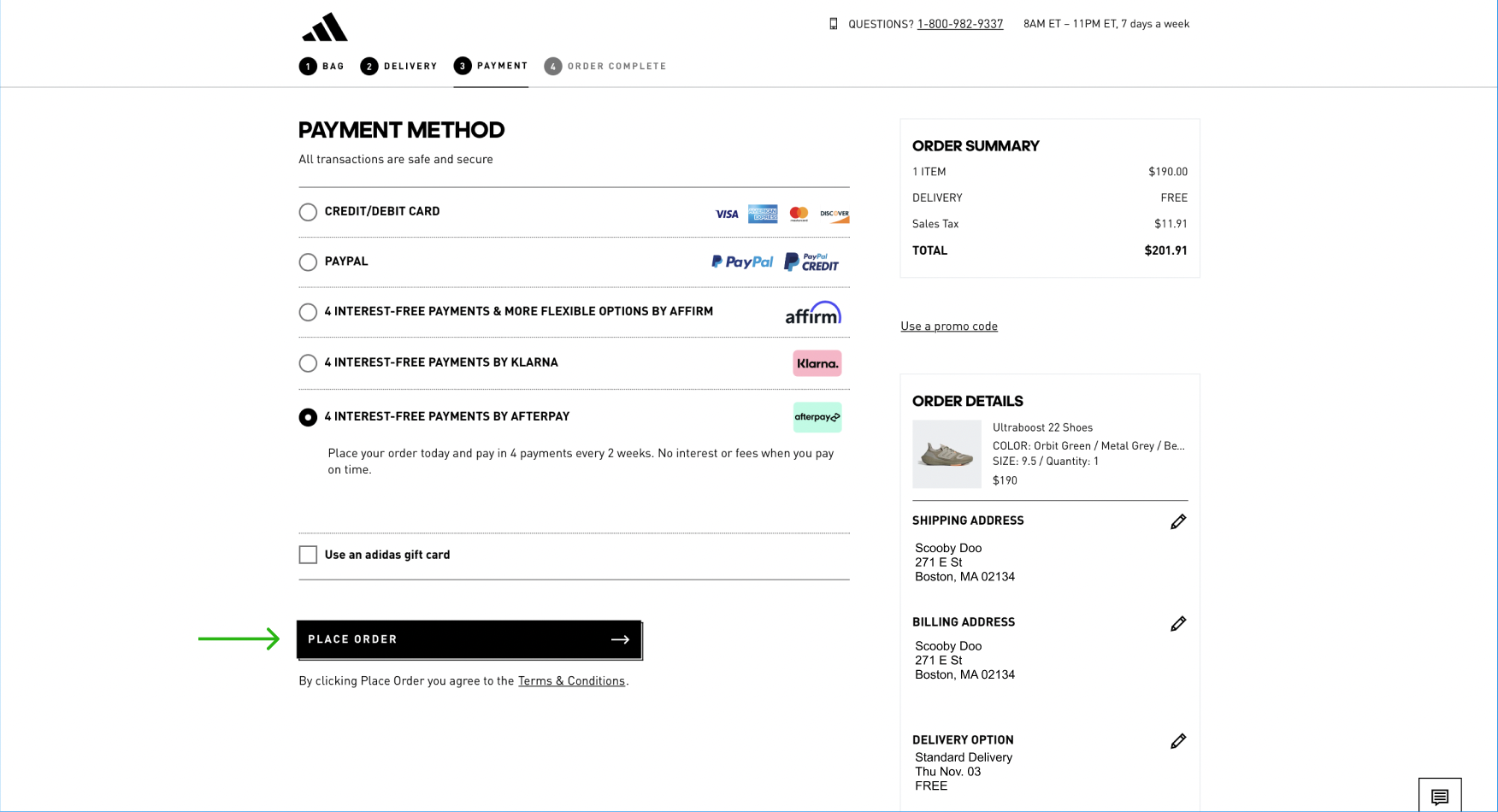

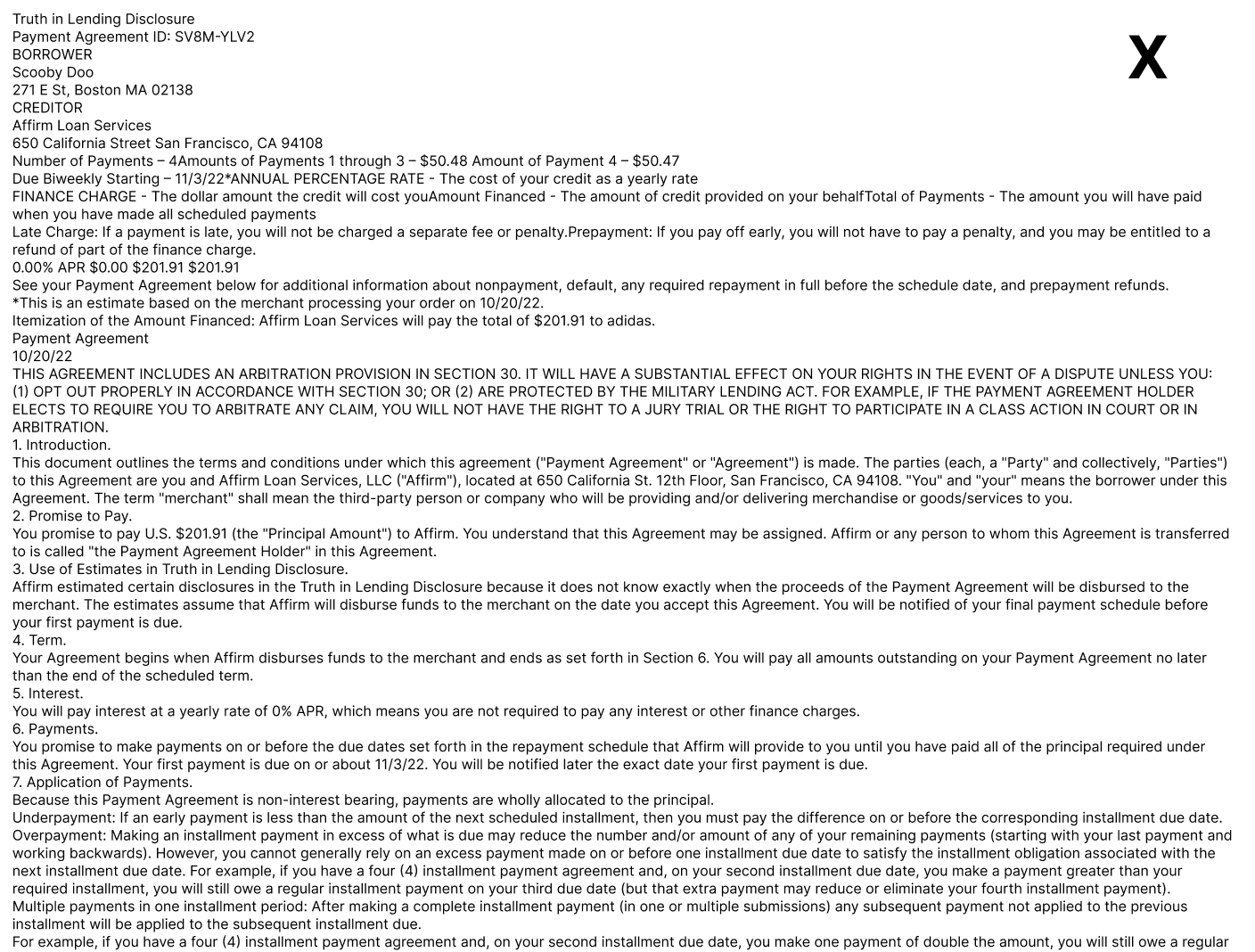

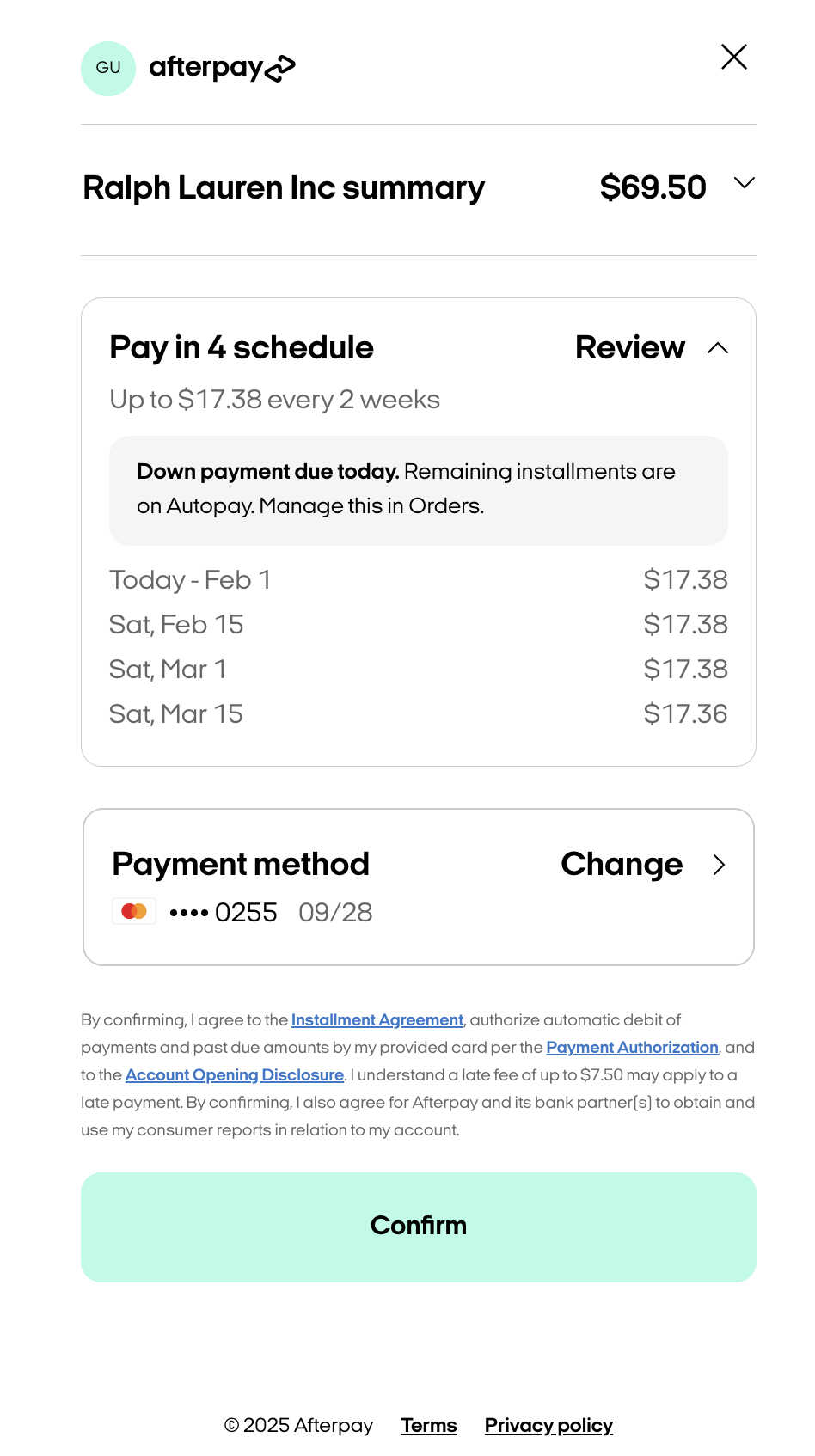

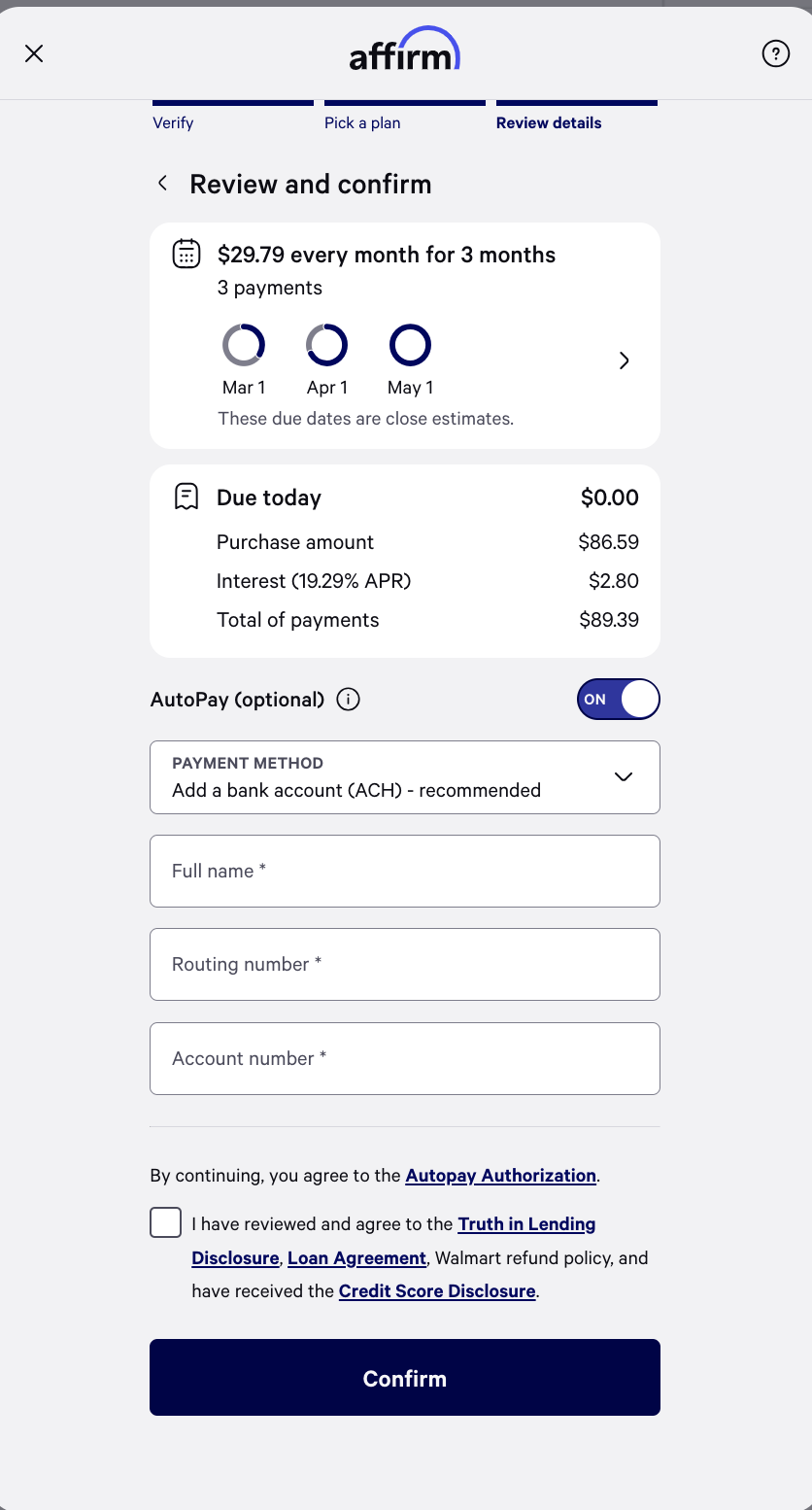

Since this study was first conducted in 2022, TILA was amended to apply to BNPL providers [18]. An effect of this regulatory shift is visible in Figure 29, which shows the 2025 (left) and 2022 (right) Afterpay payment flows and Figure 30, which displays the 2025 (left) and 2022 (right) Affirm payment flows. While few substantive changes were made to the Affirm flow, the Afterpay flow now informs consumers 1) that their payment method will be automatically charged on the specified dates; 2) where they can manage payments or access additional information; and 3) that Afterpay may “obtain and use” their consumer reports, i.e., Afterpay can perform a credit check.

Figure 29. Final screen in 2025 Afterpay payment flow (left) vs.final screen in 2022 Afterpay payment flow (right). Key changes include: 1) consumer is informed their payment method will be automatically charged on the following dates; 2) consumer is informed where they can manage payments and access additional information; 3) consumer is informed that Afterpay may “obtain and use” their consumer reports, i.e., Afterpay can perform a credit check.

Figure 30. Final screen in 2025 Affirm payment flow (left) vs.final screen in Affirm 2022 payment flow (right). No substantive changes have been made. Affirm’s decision to have consumers agree to a “Truth in Lending Disclosure and Loan Agreement” before the CFPB specified that BNPL was included under Regulation Z demonstrates the company’s attempt to follow Truth-in-Lending guidelines in a period of regulatory ambiguity.

While these disclosures may seem trivial, existing research has shown that understanding the terms and conditions (T&Cs) of BNPL products plays a significant role in consumers’ financial well-being [41].Diligence when reading and comparing T&Cs of BNPL plans has been associated with positive financial outcomes. Conversely, a poor understanding of T&Cs has been associated with lower financial wellbeing. These findings underscore the importance of accessibility and transparency in financial disclosures, and future research could investigate the extent to which these now-required TILA disclosures may or may not influence consumers’ perceptions of the possible risks posed by BNPL services.

Important questions remain to be answered before U.S. policymakers can close the book on this growing financial technology. This study constitutes one step forward by illustrating survey respondents’ lack of comprehension of the payment mechanics and associated financial risks of two prominent BNPL companies before BNPL was regulated by the Truth in Lending Act. Recent Truth In Lending Act disclosure requirements might indicate steps towards increased transparency, but the effectiveness of these measures in promoting financial well-being remain unclear.

References

- [Z. Brewer, “Risk Representation on Buy-now, Pay-later Platforms.” Tech Science Project Plan, Dec. 2021, unpublished.]

- [J. Caporal, “2024 Buy Now, Pay Later Trends Study.” Motley Fool Money, updated Oct. 18, 2024. Accessed July 18, 2022 [Online]. Available: https://www.fool.com/money/research/buy-now-pay-later-statistics/ ]

- [E. Howcroft, “Buy Now Pay Later business model faces test as rates rise,” Reuters, June 10, 2022. Accessed: July 20, 2022 [Online]. Available: https://www.reuters.com/technology/buy-now-pay-later-business-model-faces-test-rates-rise-2022-06-10/]

- [R. Moran, “Credit Karma’s State Debt and Credit Report,” Credit Karma, updated Feb. 4, 2025. Accessed: July 20, 2022 [Online]. Available: https://www.creditkarma.com/insights/i/state-of-debt-and-credit-report]

- [P. Wang, “The Hidden Risks of Buy-Now, Pay-Later Plans,” Consumer Reports, Feb. 14, 2021. Accessed: July 20, 2022 [Online]. Available: https://www.consumerreports.org/money/shopping-retail/hidden-risks-of-buy-now-pay-later-plans-a7495893275/ ]

- [R. Shevlin, “Buy Now, Pay Later: The ‘New’ Payments Trend Generating $100 Billion in Sales,” Forbes, Apr. 14, 2022. Accessed: July 20, 2022 [Online]. Available: https://www.forbes.com/sites/ronshevlin/2021/09/07/buy-now-pay-later-the-new-payments-trend-generating-100-billion-in-sales/?sh=3db41cf72ffe]

- [“Affirm | Buy now, pay later with no late fees or surprises,” affirm.com. https://www.affirm.com/ (accessed May 16, 2022).]

- [“Buy Now Pay Later with Afterpay,” afterpay.com. https://www.afterpay.com/en-US (accessed May 16, 2022).]

- [P. Dikshit, D. Goldshtein, U. Kaura, F. Tan, and B. Karwowski, “Buy now, pay later: Five business models to compete,” McKinsey & Company, July 29, 2021. Accessed: July 20, 2022 [Online]. Available: https://www.mckinsey.com/industries/financial-services/our-insights/buy-now-pay-later-five-business-models-to-compete]

- [M. McCluskey, “‘Buy Now, Pay Later’ Apps Are Taking Over Holiday Shopping Season. Here’s What to Know About the Risks,” TIME, Nov. 22, 2021. Accessed July 19, 2022 [Online]. Available: https://time.com/6107963/buy-now-pay-later-holiday-shopping/]

- [C. Williams, “‘Buy Now, Pay Later’ Users Significantly More Likely to Overdraft Than Nonusers,” Morning Consult, Mar. 2, 2022. Accessed July 19, 2022 [Online]. Available: https://pro.morningconsult.com/trend-setters/buy-now-pay-later-bnpl-overdraft-data]

- [R. Cordray, “Prepared Remarks of CFPB Director Richard Cordray at the NAACP Convention,” Consumer Financial Protection Bureau, Jul 19, 2016. Accessed: July 19, 2022 [Online]. Available: https://www.consumerfinance.gov/about-us/newsroom/prepared-remarks-cfpb-director-richard-cordray-naacp-annual-convention/]

- [C. Shupe and J. DeLuca, “Consumer Use of Buy Now, Pay Later and Other Unsecured Debt,” Consumer Financial Protection Bureau, Jan. 2025. Accessed: Jan. 4, 2025. [Online]. Available: https://www.consumerfinance.gov/data-research/research-reports/consumer-use-of-buy-now-pay-later-and-other-unsecured-debt/]

- [M. Di Maggio, J. Katz, and E. Williams, “Buy Now, Pay Later Credit: User Characteristics and Effects on Spending Patterns,” SSRN, Sep. 6, 2022. Accessed Aug. 23, 2022. http://dx.doi.org/10.2139/ssrn.4198320. [Online]. Available: https://papers.ssrn.com/sol3/papers.cfm?abstract_id=4198320]

- [E. deHaan, J. Kim, B. Lourie, and C. Zhu, “Buy Now Pay (Pain?) Later,” Management Science, Mar. 21, 2024. Accessed Aug. 23, 2024. https://doi.org/10.1287/mnsc.2022.03266. [Online]. Available: https://pubsonline.informs.org/doi/10.1287/mnsc.2022.03266]

- [Consumer Financial Protection Bureau, “CFPB Proposes Rule to Close Bank Overdraft Loophole that Costs Americans Billions Each Year in Junk Fees.” consumerfinance.gov, Jan. 17, 2024. https://www.consumerfinance.gov/about-us/newsroom/cfpb-proposes-rule-to-close-bank-overdraft-loophole-that-costs-americans-billions-each-year-in-junk-fees/ (accessed Aug. 23, 2024).]

- [A. Vasan and W. Zhang, “Americans pay $120 billion in credit card interest and fees each year,” Consumer Financial Protection Bureau, Jan. 19, 2022. Accessed: July 19, 2022. [Online]. Available: https://www.consumerfinance.gov/about-us/blog/americans-pay-120-billion-in-credit-card-interest-and-fees-each-year/]

- [R. Chopra, “Truth in Lending (Regulation Z); Use of Digital User Accounts to Access Buy Now, Pay Later Loans,” Federal Register, May 31, 2024. Accessed: July 10, 2024. [Online]. Available: https://www.federalregister.gov/documents/2024/05/31/2024-11800/truth-in-lending-regulation-z-use-of-digital-user-accounts-to-access-buy-now-pay-later-loans]

- [A. Wilson, “These Buy Now, Pay Later Apps Make Budgeting Purchases a Breeze.” popsugar.com, updated Oct. 26, 2024. https://www.popsugar.com/money/best-buy-now-pay-later-apps-48653985 (accessed Nov. 10, 2024).]

- [S. Hupka, “Buy-now-pay-later apps: How they work.” Los Angeles Times, Aug. 11, 2021. https://www.latimes.com/politics/story/2021-08-11/buy-now-pay-later-apps-how-they-work (accessed July 20, 2022).]

- [Affirm Holdings, Inc., “Form 10-K: Annual Report Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934 for the fiscal year ended June 30, 2021,” Affirm, San Francisco, CA, USA, 2021. [Online]. Available: https://investors.affirm.com/static-files/b85853cf-b293-46f8-a6e9-e63c0287e6f1]

- [E. Aldrich, “How Does Buy Now, Pay Later Work?” Motley Fool Money, updated Oct. 17, 2023. Accessed July 20, 2022 [Online]. Available: https://www.fool.com/money/credit-cards/how-does-buy-now-pay-later-work/]

- [A. Burge and T. Bates, “Algorithmic underwriting: What is it and how can it help insurers?” artificial, March 9, 2021. https://artificial.io/company/blog/algorithmic-underwriting-what-is-it-and-how-can-it-help-insurance-syndicates (accessed July 20, 2022).]

- [“Klarna – Compare prices and pay in 4 payments,” klarna.com. https://www.klarna.com/us/ (accessed May 16, 2022).]

- [M. Mossop, “Key moments in the Afterpay story from zero to $39b.” Financial Review, Aug. 2, 2021. https://www.afr.com/companies/financial-services/key-moments-in-the-afterpay-story-from-zero-to-39b-20210802-p58f6n (accessed July 6, 2022).]

- [CBS News, “‘Buy now, pay later’: Critics concerned about new online payment plans.” cbsnews.com, Dec. 11, 2018. https://www.cbsnews.com/news/affirm-afterpay-klarna-point-of-sale-lending-popular-but-could-hurt-credit-score/ (accessed July 20, 2022).]

- [L. Huffman, “Affirm vs. Afterpay: Affirm’s financing options and no late fees make it the best choice.” Investopedia, updated July 19, 2024. https://www.investopedia.com/affirm-vs-afterpay-5187944 (accessed Feb. 7, 2022).]

- [Federal Deposit Insurance Corporation, “Fair Lending Laws and Regulations,” Federal Deposit Insurance Corporation, Arlington, VA, USA 2021. Accessed: July 20, 2022. [Online]. Available: https://www.fdic.gov/resources/supervision-and-examinations/consumer-compliance-examination-manual/documents/4/iv-1-1.pdf]

- [Cornell Law School, “Credit Card Accountability Responsibility and Disclosure Act of 2009,” Cornell Law School, Ithaca, NY, USA, Jul. 2022. Accessed: Dec. 6, 2022. [Online]. Available: https://www.law.cornell.edu/wex/credit_card_accountability_responsibility_and_disclosure_act_of_2009]

- [“Dodd-Frank Act | CFTC,” cftc.gov. https://www.cftc.gov/LawRegulation/DoddFrankAct/index.htm (accessed May 16, 2022).]

- [D. Sloan, “Why Regulation Will Help The Buy Now, Pay Later Giants,” Forbes, Jul. 12, 2022. Accessed: July 20, 2022. Available: https://www.forbes.com/sites/dylansloan/2022/07/12/why-regulation-will-help-the-buy-now-pay-later-giants/]

- [T. Paul, “Everything you need to know about the most popular buy now, pay later apps,” cnbc.com, updated Feb. 1, 2025. https://www.cnbc.com/select/best-buy-now-pay-later-apps/#:~:text=Some%20of%20the%20most%20popular,Pay%20in%204%27%20and%20Sezzle (accessed July 20, 2022).]

- [Afterpay, “Afterpay Turns 10: How Aussie Customer Behaviour Has Changed A Decade After BNPL Offered a Better Way to Pay,” newsroom.afterpay.com, Nov. 7, 2024. https://newsroom.afterpay.com/updates/afterpay-turns-10-how-aussie-customer-behaviour-has-changed-a-decade-after-bnpl-offered-a-better-way-to-pay (accessed Dec. 9, 2024).]

- [Affirm, “Affirm Expands Merchant Network Ahead of Final Holiday Shopping Push,” investors.affirm.com, Dec. 3, 2024. https://investors.affirm.com/news-releases/news-release-details/affirm-expands-merchant-network-ahead-final-holiday-shopping (accessed Dec. 9, 2024).]

- [Affirm, “A simple integration. A better way to pay,” affirm.com. https://www.affirm.com/docs (accessed May 16, 2022).]

- [Afterpay, “API Environments | Afterpay Online Developer,” developers.afterpay.com. https://developers.afterpay.com/docs/api/online-api/api-environments (accessed May 16, 2022).]

- [Content Square, “Usability Testing: what it is, its benefits, and why it matters,” contentsquare.com. https://contentsquare.com/guides/usability-testing/ (accessed Nov. 30, 2021).]

- [Maze, “Maze | User insights at the speed of product development,” maze.co. https://maze.co/ (accessed Dec. 16, 2022).]

- [Figma, “Free Prototyping Tool: Build Interactive Prototype Designs | Figma,” figma.com. https://www.figma.com/prototyping/ (accessed Dec. 17, 2021).]

- [Office of the Comptroller of the Currency, “Truth in Lending,” occ.treas.gov. https://www.occ.treas.gov/topics/consumers-and-communities/consumer-protection/truth-in-lending/index-truth-in-lending.html (accessed May 16, 2022).]

- [R. Powell, A. Do, D. Gengatharen, J. Yong, and R. Gengatharen, “The relationship between responsible financial behaviours and financial wellbeing: The case of buy-now-pay-later,” Accounting & Finance, vol. 63, no. 4, pp. 4431-4451, Dec. 2023. Accessed Dec. 9, 2024. doi: https://doi.org/10.1111/acfi.13100. [Online]. Available: https://onlinelibrary.wiley.com/doi/10.1111/acfi.13100]

Appendix

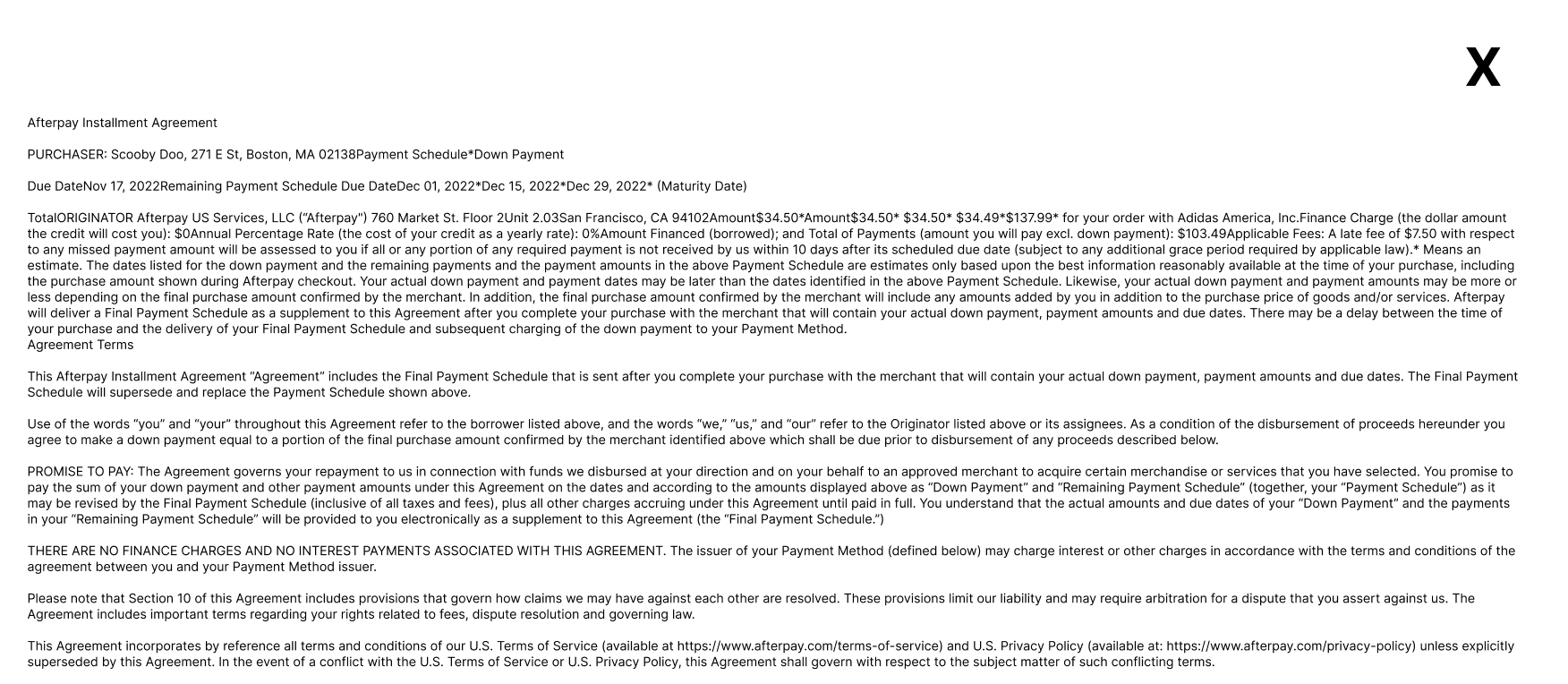

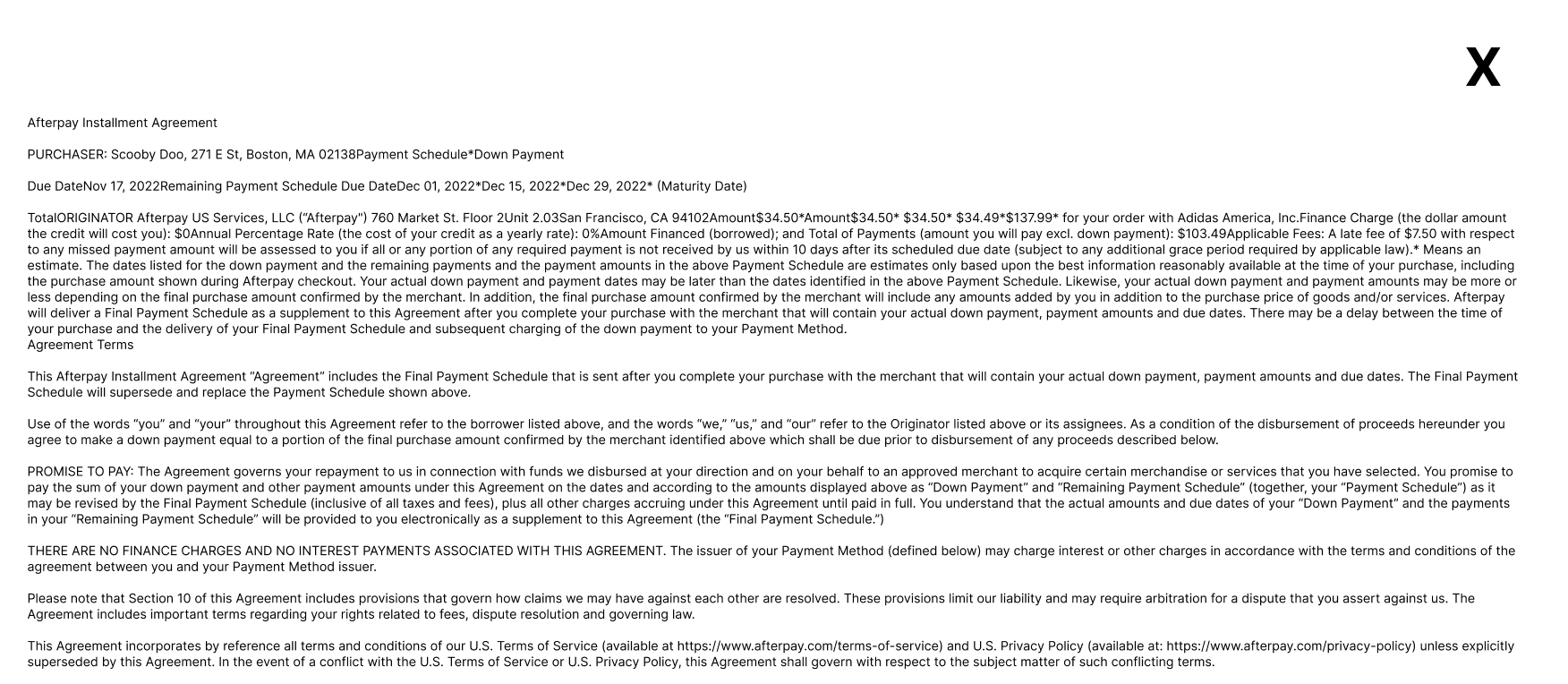

Appendix A: Afterpay Purchasing Flow

The image below is what appears in the prototype if the respondent clicks Terms of Use. The respondent can click “X” to return to the previous image.

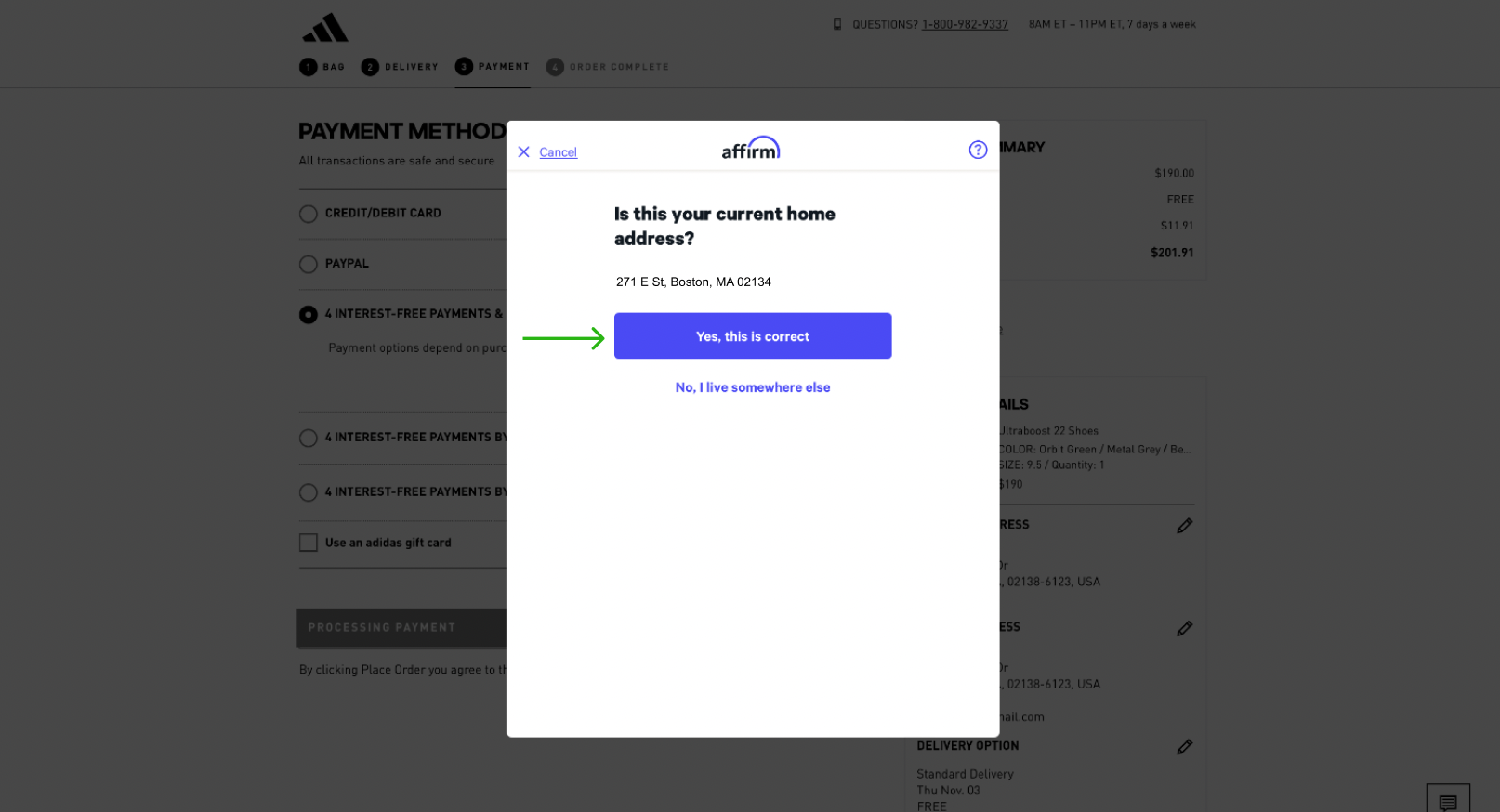

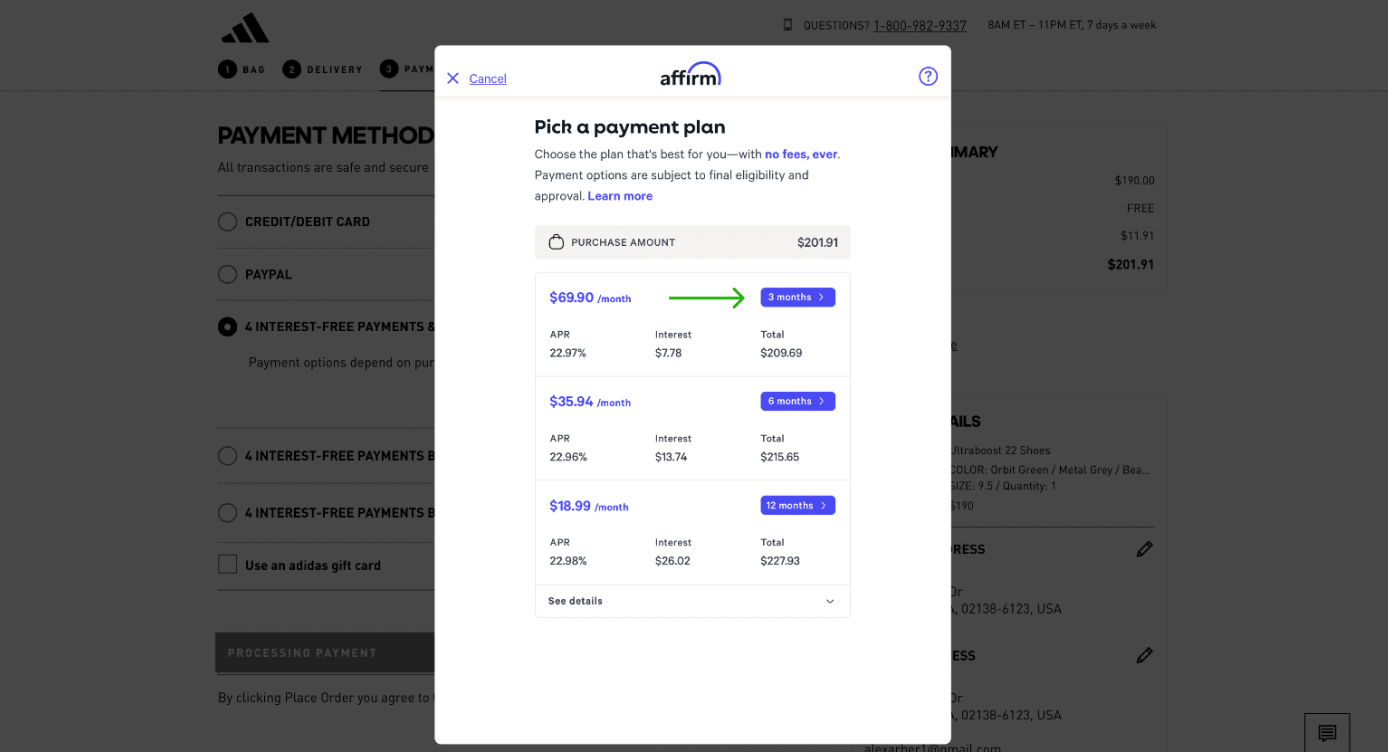

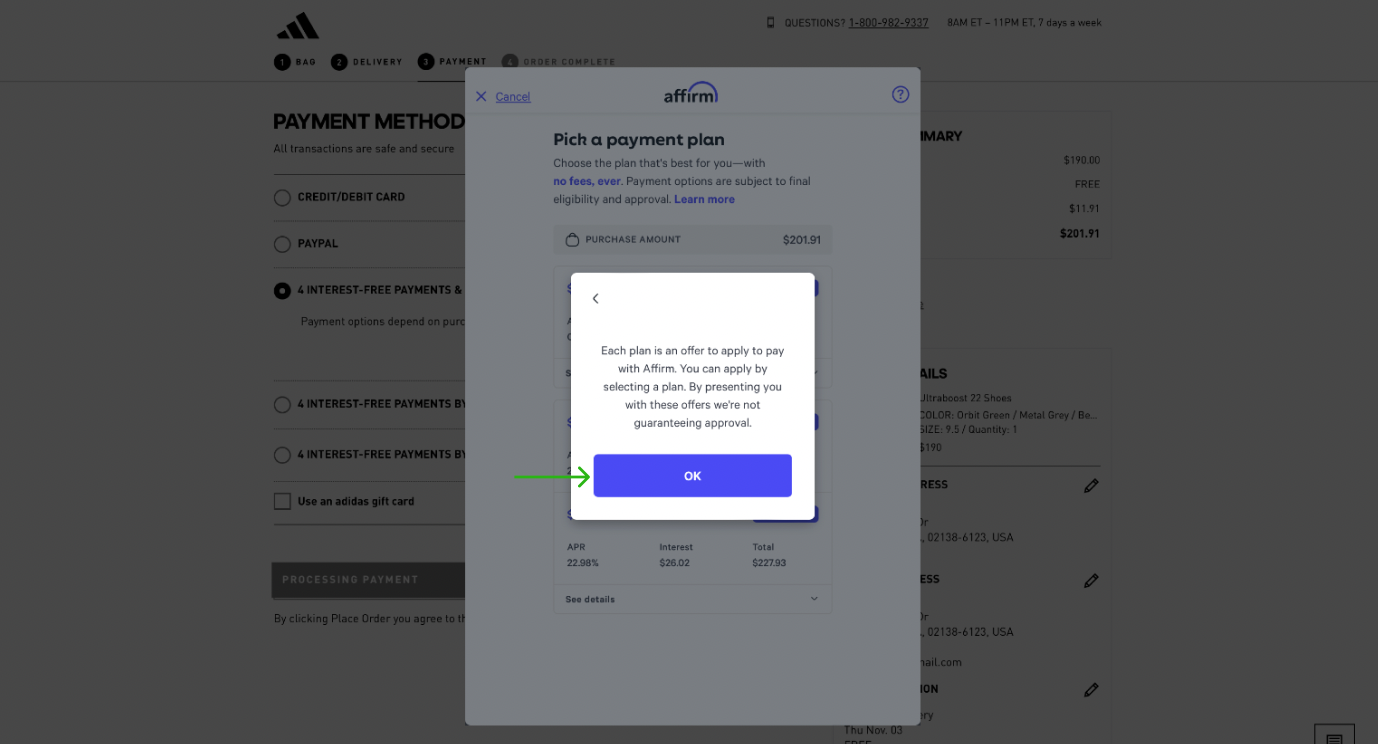

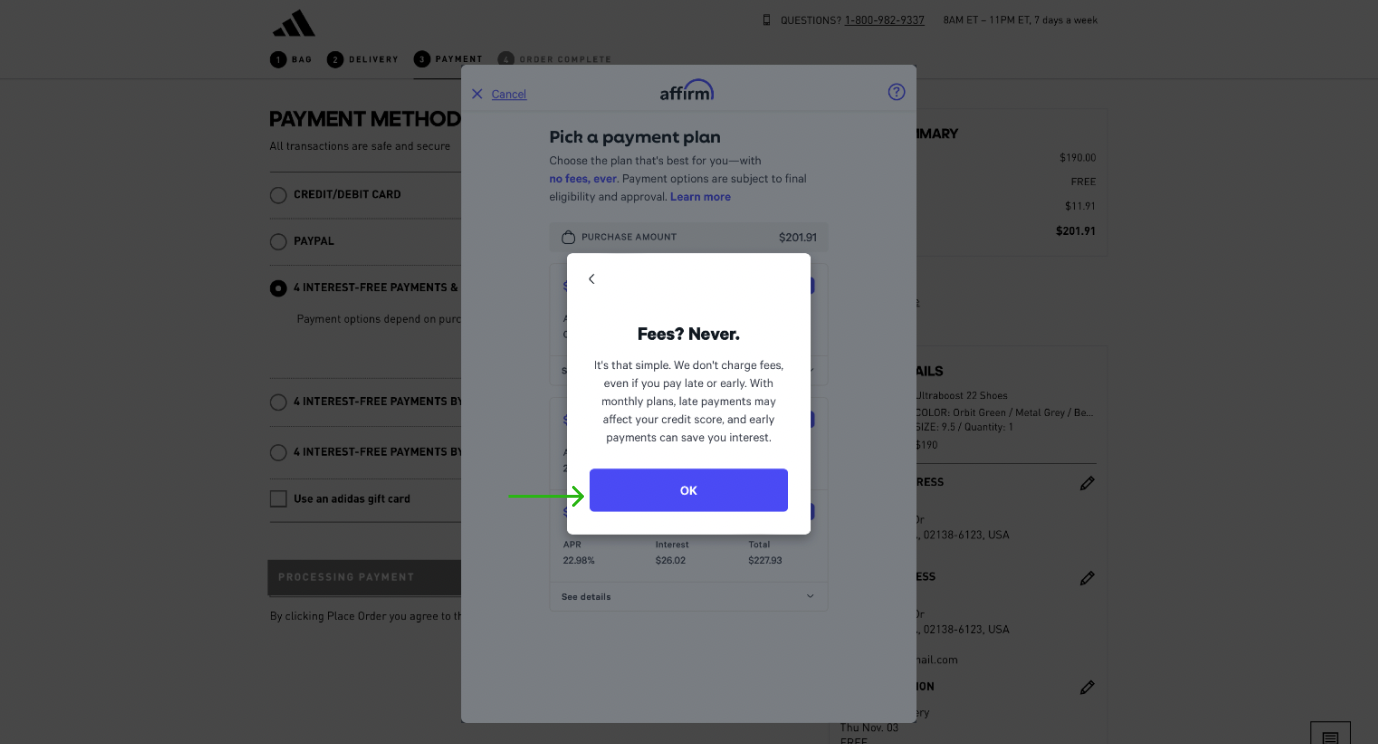

Appendix B: Affirm Purchasing Flow

The image below is what appears if the respondent clicks Learn more.

The image below is what appears if the respondent clicks no fees, ever.

If a respondent clicks on any of the hyperlinks on the image above that lead to legal agreements, they are presented with all three documents on a scrollable page within the prototype. The respondent can click on “X” to return to the previous image.

Appendix C: Prototyping Instructions

Appendix D: Survey Questions and Responses

Authors

Zoe Brewer holds an A.B. degree in Government from Harvard University, where she studied public interest technology under digital privacy pioneers such as Latanya Sweeney, Jim Waldo, and Bruce Schneier. Her commitment to responsible technology development is reflected in her work as a product manager and growth-stage software investor.

Alexander Arber earned his Harvard A.B. in 2023 with studies in Government, Technology Science, and Economics. He has worked in strategy and operations at a startup, supported investments at a venture capital fund, and researched consumer finance as a Fellow at Princeton University’s Center for Information Technology Policy.

Author Emails

zebrewer@gmail.com

alexarber1@gmail.com

Suggestions (0)

Click the below button to open the suggestions form in a new tab.

Enter your recommendation for follow-up or ongoing work in the box at the end of the page.

Feel free to provide ideas for next

steps, follow-on research, or other research inspired by this paper.

Perhaps someone will read your

comment, do the described work, and publish a paper about it. What do

you recommend as a next research step?

Submit Suggestion on MyPrivacyPolls

Back to Top